VinEnergo Energy JSC recently announced a significant transaction involving shares held by an individual closely associated with Vingroup Corporation’s (stock code: VIC) internal leadership.

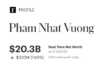

Billionaire Pham Nhat Vuong, Chairman of Vingroup’s Board of Directors, plans to transfer ownership of over 60 million VIC shares to VinEnergo as part of a capital increase initiative. Prior to this transaction, Mr. Vuong directly held nearly 450 million VIC shares, representing 11.59% of the company’s equity.

According to the announcement, these shares equate to 1.55% of Vingroup’s chartered capital, valued at VND 600 billion (approximately VND 10,000 per share).

The transaction is scheduled to take place between October 9 and November 7 through the Vietnam Securities Depository and Clearing Corporation (VSDC). Upon completion, VinEnergo’s total VIC shareholdings will increase to 165.7 million units, or 4.27% of the company’s equity.

Established on March 12, 2025, VinEnergo Energy JSC specializes in electricity production and electrical equipment manufacturing. The company’s formation aligns with Pham Nhat Vuong’s commitment to invest heavily in energy development, driven by his observation that “Vietnam currently faces a significant energy shortage, particularly in green energy.”

In addition to Pham Nhat Vuong, his two sons and Vingroup are also shareholders in VinEnergo. Specifically, Pham Nhat Quan Anh and Pham Nhat Minh Hoang each hold 5% of the company’s capital.

VinEnergo is set to partner with Vingroup in the Hai Phong LNG Thermal Power Plant project, planned for the Tan Trieu Industrial Zone in Kien Thuy district. The project is expected to commence between 2025 and 2030, pending its inclusion in the adjusted Power Master Plan VIII.

On the market, VIC shares closed at a historic high of VND 176,500 per share on October 3. Based on this price, the transaction’s value reaches VND 10,590 billion.

With VIC’s record-breaking performance, Vingroup’s market capitalization surpassed VND 680,000 billion (~USD 25.8 billion) for the first time. This milestone solidifies Pham Nhat Vuong’s conglomerate as the undisputed leader on the stock exchange, significantly outpacing its competitors.

The Scale of 18 Enterprises Selected by the Ministry of Construction for Social Housing Projects

Eighteen businesses selected by the Ministry of Construction to develop social housing projects have been introduced to local authorities, all of which demonstrate strong financial capabilities and proven expertise in the field.

Deputy Prime Minister Requests Vingroup to Submit Report by October 6th

Unveiling the Autumn Fair 2025, Vingroup proudly announces its sponsorship of a comprehensive design package, encompassing master planning, detailed design, branding, and zoning layouts. Additionally, they offer complimentary venue usage and waive all utility fees, including electricity, water, cleaning, and security services.

Unveiling the Mastermind: The Mega-Corporation’s Latest Blockbuster Projects

Unveiling a series of mega-projects across Vietnam, Vingroup has become the focal point of market attention. Yet, few know that behind these colossal ventures lies a decades-long journey of silent preparation—transforming visions and ideas on paper into feasible, legally sound projects. This meticulous process ensures there’s no risk of oversupply, making each development a testament to strategic foresight and execution.