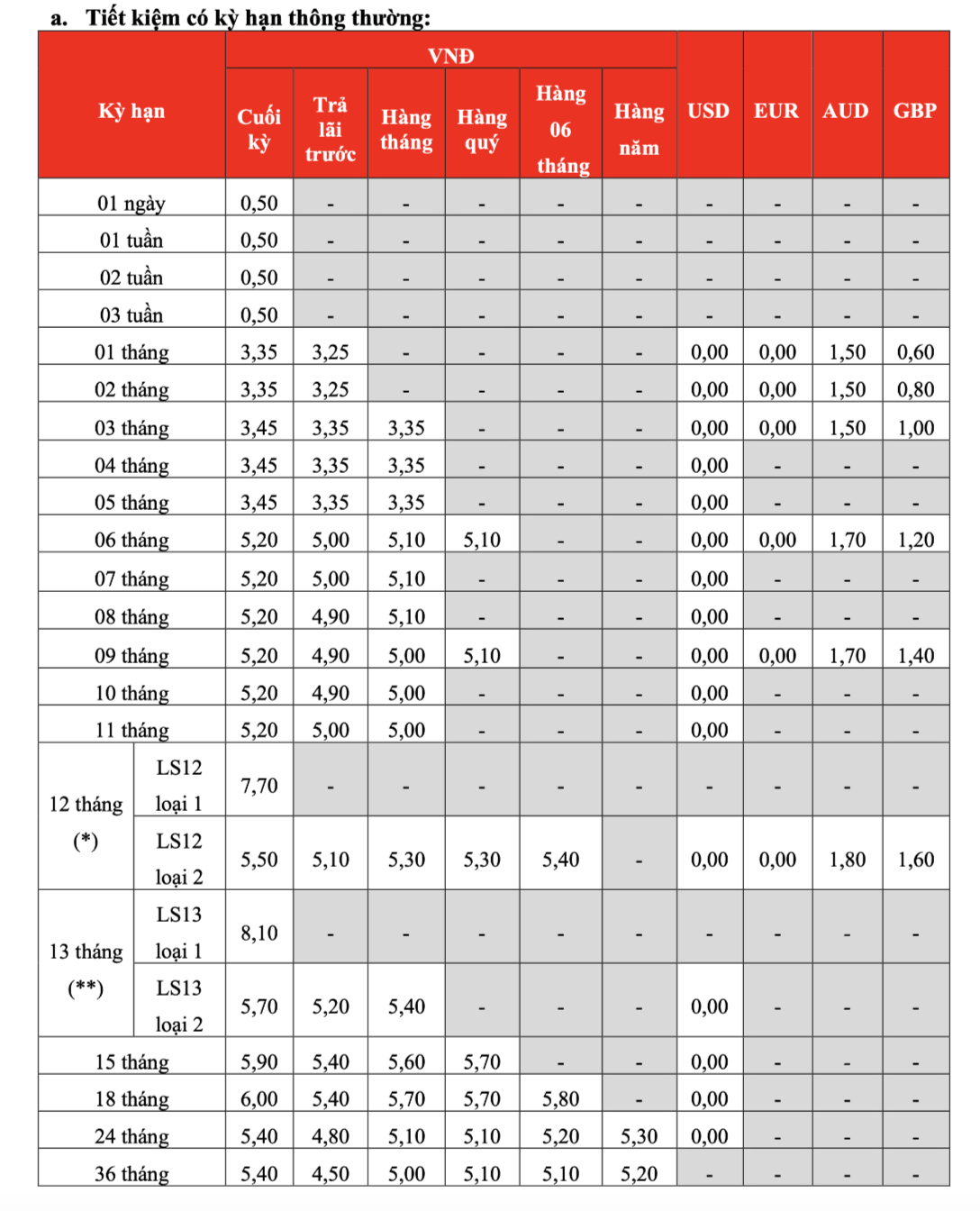

Deposit Interest Rates for Over-the-Counter Transactions in October 2025

As of early October 2025, Ho Chi Minh City Development Commercial Joint Stock Bank (HDBank) has set its over-the-counter deposit interest rates to range between 0.5% and 8.1% per annum.

Specifically, deposits with terms under 1 month are offered at 0.5%/year; 1-2 months at 3.35%/year; 3-5 months at 3.45%/year; 6 months at 5.2%/year; and 7-11 months also at 5.2%/year.

For 12-month terms, deposits of 500 billion VND or more earn 7.7%/year, while smaller amounts receive 5.5%/year. At the 13-month term, rates are 8.1%/year for deposits above 500 billion VND and 5.7%/year for smaller deposits.

The 15-month and 18-month terms offer rates of 5.9%/year and 6.0%/year, respectively. Deposits with 24 to 36-month terms are set at 5.4%/year.

In addition to end-of-term interest payments, HDBank provides various payout options: Advance Interest at 3.25% – 5.4%/year; Monthly Interest at 3.35% – 5.7%/year; Quarterly Interest at 4.5% – 5.7%/year; Semi-Annual Interest at 5.1% – 5.8%/year; and Annual Interest at 5.2% – 5.3%/year.

Over-the-Counter Deposit Interest Rate Chart as of October 5, 2025

Source: HDBank

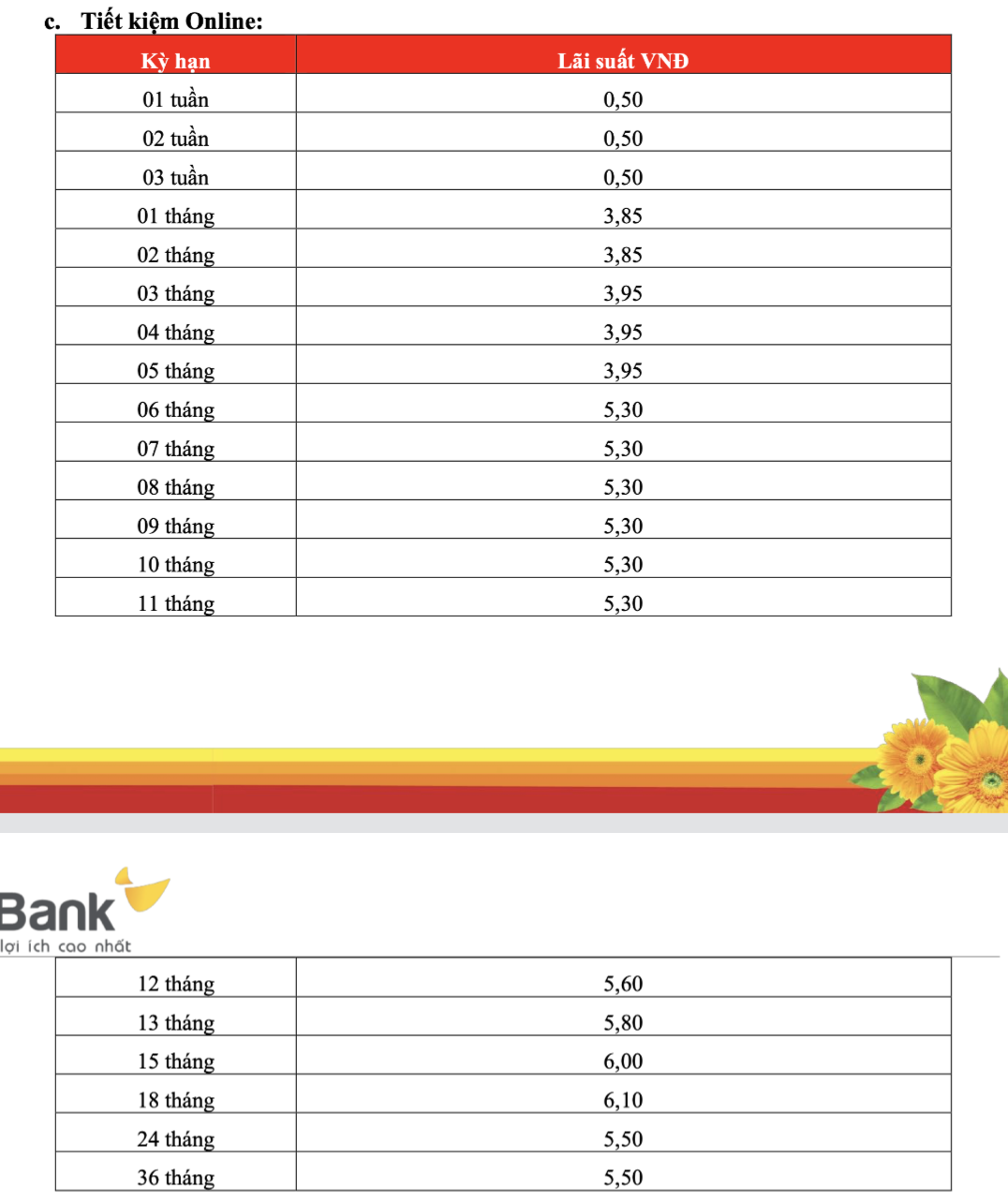

HDBank Online Savings Interest Rates for October 2025

In October 2025, HDBank’s online deposit interest rates range from 0.5% to 6.1% per annum.

Details include: Under 1 month at 0.5%/year; 1-2 months at 3.85%/year; 3-5 months at 3.95%/year; 6 months at 5.3%/year; 7-11 months at 5.3%/year; 12 months at 5.6%/year; 13 months at 5.8%/year; 15 months at 6.0%/year; 18 months at 6.1%/year; and 24 to 36 months at 5.5%/year.

With a peak rate of 6.1%/year for 18-month terms, HDBank remains among the banks offering the highest deposit interest rates in the current market.

Online Deposit Interest Rate Chart as of October 5, 2025

Source: HDBank

Elevating Market Status: Vietnam’s Blue-Chip Stocks Step onto the Global Stage

The race to upgrade Vietnam’s stock market has entered a critical phase. Beyond attracting foreign capital, what the market truly needs is a new governance standard—a foundation for Vietnam’s blue-chip companies to compete on the global stage.

The Commercial Banking Sector: Accelerating Budgetary Contributions and Strengthening National Resources

On September 9, at the Private 100 and VNTax 200 Awards, organized by CafeF (VCCorp), the banking industry once again demonstrated its pivotal role in the economy. This prestigious event recognized the top 200 businesses making the most significant contributions to the national budget, with several prominent banking institutions featuring prominently in the rankings.