Taiwan (China) is among the largest seafood consumer markets, with an average per capita consumption of 31.65 kg in 2023, surpassing the global average by 50%. Locals favor products such as fish, shellfish, squid, octopus, shrimp, and crab.

Taiwanese consumers are willing to pay a premium for high-quality imported goods. This trend aligns with the rapid growth of the gourmet dining sector, evidenced by 49 Michelin-starred restaurants that frequently use imported seafood ingredients.

Despite high demand, domestic production falls short, making Taiwan increasingly reliant on imports. In 2024, Taiwan’s seafood imports reached USD 1.885 billion from 86 countries, primarily shrimp, salmon, squid, scallops, and flatfish. China, Japan, Norway, Vietnam, and Indonesia account for nearly 50% of total imports, with Vietnam ranking fourth at approximately 9% market share.

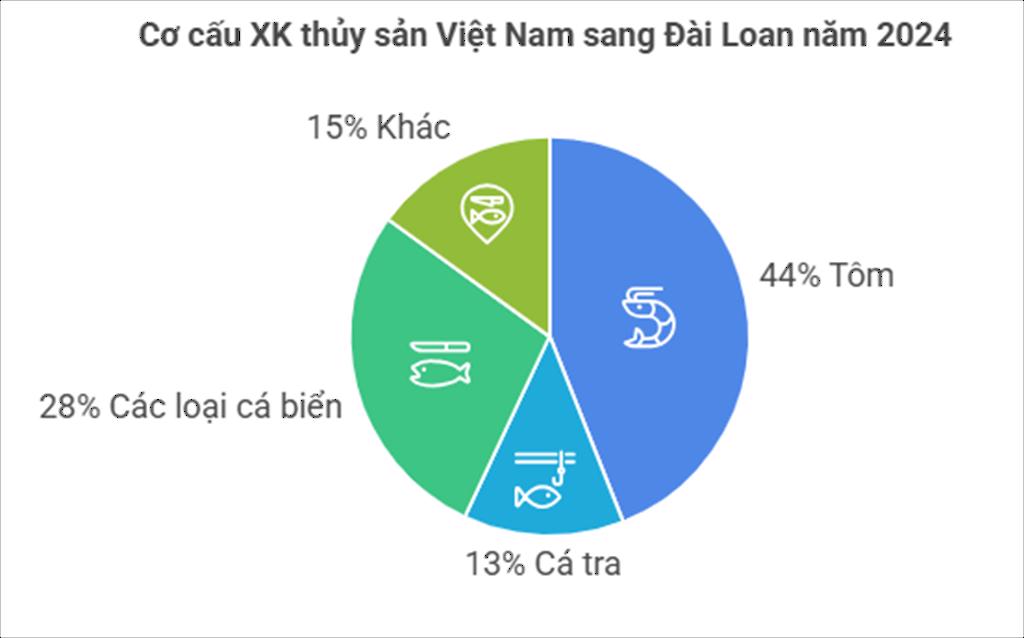

Taiwan is also a key market for Vietnamese seafood. In 2024, Vietnam’s exports to Taiwan reached USD 168 million, accounting for nearly 1.7% of the industry’s total revenue. The product mix includes shrimp (44%), pangasius (13%), marine fish (28%), and smaller shares of squid, octopus, and crab.

According to statistics, in the first eight months of 2025, Vietnam’s seafood exports to Taiwan exceeded USD 123 million, an 18% increase year-on-year. Shrimp exports rose by 37%, primarily whiteleg and black tiger shrimp, while pangasius exports grew by 31%. Conversely, squid and octopus exports declined by 5%, and shellfish exports dropped by 45%.

These results highlight shrimp and pangasius as Vietnam’s most competitive products in Taiwan’s market.

For Vietnam, Taiwan presents both significant opportunities and challenges. The market’s high demand for premium and high-quality imported seafood favors Vietnam’s growth in value-added processed products, including whiteleg shrimp, black tiger shrimp, and marine fish. Additionally, being among the top four suppliers gives Vietnam a strong foundation to expand its market share.

However, Vietnamese businesses face fierce competition from China, Japan, and Norway, which dominate in salmon, squid, and marine fish exports.

Moreover, Taiwan’s Food and Drug Administration (TFDA) has tightened quarantine and quality certification requirements, coupled with a declining demand for squid, octopus, and shellfish, posing significant challenges to Vietnam’s seafood export structure.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnamese seafood enterprises should focus on strengthening key product lines such as shrimp and pangasius, while expanding into value-added processed goods to meet Taiwan’s premium consumption trends.

Positioning products in the high-quality segment, emphasizing freshness, and ensuring transparent traceability will enhance competitive advantages.

Simultaneously, businesses should intensify trade promotions, collaborate with local restaurants and chefs to promote products, and participate in international food exhibitions to enhance brand visibility.

Critically, strict adherence to Taiwan’s import regulations on food safety and animal health certifications is essential to build a sustainable reputation for Vietnamese seafood in this market.

Vietnam’s seafood processing and export industry is a key economic sector. In 2024, it achieved impressive results with export revenues of USD 10 billion, a 12.7% increase from 2023.

In 2025, despite favorable conditions, the industry faces notable challenges. Projections indicate that Vietnam’s seafood export revenue may reach between USD 9 billion and USD 9.2 billion this year.

Sunshine Group Honored Among Top 10 Innovative Pioneer Brands of 2025

Sunshine Group has been honored among the Top 10 Innovative Pioneer Brands 2025 at the Vietnam Strong Brand 2024-2025 announcement ceremony. This prestigious event, held on October 2, was organized by the Vietnam Economic Science Association and VnEconomy – Vietnam Economic Times Magazine.

Bridging the Gap: Maximizing Local and Business Potential Through FTA Utilization

The inaugural FTA Index, released in April 2025, reveals persistent challenges in local and business utilization of free trade agreements. Amid rising trade protectionism, pinpointing these “strengths and weaknesses” is crucial for crafting effective solutions and strategic implementation in the years ahead.