Vietnam’s Pharmaceutical and Medical Equipment Market Booms, but Capital Challenges Persist for Businesses

Vietnam’s pharmaceutical and medical equipment market is experiencing rapid growth in both scale and investment demand. According to IQVIA’s 2024 Vietnam Pharmaceutical Industry Overview Report, pharmaceutical sales reached $8.9 billion, ranking second in Southeast Asia. Projections indicate that by 2030, the total market value of pharmaceuticals in Vietnam will surge to approximately $13 billion. Meanwhile, the medical equipment market is forecasted to grow at an annual rate of 10% from 2025 to 2027, reflecting the demand for modernizing healthcare systems and improving public health nationwide.

However, despite the market’s vast potential, domestic medical equipment supply remains heavily reliant on imports, particularly for high-tech machinery and specialized products. Domestic pharmaceutical and medical supply companies must therefore secure substantial capital to import equipment that meets international standards and fulfills hospital tender timelines. With slow-returning cash flows from distribution contracts, many small and medium-sized enterprises find themselves in a precarious position, juggling daily operations while striving for expansion.

The pharmaceutical and medical supply market boasts high growth potential and significant development opportunities.

|

Tailored Solutions from NCB: Up to 90% Capital Coverage, with Limits up to 30 Billion VND

Understanding the unique challenges faced by businesses in this sector, National Citizen Bank (NCB) has crafted a specialized financial solution for the pharmaceutical and medical equipment industry. This solution focuses on providing working capital support, issuing guarantees, opening letters of credit, and committing capital. It empowers small and medium-sized enterprises to operate more proactively, alleviating initial cost pressures and enhancing competitiveness.

Specifically, NCB finances up to 90% of customers’ working capital needs for the fiscal year or individual business plans. Notably, the bank accepts credit guarantees secured entirely by the company’s accounts receivable, enabling businesses to access capital even before debt recovery, with limits reaching up to 30 billion VND.

NCB offers flexible capital financing for pharmaceutical and medical supply companies.

|

Additionally, the guarantee deposit ratio starts at 0%, facilitating smoother participation in tenders, increasing bid-winning opportunities, and expanding market share. Consequently, companies can not only strengthen their domestic positions but also better prepare for international collaborations as Vietnam’s pharmaceutical and medical supply market becomes increasingly integrated globally.

With flexible capital solutions, swift approval processes, and competitive financing policies, NCB not only alleviates financial pressures for pharmaceutical and medical supply businesses but also provides them with greater scope to focus on research, production, and distribution. This, in turn, contributes to the sustainable development of the healthcare sector and enhances community healthcare quality.

In recent years, NCB has consistently developed specialized product packages for various key sectors, including manufacturing, exports, fast-moving consumer goods (FMCG), and real estate. Through its tailored approach to each industry, NCB is establishing itself as a trusted financial partner, supporting businesses at every stage of their development. Simultaneously, the bank is accelerating the digitalization of its products and services to enhance user experiences, optimize operational efficiency, and create tangible value for Vietnam’s business community.

For detailed information, program terms, and other attractive offers, customers can visit NCB’s website at https://www.ncb-bank.vn/, contact any NCB transaction office/branch nationwide, or call the Hotline at (028) 38 216 216 – 1800 6166.

– 14:26 06/10/2025

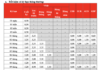

Bidiphar: Forging Ahead with a Solid Foundation

According to Phu Hung Securities (PHS), Binh Dinh Pharmaceutical and Medical Equipment Joint Stock Company (Bidiphar, HOSE: DBD) is expected to achieve impressive revenue growth of approximately 9.1% in 2024 and 9.8% in 2025, reaching nearly VND 2,000 billion. Profit margins and net profit are also anticipated to witness significant improvements, with net profit for 2024 and 2025 projected to grow by 4% and 21%, respectively. This optimistic outlook is attributed to both subjective and objective factors, mainly stemming from the solid foundation that Bidiphar has established over the years.