I. MARKET DYNAMICS OF WARRANTS

By the close of the trading session on October 6, 2025, the market recorded 230 gainers, 22 decliners, and 30 unchanged securities.

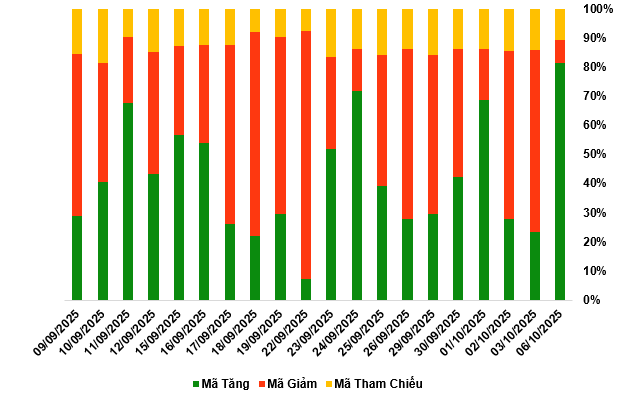

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

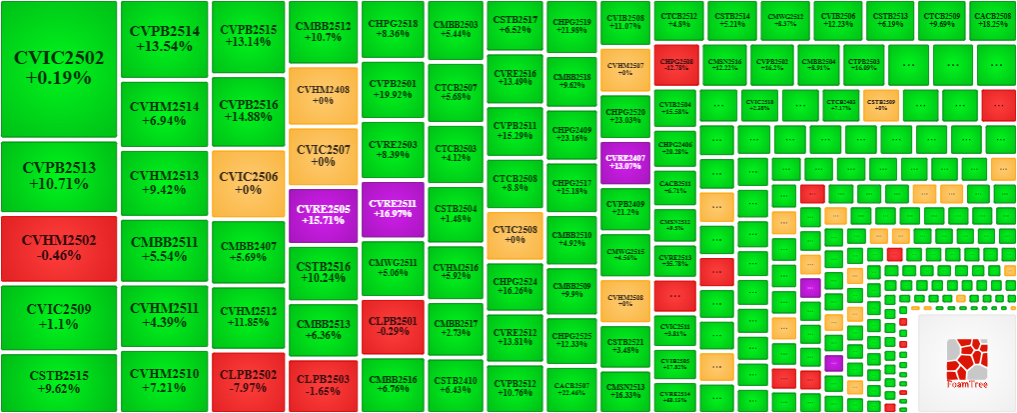

During the October 6, 2025 trading session, buyers regained dominance, driving prices higher for most warrant codes. Notably, the top gainers included CVIC2502, CVHM2514, CHPG2518, and CVPB2515.

Source: VietstockFinance

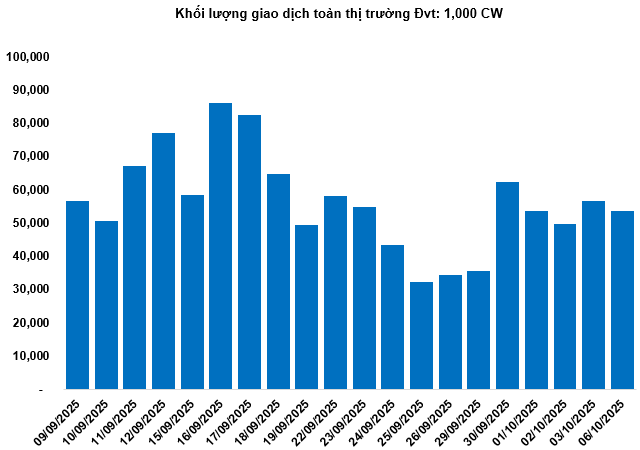

Total market volume on October 6 reached 53.68 million CW, down 5.06%; trading value hit VND 143.41 billion, up 1.39% compared to October 3. CHPG2520 led the market in both volume and value, with 2.12 million CW traded, equivalent to VND 7.64 billion.

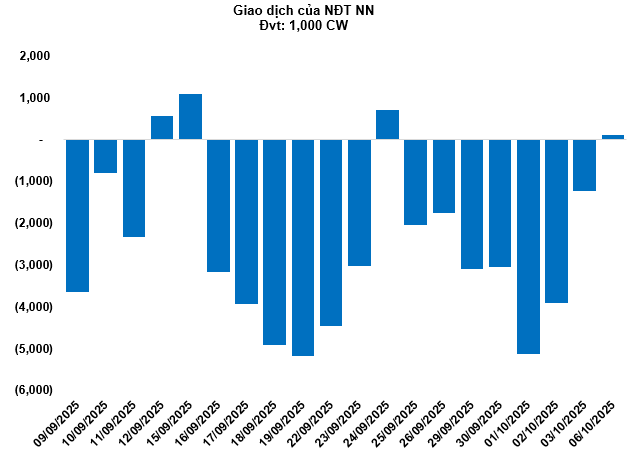

Foreign investors turned net buyers on October 6, with a total net purchase of 113,700 CW. CLPB2505 and CHPG2516 were the most net-bought warrants.

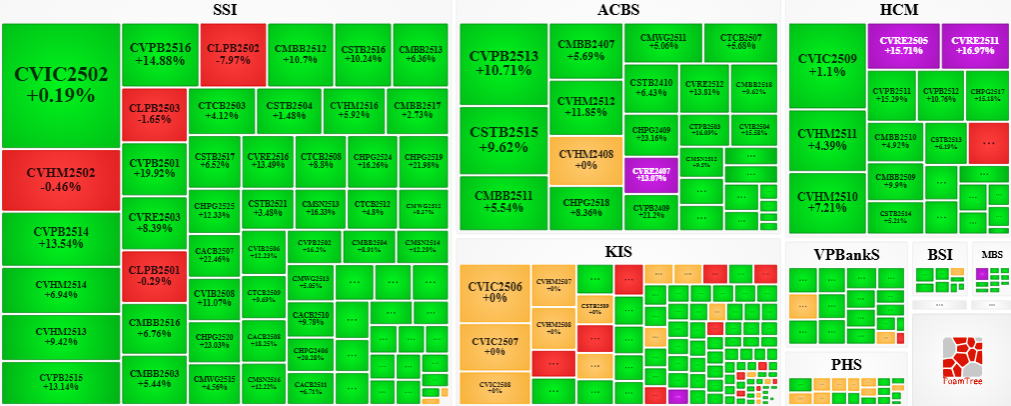

Securities firms SSI, ACBS, HCM, KIS, and VPBankS currently issue the most warrants in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

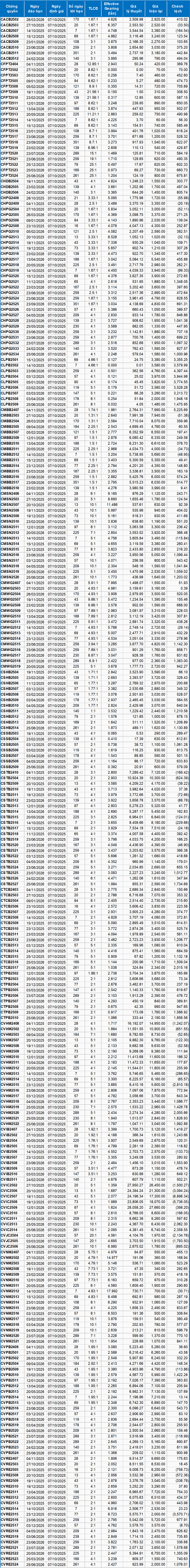

III. WARRANT VALUATION

Based on the valuation method applicable from October 7, 2025, the fair prices of warrants currently trading are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for the respective warrant maturities.

According to the valuation, CVIC2507 and CVIC2508 are currently the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2512 and CVNM2502 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 06/10/2025

Market Outlook for Warrant Trading Week of October 6–10, 2025: Pessimism Continues to Rise

At the close of trading on October 3, 2025, the market saw 66 stocks rise, 176 fall, and 40 remain unchanged. Foreign investors continued their net selling streak, offloading a total of 1.23 million CW.

October 1, 2025: Warrant Market Trading Value Surges Over 112%

As the trading session closed on September 30, 2025, the market witnessed 120 stocks advancing, 124 declining, and 39 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 3.05 million CW.