Approaching the 2024 Record

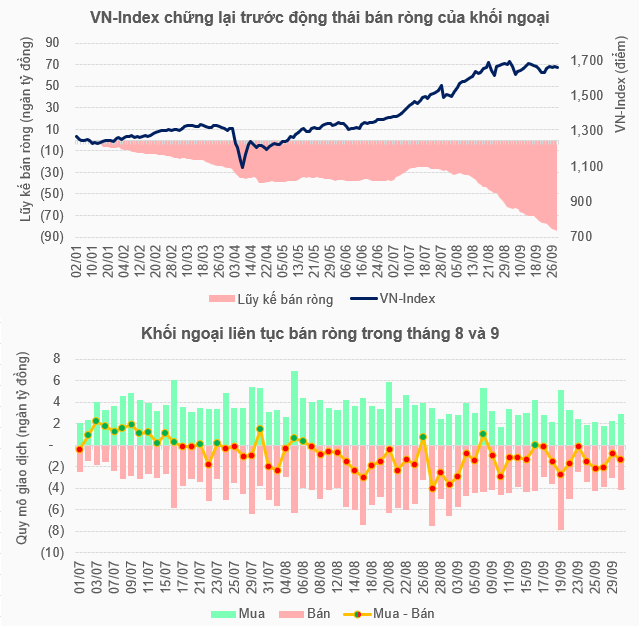

Data from VietstockFinance in September reveals persistent net selling by foreign investors, with 18 out of 20 trading sessions ending in net outflows. As a result, September recorded a net selling volume of up to VND 25.5 trillion.

This trend mirrors August, where 18 out of 21 trading sessions also concluded with net selling, totaling nearly VND 29.6 trillion.

Thus, in just the last two months, the cumulative net selling since the beginning of the year has reached nearly VND 84.5 trillion, approaching the record level of VND 90.2 trillion for the entire year of 2024.

Source: VietstockFinance

|

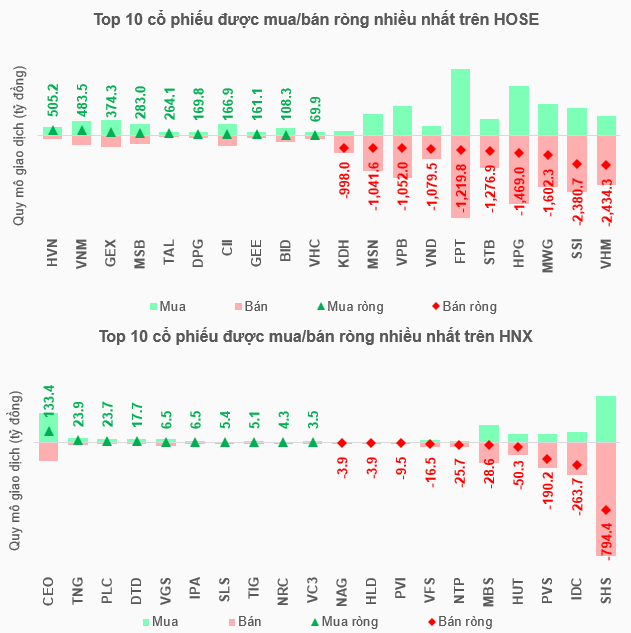

HOSE recorded nine instances of net selling exceeding VND 1 trillion in September, with VHM leading at over VND 2.4 trillion and SSI closely following at nearly VND 2.4 trillion. Conversely, the most actively bought stock was HVN, though its volume was only above VND 505 billion.

On HNX, net selling also occurred, totaling nearly VND 1.2 trillion, widening the nine-month cumulative net selling to over VND 1.4 trillion.

SHS saw the most notable net selling in September, exceeding VND 794 billion, far outpacing other stocks. In terms of net buying, CEO led with over VND 133 billion, also creating a significant gap with the rest.

Source: VietstockFinance

|

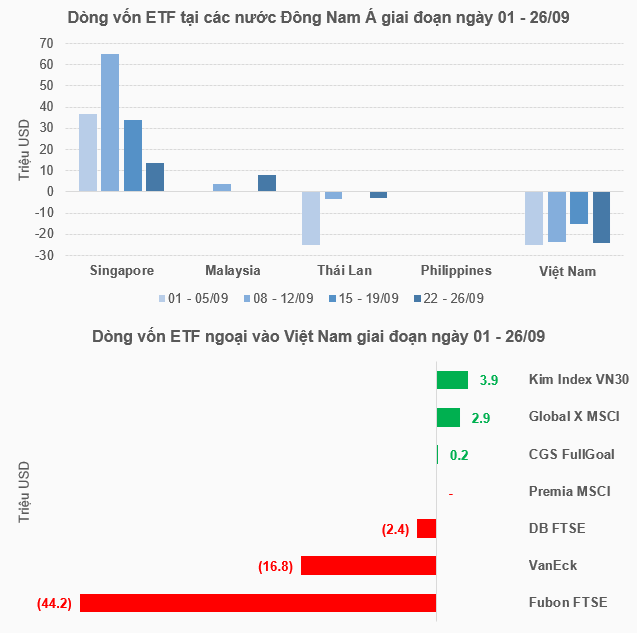

Examining foreign ETF capital flows into Vietnam over the last four weeks (September 1–26), a consistent net outflow trend is evident. Fubon FTSE and VanEck were the primary sellers, with cumulative outflows of USD 44.2 million and USD 16.8 million, respectively. Vietnam also stands out as a prominent country experiencing outflows in the region.

Source: Bloomberg

|

Exchange Rate Concerns and Profit-Taking

In a discussion with the author, Trần Thái Bình – CFA, Senior Director of Securities Analysis at OCBS, emphasized that the market has endured two consecutive years of net selling nearing VND 100 trillion. The primary causes are the yield gap between Government Bonds and the VND/USD exchange rate pressure, prompting investment funds to withdraw capital to developed markets.

Additionally, the Vietnamese stock market’s 30% growth since the beginning of the year, coupled with some large-cap stocks doubling or tripling in value, has generated substantial profits for investment funds, further fueling profit-taking actions.

For a brighter outlook, Mr. Bình suggests the market needs to meet several conditions, including a successful upgrade to increase Vietnam’s weight in the Emerging Markets index; exchange rate stabilization; and a reduced yield gap. Long-term, the market requires more high-quality listings by attracting companies, opening up more to foreign investors, and, most importantly, a stable economy with sustainable corporate profit growth.

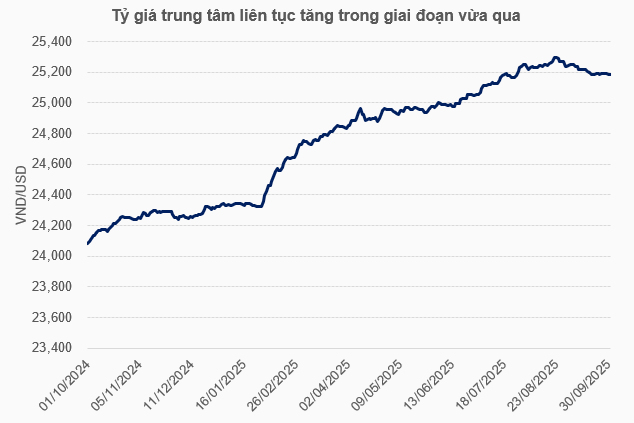

Echoing this view, Huỳnh Anh Huy – CFA, Director of Securities Industry Analysis at KAFI, also attributes the strong net selling to exchange rate pressure and profit-taking by funds. The exchange rate has risen over 5% since the beginning of the year, which, while not significant compared to market performance, may trigger selling rules to balance risk in some large funds.

Despite the substantial net selling since the beginning of the year, the KAFI expert notes that ETF outflows account for less than 20% of total net selling, indicating that capital withdrawal from the market is not extensive and awaits opportune moments to re-enter. Additionally, profit-taking ahead of the FTSE upgrade evaluation remains subdued.

At the seminar “Identifying Q4/2025 Waves: Ready for the Breakout” held on September 30, Vũ Thị Thu Thủy – Director of Market Information and Insights, Retail Securities Division at HSC, highlighted that the exchange rate is the foremost concern for foreign investors.

Source: VietstockFinance

|

The VND/USD rate has risen continuously in August and September, depreciating by approximately 4%, the highest in Southeast Asia. Historically, exchange rate fluctuations exceeding 3% often lead to stock market corrections. Notably, the VND’s depreciation occurs while the USD is also weakening, raising concerns among foreign investors about declining profits in USD terms.

According to the HSC expert, another exchange rate-related risk is Vietnam’s foreign exchange reserves of only about USD 80 billion (as of May 2025), equivalent to two months of imports, which is an unsafe level. This further amplifies foreign investors’ concerns.

– 09:00 06/10/2025

Market Pulse 06/10: Financial Stocks Soar, VN-Index Hits 1,680 Mark

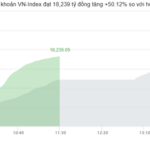

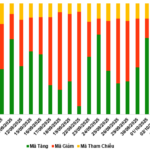

The green hue dominated the market throughout the morning session. As the midday break approached, the VN-Index surged by over 33 points (+2.02%), reaching 1,679.1 points, while the HNX-Index also saw a robust increase of 2.54%, closing at 272.51 points. Market breadth strongly favored buyers, with 502 stocks advancing and only 168 declining.

“It’s Not a Crash—Here’s How the Market Quietly Erodes Investors’ Portfolios Every Single Day”

Many individuals, despite not suffering significant losses, choose to withdraw due to the unbearable, prolonged sense of monotony and fatigue.