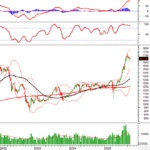

The VN-Index experienced a volatile week of trading during the quarter transition, with the opening session grappling with intense tug-of-war around the 1,660 mark.

Notably, buying pressure emerged from several large-cap stocks, while selling pressure primarily stemmed from real estate and public investment stocks that had previously surged. Foreign investors continued their strong net selling, totaling over VND 7,000 billion. The VN-Index closed the week down -0.90% at 1,645.82 points, above the psychological support level of 1,600.

Most experts agree that the market is in a waiting period for new information to reassess its direction. Investors are advised to closely monitor market movements.

Market’s upward momentum won’t solely depend on upgrade results

According to Mr. Nguyễn Tấn Phong, Securities Analyst at Pinetree, the VN-Index has continued its sideways trend for over a month, accompanied by dwindling liquidity, reflecting investor caution ahead of FTSE’s announcement on Vietnam’s market upgrade on October 8th.

The market is experiencing a frustrating “green on the outside, red on the inside” phase, where most investor accounts holding stocks are in the red, while the VN-Index is propped up by just a few stocks, notably VIC. Last week, VIC alone contributed over 12 points to the index. Excluding VIC and a few others like VRE, GEE, or LPB, the VN-Index would likely revert to the 1,620-1,630 range instead of its current 1,645. While there were signs of money flowing back into bank stocks like STB, MBB, and TCB mid-week, the final session largely negated these gains.

Mr. Phong predicts the VN-Index will maintain its sideways trend, with narrowing volatility until FTSE’s upgrade announcement on Wednesday, October 8th. VIC, VRE, and LPB will likely continue driving the market early next week.

Post-Wednesday, the VN-Index is expected to enter a new phase of heightened volatility, with direction hinging on the upgrade outcome. A failure to upgrade could signal a negative market sentiment, potentially triggering a medium-term correction measured in months, though this probability is low.

Pinetree’s expert anticipates a high likelihood of Vietnam’s market upgrade. However, even in this scenario, the VN-Index will only surge past its peak if money strongly returns to bank stocks and spreads to other sectors. Otherwise, the VN-Index may continue correcting until third-quarter business results are released.

Foreign investors’ persistent daily selling of over VND 1,000 billion is another concern. Mr. Phong notes that foreign capital is flowing into China while being withdrawn from other regional markets, including Vietnam. The USD exchange rate is also heating up, repeatedly hitting new highs. Although the State Bank has sold forward USD, this is only a temporary solution. Prolonged pressure on the exchange rate would be a negative signal for the market.

Additionally, next week’s release of September’s domestic macroeconomic data by the General Statistics Office will also impact the VN-Index’s short-term trend.

Investors should closely monitor market movements and focus on portfolio risk management

According to VCBS Securities’ analysis team, market liquidity last week continued to decline below the 20-session average, indicating investor caution.

While the VN-Index remains within the 1,620 – 1,680 range, it has formed a downward zigzag pattern over the past month. Last week’s selling pressure primarily came from real estate and public investment stocks that had overheated, with money gradually shifting towards large-cap stocks like Vingroup (VIC, VHM, VRE) and banks.

VCBS advises investors to closely monitor next week’s market movements and focus on portfolio risk management while awaiting the market upgrade results and third-quarter earnings reports. Investors may also consider exploratory investments in stocks maintaining support levels or rebounding from accumulation phases, particularly in banking and securities sectors.

Market needs strong catalysts and improved liquidity for VN-Index to break out

SHS Securities notes the VN-Index’s short-term trend is weak, failing to hold the nearest short-term support around 1,660. The market requires significant catalysts and a substantial liquidity boost to break out of the accumulation phase formed over the past month.

SHS observes that after a strong rally ending Q3, the VN-Index surpassed its 2022 historical peak. The market has now entered an accumulation phase, with investors reassessing fundamentals, macroeconomic data, and third-quarter earnings, while awaiting the market upgrade announcement before making new investment decisions.

SHS recommends investors maintain a reasonable allocation, targeting stocks with strong fundamentals, leading positions in strategic sectors, and superior growth potential within the economy.

Weathering the Storm of Sell-Offs: What Does the Market Need to Turn the Tide?

Following a robust surge that brought it close to the 1,700-point mark, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. While many analysts deem this adjustment healthy, the persistent net selling by foreign investors has sparked anxiety among a significant number of market participants.

Market Pulse 06/10: Financial Stocks Soar, VN-Index Hits 1,680 Mark

The green hue dominated the market throughout the morning session. As the midday break approached, the VN-Index surged by over 33 points (+2.02%), reaching 1,679.1 points, while the HNX-Index also saw a robust increase of 2.54%, closing at 272.51 points. Market breadth strongly favored buyers, with 502 stocks advancing and only 168 declining.

Vietstock Weekly 06-10/10/2025: Is the Market Still Hesitant?

The VN-Index extended its decline for the fourth consecutive week, accompanied by a drop in trading volume. Recent weeks have seen the index consistently forming long-shadowed candlesticks, signaling investor hesitation and uncertainty. With the Stochastic Oscillator weakening further following a sell signal in overbought territory, short-term volatility risks remain elevated.