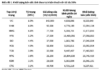

Increased trading in large-cap stocks significantly boosted market liquidity this morning. Trading volume on the HOSE reached over 622 million units, equivalent to a value of more than 18 trillion VND, doubling compared to the same period in the previous session. HNX also recorded a volume of nearly 59 million units, equivalent to almost 1.4 trillion VND.

Source: VietstockFinance

|

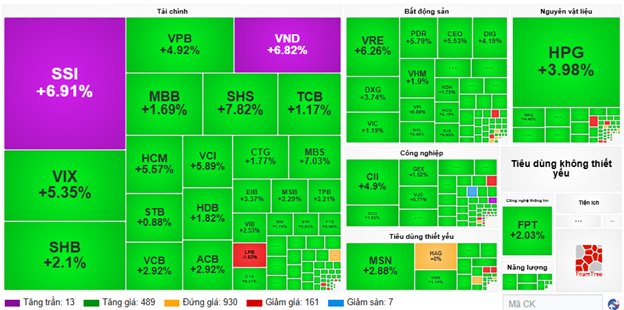

In terms of impact, VCB and VPB are the two stocks with the most positive influence, contributing 3.5 points and 2.7 points, respectively, to the VN-Index. Additionally, HPG, VIC, and VHM added a combined total of 5.6 points to the VN-Index. Meanwhile, the top 10 stocks with negative influence collectively reduced the index by less than 1 point.

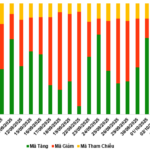

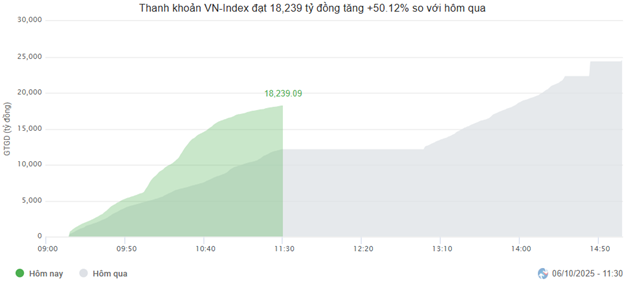

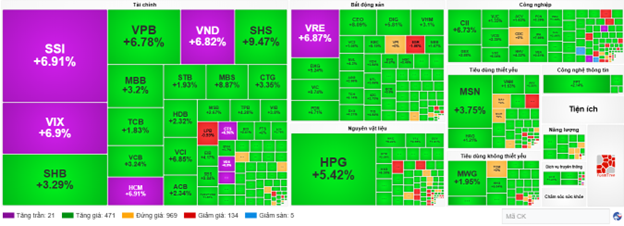

Across sectors, green dominated all stock groups, with 7 out of 11 groups closing mid-session with gains exceeding 1%. The financial sector temporarily led the market in the morning session, with widespread green across banking and securities stocks such as VCB (+2.92%), BID (+1.76%), CTG (+1.77%), VPB (+4.92%), ACB (+2.92%), SHB (+2.1%), VIB (+2.53%), along with VND and SSI reaching their upper limits.

Source: VietstockFinance

|

Furthermore, the materials and real estate sectors also saw vibrant trading, with highlights including HPG (+3.98%), GVR (+2.06%), MSR (+2.16%), DCM (+2.15%), HSG (+3.32%); VIC (+1.19%), VHM (+1.9%), VRE (+6.26%), KBC (+3.32%), NVL (+2.98%), and PDR (+5.79%).

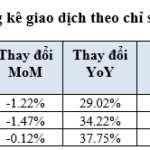

A notable downside was that foreign investors continued to net sell with a value of over 1.2 trillion VND across all three exchanges. Selling pressure was concentrated on VRE and STB, with values of 174.77 billion VND and 151.94 billion VND, respectively. Meanwhile, VIX and HPG led the net buying with a value of over 31 billion VND.

| Top 10 Stocks with Strongest Net Buying and Selling by Foreign Investors in the Morning Session of 06/10/2025 |

10:30 AM: Purple Dominates Financial Stocks

Buyers continued to dominate, driving the main indices higher. As of 10:30 AM, the VN-Index rose by 33.13 points, trading around 1,678.95 points. The HNX-Index increased by 6.01 points, trading around 271.76 points.

All stocks in the VN30 basket turned green, with notable performers including HPG up 7.76 points, VPB up 4.1 points, VHM up nearly 3.15 points, and VRE up 3.07 points. Among Bluechip stocks, HPG rose by 4.88%, MSN by 3.38%, FPT by 2.03%, and MWG by 1.43%.

Source: VietstockFinance

|

The financial sector continued to attract significant inflows, driving all stocks in the sector higher. Specifically, stocks like SSI, SHS, VIX, VND, VDS… turned purple, while others such as VPB rose by 4.92%, VCB by 3.4%, HCM by 5.95%, and VIX by 6.34%. This reflects a positive sentiment ahead of the FTSE Russell’s market upgrade results expected early on October 8th.

Following closely, the real estate sector also saw impressive gains. Notably, VRE and PDR hit their upper limits, while NVL rose by 4.3%, DXG by 3.74%, and DIG by 3.95%.

Compared to the opening, buyers were in complete control. There were 471 advancing stocks and 134 declining stocks.

Source: VietstockFinance

|

Opening: Market Kicks Off with Widespread Green

At the start of the session on October 6th, as of 9:30 AM, the VN-Index rose positively to 1,670 points. The HNX-Index increased by nearly 3 points to 268.51 points. Notably, stocks in the VN30 basket made significant contributions to the index.

The financial sector was among the top performers in the early session, with VCB up 2.27%, BID up 1.13%, TCB up 1.04%, and MBB up 1.13%.

The materials sector also contributed significantly, with major players turning green, such as HPG up 1.99%, GVR up 1.69%, DGC up 1.09%, and KSV up 2.89%.

Additionally, the real estate sector played a notable role in the market’s early gains, with green dominating most stocks, including VIC up 1.53%, VHM up 1.4%, VRE up 2.75%, and BCM up 0.15%.

– 12:00 PM, 06/10/2025

Technical Analysis Afternoon Session 06/10: Positivity is Making a Comeback

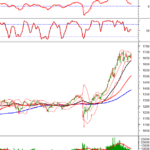

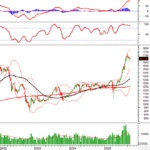

The VN-Index staged a robust recovery, with the Stochastic Oscillator signaling a buy opportunity. Meanwhile, the HNX-Index found solid support at its August 2025 lows.

Vietstock Weekly 06-10/10/2025: Is the Market Still Hesitant?

The VN-Index extended its decline for the fourth consecutive week, accompanied by a drop in trading volume. Recent weeks have seen the index consistently forming long-shadowed candlesticks, signaling investor hesitation and uncertainty. With the Stochastic Oscillator weakening further following a sell signal in overbought territory, short-term volatility risks remain elevated.

“It’s Not a Crash—Here’s How the Market Quietly Erodes Investors’ Portfolios Every Single Day”

Many individuals, despite not suffering significant losses, choose to withdraw due to the unbearable, prolonged sense of monotony and fatigue.