Recent reports highlight a surge in mega-projects by leading conglomerates, reshaping the real estate market. The latest hotspot is the Vinhomes Green Paradise project (also known as Vinhomes Can Gio) in Can Gio district, Ho Chi Minh City. Spanning 2,870 hectares with an investment of approximately $10 billion by Vingroup, the project has already heated up the market, despite not yet being officially launched.

Vinhomes Can Gio after over 5 months of construction.

Notably, over the past two weeks, numerous real estate agencies from the North to the South have become distributors for the project. Dozens of agencies from the North have started moving South. Around the project, agents are constantly on standby, and agencies are racing to secure office space and accommodations for their staff.

An agent named H. shared, “Can Gio’s land is heating up, and the entire market is focusing on this area. Vinhomes Can Gio is attracting dozens of agencies and hundreds of thousands of sales agents.”

The director of a real estate agency noted that when major projects are launched, the entire market seems to pause. Looking back, when Vinhomes Co Loa was launched, some developers delayed their own project launches. Mega-projects by industry leaders attract significant capital and sales teams.

They added that Vinhomes Can Gio is now in the same situation, with investors from Hanoi and Ho Chi Minh City eagerly awaiting. Thanks to the project’s appeal, the area is set to become a new growth hub in the outskirts.

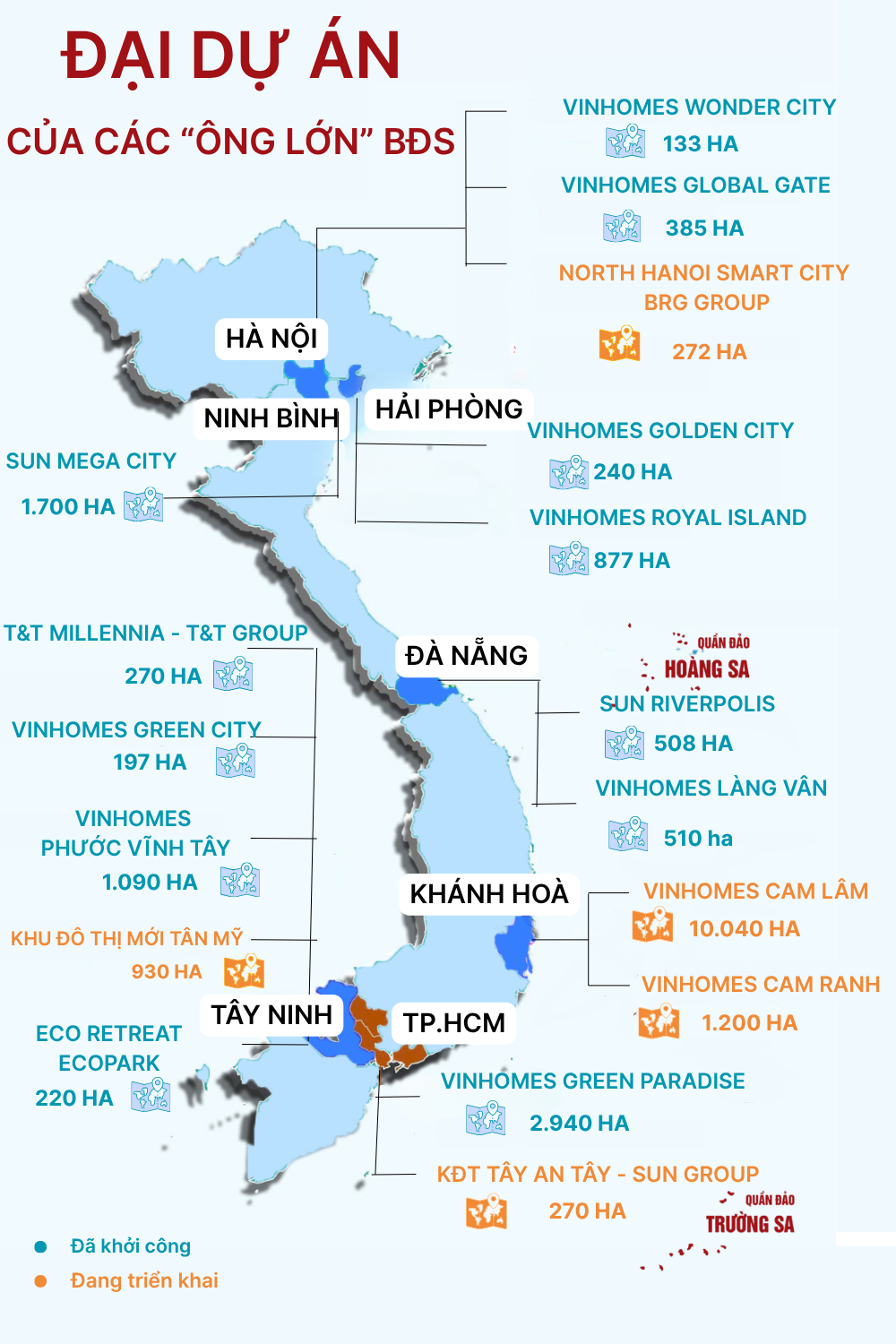

Additionally, Vingroup has accelerated its strategy of investing in large-scale urban developments, ranging from hundreds to thousands of hectares. In Tay Ninh, the group has projects like Vinhomes Green City (over 197 hectares), Vinhomes Phuoc Vinh Tay (over 1,090 hectares), and the new Tan My Urban Area (930 hectares).

In Khanh Hoa, Vingroup is developing Vinhomes Cam Lam (nearly 10,400 hectares) and Vinhomes Cam Ranh (over 1,200 hectares). In Hai Phong, there’s Vinhomes Royal Island (approximately 877 hectares) on Vu Yen Island and Vinhomes Golden City (over 240 hectares). In Hanoi, major projects include Vinhomes Global Gate (385 hectares) and Vinhomes Wonder City (over 133 hectares).

The impact of Vingroup’s projects in Hanoi, Ho Chi Minh City, Tay Ninh, and Hai Phong is evident: wherever Vingroup invests, the real estate market becomes vibrant, attracting capital and investors.

Vingroup not only addresses the housing supply shortage but also expands urban areas and reshapes population distribution, creating new growth hubs. In Hanoi, Vinhomes Smart City (Tay Mo – Dai Mo, Nam Tu Liem) is a prime example. Before the project, the area was sparsely populated with underdeveloped infrastructure. Now, it provides tens of thousands of apartments, easing the capital’s housing shortage, and has spurred infrastructure and commercial development.

Other mega-projects like Vinhomes Ocean Park 1 (Gia Lam, Hanoi), Vinhomes Ocean Park 2 (Van Giang, Hung Yen), and Vinhomes Wonder Park (Dan Phuong, Hanoi) have expanded living spaces beyond the city center, redistributing the population and reducing pressure on the inner city. These new urban hubs are driving sustainable growth in both the economy and quality of life.

Notably, Masterise Homes and MIK Group are key secondary developers partnering with Vingroup. Masterise’s acquisition of 32 apartment buildings in Vinhomes Ocean Park 3 has made it a major player in Hanoi’s apartment market.

This collaborative strategy creates a unique market synergy. Vingroup focuses on planning and developing mega-urban projects with vast land resources, while partners like Masterise Homes, MIK Group, Mitsubishi Corporation, and CapitaLand handle specific district developments. This division of roles maximizes each party’s strengths: Vingroup provides land and a cohesive ecosystem, while secondary developers contribute design, marketing, and sales expertise.

Sun Group, known for tourism and entertainment projects, is now venturing into urban real estate. Its flagship project is the Sun Mega City in former Ha Nam (now Ninh Binh), covering nearly 1,700 hectares.

In Da Nang, Sun Group is launching Sun Riverpolis, a 508-hectare mega-project, one of its largest in Central Vietnam. Other projects include the Tay An Tay Urban Area in Ho Chi Minh City (nearly 270 hectares) and Ham Tien – Mui Ne in Lam Dong (nearly 220 hectares). Sun Group is also active in key provinces like Bac Ninh, Da Nang, Khanh Hoa, and Quang Ninh, with total investments reaching hundreds of trillions of dong.

Sun Mega City by Sun Group in former Ha Nam (now Ninh Binh), covering nearly 1,700 hectares.

Ecopark has joined the Southern mega-project race with Eco Retreat, a 220-hectare development in Tay Ninh (formerly part of Long An). Its launch has further heated up the Tay Ninh market.

Tay Ninh is emerging as a new hotspot, with major players like Vingroup, Ecopark, and T&T Group (with T&T Millennia, nearly 270 hectares) investing heavily. This influx of leading developers signals a new development cycle, positioning Tay Ninh as a key real estate growth hub in the South.

BRG Group is also making waves with its North Hanoi Smart City project, covering nearly 272 hectares and an estimated investment of $4.2 billion.

In contrast to the mega-project boom, companies like Novaland, Nam Long, Khang Dien, Dat Xanh, and Bitexco are focusing on developing their existing land banks.

Hanoi, Hai Phong, Da Nang, Tay Ninh, and Ho Chi Minh City are the focal points for these mega-projects, attracting significant investment and reshaping Vietnam’s real estate landscape.

According to the Land Services Real Estate Research Institute, over 100 projects with approximately 43,000 new units are expected this year, a 30-40% increase from 2024. The South accounts for over half, primarily from large-scale urban developments.

DKRA Group forecasts that in Q3, the Southern housing supply could reach nearly 11,000 units, concentrated in Ho Chi Minh City (including Binh Duong and former Ba Ria – Vung Tau) and Tay Ninh (including former Long An). Large-scale integrated urban projects will account for over 50% of new launches, driving the second-half supply.

Ms. Cao Thi Thanh Huong, Head of Research at Savills Ho Chi Minh City, notes that demand is focused on projects by reputable developers, especially large-scale, well-planned urban developments with comprehensive amenities.

While smaller projects attract buyers with competitive pricing, mega-projects appeal through scale, visionary planning, and integrated amenities. Backed by strong financial capabilities, diverse ecosystems, and trusted brands, these projects continue to attract both homeowners and investors.

Exciting News for Thanh Hoa Residents: Vingroup, Led by Billionaire Pham Nhat Vuong, Set to Launch 1,600 Affordable Housing Units, Anticipated Price Over 20 Million VND/m²

Vingroup is set to launch nearly 1,600 affordable housing units in Thanh Hoa, with prices starting from 20.6 million VND per square meter.

Ho Chi Minh City Authorities Consider Vingroup’s Proposal for a Can Gio – Vung Tau Sea-Crossing Highway

Previously, Vingroup submitted an official proposal to the Ho Chi-Minh City People’s Committee, requesting permission to conduct a feasibility study for an ambitious sea-crossing road project. This proposed route aims to connect the Cần Giờ district with the Bà Rịa – Vũng Tàu province, bridging a critical gap between these regions.

The Planet’s Premier Natural Bayfront Megacity by Vinhomes Consortium Celebrates a Major Milestone

The Vinhomes consortium’s Cam Ranh Bay urban area has been granted permission to raise an additional VND 24.5 trillion for the development of infrastructure on the allocated land.