Insurance Debt of VND 7.8 Billion

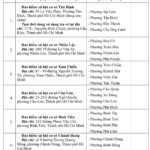

The Ho Chi Minh City Social Insurance (BHXH) recently published a list of 18,984 entities in the city that have delayed insurance payments for three months or more. The data, updated until August 31, 2025, and verified until September 15, 2025, includes PVC – MS (stock code: PXS, UPCoM). The company has delayed insurance payments for 756 employees over five months, totaling nearly VND 7.8 billion.

Established in 1983 as the Steel Structure Enterprise under the PetroVietnam Construction Joint Stock Corporation, PVC – MS transformed into a Joint Stock Company in 2009 with a registered capital of VND 200 billion. Located at 2 Nguyen Huu Canh, Rach Dua Ward, Ho Chi Minh City, the company specializes in trading machinery, equipment, and construction of electrical projects, as well as equipment rental.

In May 2010, 20 million PXS shares were listed on the HoSE. After 12 years, in June 2022, 60 million PXS shares were delisted from HoSE. In July 2022, PXS shares were approved for trading on the UPCoM platform.

Illustrative Image

According to the 2025 semi-annual audited financial report, PVC – MS recorded a revenue of over VND 426 billion, a 50% increase compared to the same period last year, primarily driven by construction activities. After deducting costs, gross profit rose by 30% to VND 26 billion.

Net profit after tax reached VND 7.5 billion, 2.7 times higher than the previous year. The company attributed this growth to several ongoing projects in their peak phases, including the supply of Topside processing services for the Block B Gas Project (4 Topsides) and jacket fabrication services for the Golden Camel Platform Project for PTSC M&C. Additionally, PVC – MS completed contracts for steel structure fabrication, installation, and wastewater system construction at the Long Son Petrochemical Refinery for Van Lang Environment Company. Other activities included mechanical processing, commercial office leasing, apartment management, and market operations in Ward 9. Cost-cutting measures further contributed to the VND 7.5 billion profit.

Auditors Withhold Opinion

As of June 30, 2025, PVC – MS’s total assets stood at VND 852 billion, an increase of VND 20 billion from the beginning of the year. Cash and bank deposits rose by VND 30 billion to VND 84 billion, while short-term receivables decreased by VND 19 billion to VND 155 billion. Inventory increased by VND 28 billion to VND 125 billion, including work-in-progress costs for projects such as the Thai Binh 2 Thermal Power Plant, Block B – O Mon Project, and Song Hau 1 Thermal Power Plant.

Notably, auditors declined to issue an opinion on the financial report due to insufficient documentation for certain projects, including the Thai Binh 2 Thermal Power Plant and Song Hau 1 Thermal Power Plant. Consequently, auditors could not verify the accuracy of cumulative revenue and cost of goods sold as of June 30, 2025, totaling VND 893.96 billion and VND 935.62 billion, respectively (with VND 987 million in revenue and VND 14.28 billion in costs recognized during the period). They also could not assess the completeness of work-in-progress costs related to these projects, valued at VND 145.9 billion and VND 146.25 billion as of June 30, 2025, and January 1, 2025, respectively, or their impact on the interim financial statements.

In addition to withholding an opinion, auditors highlighted two critical issues in the financial report. First, as of June 30, 2025, the company’s short-term liabilities of VND 732 billion exceeded short-term assets by VND 358.1 billion and were 6.3 times higher than equity. Accumulated losses of VND 589 billion and overdue debt of VND 438 billion indicate significant uncertainty regarding the company’s ability to continue operating. The financial statements were prepared under the going concern assumption.

Second, auditors noted that PVC – MS had not recorded land rental expenses for infrastructure leasing at the Sao Mai Ben Dinh Maritime Service Base, as the lessor is seeking rent exemption under applicable regulations.

As of the second quarter of 2025, PVC – MS’s major shareholders include PetroVietnam Construction Joint Stock Corporation (PETROCONs, stock code: PVX, UPCoM) with 50.97% ownership and Mepcon Offshore and Marine Pte.Ltd with 10%.

VinaCapital Member Fund Seeks to Offload Over 9 Million KDH Shares

VinaCapital’s fund, Vietnam Investment Limited, has recently filed to offload approximately 9.3 million shares of KDH as part of its portfolio restructuring strategy.

“Shantira Beach Resort and Spa Investor Owes Insurance Overdue Premium of Tens of Billions of Dongs”

As of the end of July 2025, Royal Capital Group and its subsidiary, Vinacapital Hoiana Tourism Company Limited, the investors of Shantira Beach Resort and Spa, owed a total of VND 19 billion in insurance.