Vietnam Commercial Bank Securities Company (VCBS) has released a comprehensive report forecasting the Q3/2025 and full-year 2025 business results for various sectors in Vietnam’s economy. A notable highlight is the performance of the residential real estate sector.

Specifically, VCBS analysis indicates that the final two quarters of 2025 are not expected to show significant growth, as the focus this year remains on legal processing, capital mobilization, project implementation, and sales.

However, many companies have seen substantial improvements in sales volume and cash flow. There is still room for stock price growth, particularly for companies with projects in the Southern region, where property prices are expected to rise further over the next year.

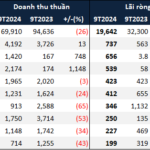

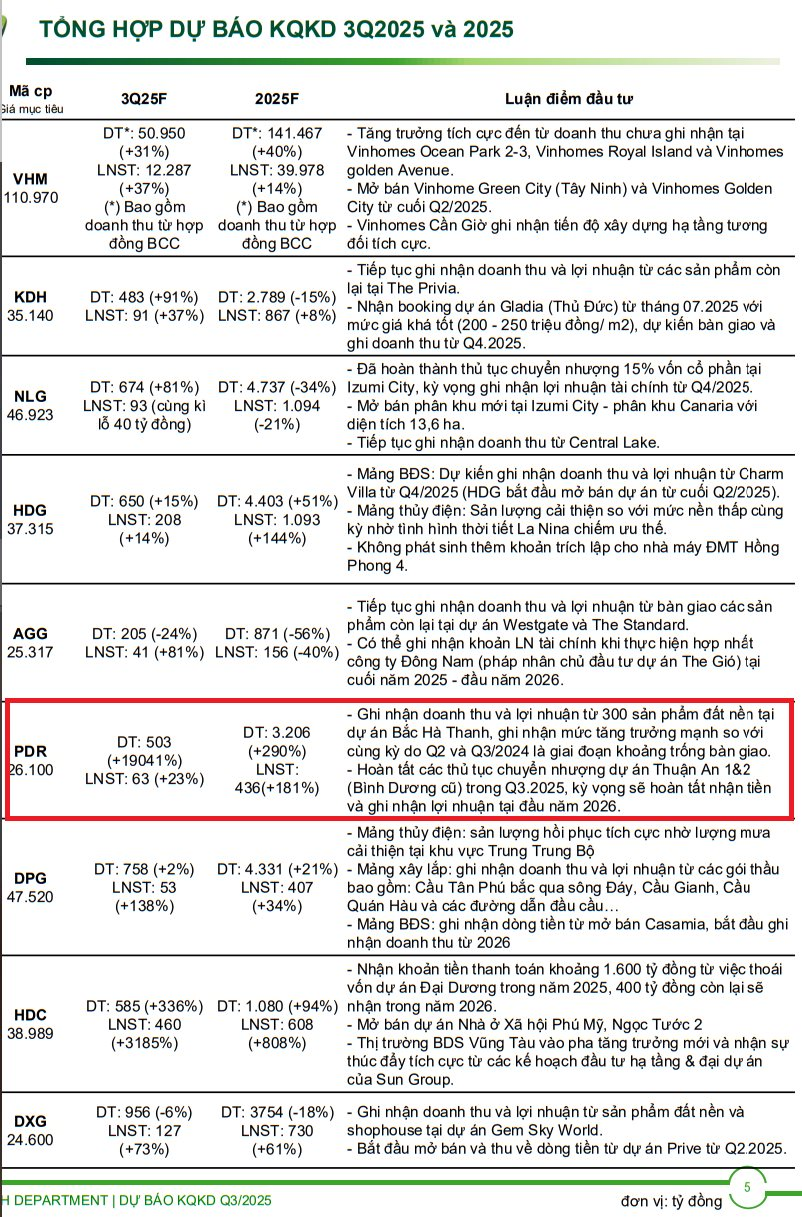

Among the nine companies analyzed by VCBS, Phat Dat Real Estate Development Corporation (PDR) stands out with its remarkably high projected growth.

PDR is forecasted to achieve an extraordinary 19,041% revenue growth , reaching VND 503 billion, with post-tax profits of VND 63 billion, a 23% increase from the previous quarter.

This impressive performance is primarily attributed to the company’s revenue and profit recognition from 300 land plots in the Bac Ha Thanh project, marking a significant surge compared to the same period last year, which was a handover gap period in Q2 and Q3/2024.

Additionally, Phat Dat completed the transfer procedures for the Thuan An 1&2 project (formerly Binh Duong) in Q3/2025, with expectations to receive payment and recognize profits in early 2026.

Thuan An 1&2 is a modern high-rise residential complex located in the heart of Thuan An City (formerly Binh Duong). The project spans 4.46 hectares, comprising two high-rise residential complexes, Thuan An 1 and Thuan An 2, with a total investment of approximately VND 11 trillion. Thuan An 1 covers 1.8 hectares, with a maximum building height of 39 floors and 3-4 basement levels, offering up to 3,133 apartments. Thuan An 2 spans over 2.65 hectares, also reaching 39 floors with a maximum of 4 basement levels, providing approximately 3,270 apartments and 16 townhouses.

Thuan An 1 and 2 High-Rise Residential Complex Project

Established in 2004, Phat Dat is one of the largest real estate companies listed on the Vietnamese stock market. The company primarily operates in real estate investment and development.

Phat Dat has developed numerous projects in Ho Chi Minh City, Quang Ngai, and Binh Dinh, and is accelerating its expansion into new markets such as Da Nang, Binh Duong, Ba Ria – Vung Tau, and Phu Quoc. The company also holds a substantial land bank in Binh Duong, Dong Nai, and Ba Ria – Vung Tau for future development.

PDR’s product portfolio now spans from residential real estate to tourism and hospitality. All projects are meticulously developed with the vision and expertise of a professional real estate developer.

As of the end of 2024, the company’s chartered capital exceeds VND 8,731 billion, ranking it among the top 10 most reputable real estate companies in 2024.

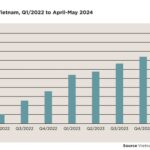

Southeast Region Real Estate Credit Surges by 10.9%

By the end of August 2025, the total outstanding credit for real estate loans in the Southeast region (Ho Chi Minh City and Dong Nai Province) reached 1,465 trillion VND, marking a 10.9% increase compared to the end of the previous year and a 16.7% rise year-on-year.