PVCFC Meets with Petrovietnam’s Supervisory Delegation

On October 2, 2025, PetroVietnam Fertilizer and Chemicals Corporation (PVCFC) reported its operational performance during a periodic meeting with the supervisory delegation from the Vietnam Oil and Gas Group (Petrovietnam).

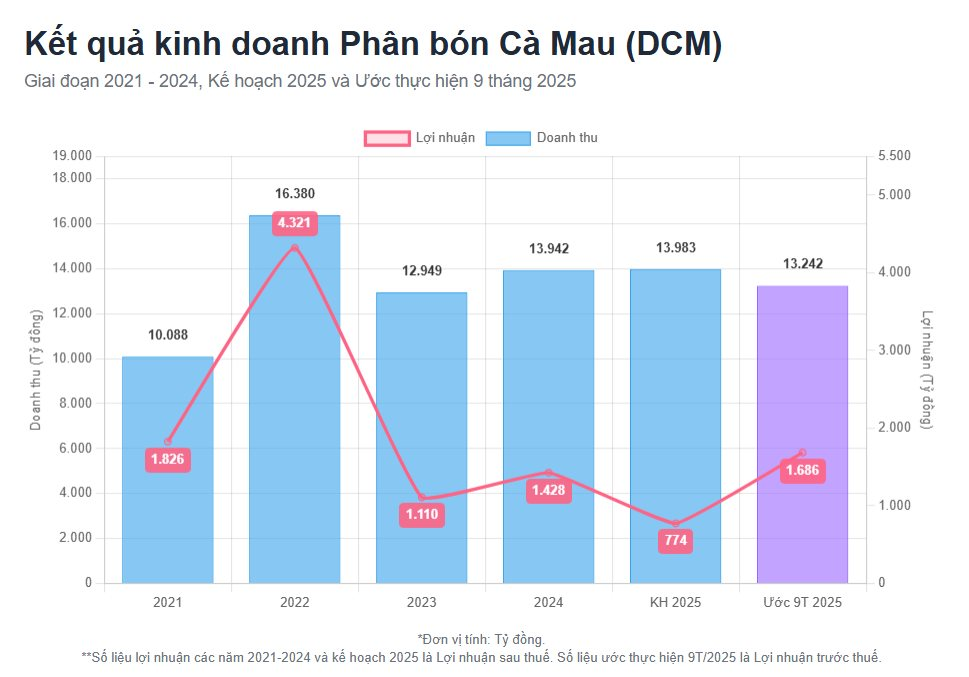

During the meeting, Mr. Van Tien Thanh, CEO of PVCFC, presented a report on the company’s performance for the first nine months of 2025 and projections for the full year. Consolidated revenue for the nine months is estimated at VND 13,241.6 billion, with pre-tax profit reaching VND 1,686.11 billion. Key product sales volumes for the period include 631,570 tons of urea and 249,870 tons of NPK fertilizers.

In Q3 alone, the company’s revenue is estimated at VND 3,418 billion, a 28% increase compared to Q3/2024, while pre-tax profit reached VND 344 billion, 2.6 times higher than the same period last year.

For 2025, PVCFC set a target of VND 13,983 billion in consolidated revenue and approximately VND 774 billion in post-tax profit. After three quarters, the company has achieved 95% of its revenue target and exceeded the full-year profit plan.

However, PVCFC’s leadership requested Petrovietnam’s support in resolving long-term gas supply challenges and certain bidding regulation issues. In response, Mr. Bui Minh Tien, a Petrovietnam Board Member, acknowledged the company’s efforts, particularly in digital transformation.

Supervisory Delegation led by Mr. Bui Minh Tien – Petrovietnam Board Member

He urged PVCFC to further optimize financial management, accelerate investments, and develop long-term strategies, affirming Petrovietnam’s continued support for the company’s sustainable growth.

According to a VCBS analysis, PVCFC’s outlook is positive, benefiting from both declining input gas costs and anticipated higher fertilizer prices. Additional drivers include recovering domestic demand, a 5% VAT policy, and the full depreciation of the urea plant.

However, VCBS highlights potential risks. The primary concern is a possible surge in gas prices, which could squeeze profit margins. Additionally, global urea prices might drop further if China increases exports, impacting overall market pricing.

Đèo Cả Transportation Infrastructure to Offer Over 49.7 Million Shares to Shareholders

The Deo Ca Transport Infrastructure Corporation is set to offer over 49.7 million shares to existing shareholders at a price of 10,000 VND per share.

Coteccons (CTD) Bets on VND 30 Trillion Target: Ambitious Push to Surpass Historical Peak Amid Concerns Over VND 1.1 Trillion Negative Cash Flow

Following a year of surpassing profit targets, Coteccons has set an ambitious goal for the 2026 fiscal year: achieving a record-breaking revenue of 30 trillion VND. This plan is underpinned by a substantial backlog but also presents significant challenges in cash flow management and cost efficiency.