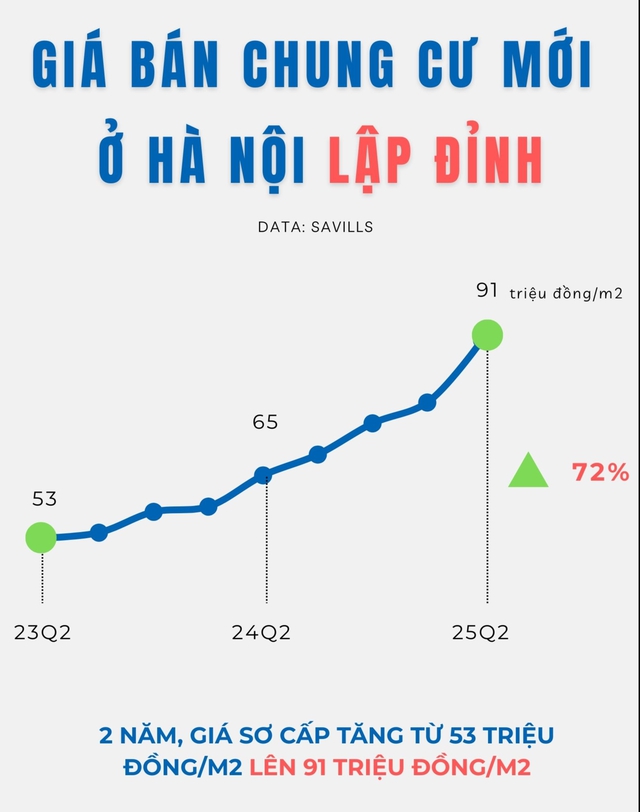

Housing Prices Projected to Rise by 10-15%

A report from the Ministry of Construction reveals that in the first nine months of the year, housing prices in Hanoi and Ho Chi Minh City reached a decade-long peak. In Hanoi, the average price per square meter for apartments hit 80 million VND, a 33% increase compared to the same period last year, while terraced houses ranged from 100 to 200 million VND. In Ho Chi Minh City, apartment prices surged by 36% to 89 million VND per square meter, and low-rise houses fluctuated between 230 and 300 million VND.

Similarly, research by real estate consultancies Knight Frank, Savills, and CBRE shows that in Q2, primary apartment prices in Ho Chi Minh City ranged from 80 to 120 million VND, and in Hanoi from 75 to 85 million VND per square meter, marking a 10-30% increase year-over-year. Since the merger on July 1st, average housing prices in Ho Chi Minh City have continued to rise by 8-18%.

Recently, the Ministry of Construction also assessed that housing prices could increase by 15-20% with the implementation of the new price framework under the updated law. According to research units, this increase is well-founded, as land costs constitute a significant portion of real estate pricing.

Amid rising housing prices that increasingly outpace affordability, Prime Minister Pham Minh Chinh demanded answers to why “apartment prices keep rising and remain high” during the first meeting of the Central Steering Committee on Housing Policy and Real Estate Market on September 22nd.

Land Costs and Clearance Expenses Burden Housing Prices

Explaining the rise in housing prices, Mr. Tran Quang Trung, Director of Business Development at OneHousing, stated, “All input factors for developers, such as new land tax rates, construction costs, and product design investments, are escalating significantly.”

According to Mr. Trung, with land becoming increasingly scarce, securing a prime location, especially in central areas, requires substantial investment. When land prices are already high, developers focusing on affordable housing are likely to incur losses. For premium locations, projects must match the site’s prestige, making low prices unattainable.

Additionally, limited supply and rising input costs have prompted developers to shift strategies, focusing on luxury and high-end projects, which has reshaped Hanoi’s housing market segments.

Dr. Can Van Luc attributes the price surge directly to escalating costs. He highlights that land and clearance expenses now account for a larger share, particularly as new land pricing aligns more closely with market rates, sharply increasing financial obligations. Rising construction material costs, labor expenses, and bank loan interest rates further compound total project costs, which are ultimately passed on to buyers, preventing price reductions.

Moreover, land pricing tables and land use fee calculations are cited as direct contributors. Adjusting land prices to reflect market values has significantly increased land-related financial obligations. This burden drives up costs, as additional financial charges are transferred to the selling price.

Dr. Can Van Luc believes the biggest bottleneck lies in procedures. He argues that many projects stall not due to capital shortages but because of prolonged approval processes, which restrict supply and drive prices higher. Streamlining these procedures could bring thousands of projects to market, increasing supply and lowering prices.

Meanwhile, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), suggests reducing land use fees and clearance costs to lower housing prices. Currently, these expenses account for about 10% of total investment in high-rise apartment projects, 30% for terraced houses, and over 50% for villas. “The government should adopt flexible policies, such as allowing one-time payments or annual installments for land use fees,” he said.

Supply Chain Risks New Blockages

Just months after Vietnam’s real estate market showed recovery signs with numerous newly licensed projects, the supply chain faces severe blockage risks due to additional land payments.

Recently, Lotte Properties HCMC, a subsidiary of South Korea’s Lotte Group, announced the termination of its contract for the Thu Thiem Eco Smart City project. This 11-tower, 50-story complex spanning over 7.4 hectares was once a key highlight in Thu Thiem’s central area. Despite an investment contract signed eight years ago and a groundbreaking ceremony three years ago, the billion-dollar project remains stalled due to financial obligations and legal hurdles.

In June, the project’s land value was approved at over 16,190 billion VND. Lotte cited prolonged land appraisals and policy changes increasing investment costs as reasons for deeming the project unfeasible, leading to contract termination.

The developer of the Thu Thiem Observation Tower Complex opposes the city’s demand for an additional 8,800 billion VND in land payments.

Following Lotte’s withdrawal from the Thu Thiem Eco Smart City project, the developer of the Thu Thiem Observation Tower Complex also contested Ho Chi Minh City’s request for an additional 8,800 billion VND in land payments.

Delays in real estate projects spanning years are not uncommon. In Ho Chi Minh City and Hanoi, hundreds of projects from 2018-2020 remain legally incomplete, severely limiting social and affordable housing supply, despite urbanization demands exceeding 374,000 units annually, as estimated by the World Bank.

Even industry leaders like Vinhomes, Vietnam’s top real estate developer, face delays. The Vinhomes Can Gio project, a 2,870-hectare coastal megacity in Ho Chi Minh City, took 21 years from conception to its April 19, 2025 groundbreaking. Similarly, the Vinhomes Giang Vo project in Hanoi, initiated in 2014, required 11 years to complete legal procedures.

These examples highlight the complexities of managing large-scale projects and underscore the urgent need for reforms, such as streamlined procedures and financial support, to accelerate supply, balance the market, and ease housing price pressures amid Vietnam’s 2025 economic recovery.

Experts warn that without swift resolution of these issues, supply blockages will persist, driving housing prices higher and further limiting access for middle-income earners.

Real Estate Firms Frozen by Land Use Fee Uncertainty

In addition to the developer of Empire City petitioning the Ho Chi Minh City People’s Committee to reconsider the additional land use fee of up to VND 8,819 billion, and Lotte Properties HCMC terminating its contract for the Thu Thiem Eco Smart City project, approximately 100 other projects in Ho Chi Minh City are awaiting financial obligation notices, which may include additional fees.

The Billionaire Behind Vietnam’s 2,870-Hectare Reclaimed Megacity and Its Multi-Billion-Dollar Projects: Two Decades of Silent Preparation by Pham Nhat Vuong

In 2024 and 2025, Vingroup unveiled a series of mega-projects spanning from North to South Vietnam. Yet, few are aware that behind the grand groundbreaking ceremonies lies a decade-long gestation period, sometimes exceeding 20 years. Vingroup’s relentless pursuit underscores a persistent market bottleneck—protracted legal procedures that perpetually stifle supply.