MARKET ANALYSIS FOR THE WEEK OF SEPTEMBER 29 – OCTOBER 3, 2025

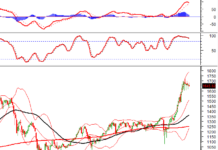

During the week of September 29 – October 3, 2025, the VN-Index experienced a decline, accompanied by a fourth consecutive week of reduced trading volume. The index has consistently formed candles with long wicks in recent weeks, reflecting investor hesitation and uncertainty.

Currently, the Stochastic Oscillator continues to weaken following a sell signal in the overbought zone, indicating that short-term volatility risks persist.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – ADX Continues to Decline

On October 3, 2025, the VN-Index saw a slight decrease, forming a small-bodied candle with trading volume remaining below the 20-day average, highlighting ongoing investor caution.

The index is currently moving within a Triangle pattern, while trading volume consistently stays below the 20-session average.

Additionally, the ADX indicator continues to fall, remaining below the gray zone (20 < ADX < 25).

HNX-Index – Breaks Medium-Term Uptrend Line

On October 3, 2025, the HNX-Index declined for the second consecutive session, forming a Big Black Candle with increasing volume, signaling heightened investor pessimism.

The index has breached its medium-term uptrend line, while the MACD indicator remains bearish, crossing below the zero line after a sell signal. This suggests a worsening outlook.

After breaking below the Triangle pattern’s lower boundary, the index continues to weaken. If technical signals remain unfavorable and the correction persists, the previous March 2025 peak (245-254 points) will serve as a key support level for the HNX-Index.

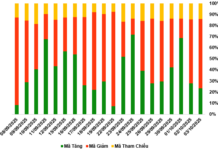

Capital Flow Analysis

Smart Money Movement: The VN-Index Negative Volume Index remains above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

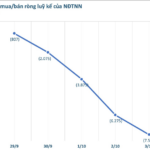

Foreign Capital Flow: Foreign investors continued net selling on October 3, 2025. If this trend persists in upcoming sessions, market sentiment will become increasingly pessimistic.

Technical Analysis Department, Vietstock Advisory Division

– 17:28 October 5, 2025

Will Selling Pressure on Stocks Persist on October 3rd?

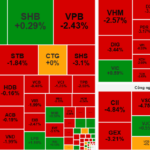

The trading session on October 2nd saw intense selling pressure in stocks, leaving investors apprehensive about a potential continuation of this trend in the upcoming session.

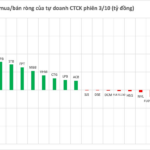

Week 29/9 – 3/10: Foreign Investors Offload Another VND 7.6 Trillion, Which Stocks Were Hit Hardest?

Foreign investors maintained their strong net selling pressure, recording another week of net outflows exceeding 7,000 billion VND.