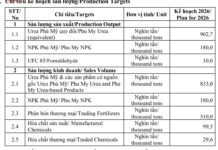

ACB Counter Deposit Rates for October 2025

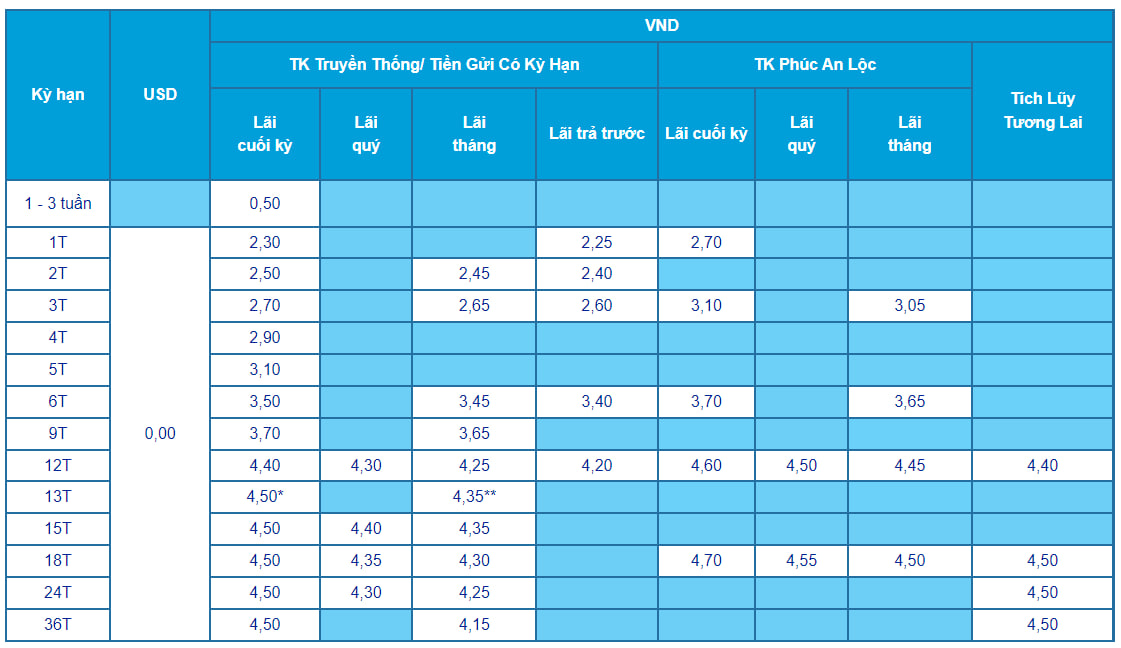

According to an early October survey, Asia Commercial Bank (ACB) continues to offer counter deposit interest rates for customers, with end-of-term interest ranging from 0.5% to 4.5% per annum.

Specifically, ACB lists a 0.5% per annum rate for deposits of 1-3 weeks; 1-month deposits at 2.3% per annum; 2-month deposits at 2.5% per annum; 3-month deposits at 2.7% per annum; 4-month deposits at 2.9% per annum; 5-month deposits at 3.1% per annum; 6-month deposits at 3.5% per annum; 9-month deposits at 3.7% per annum; and 12-month deposits at 4.4% per annum.

ACB applies a 4.5% per annum deposit rate for longer terms from 13 to 36 months. Notably, for 13-month deposits of 200 billion VND or more, customers receive a preferential rate of 6.0% per annum.

ACB Counter Deposit Rates for October 2025

Source: ACB

In addition to end-of-term interest, ACB offers flexible interest payment options: Quarterly interest ranges from 4.30% to 4.4% per annum; Monthly interest ranges from 2.45% to 4.35% per annum (13-month deposits of 200 billion VND or more receive a preferential rate of 5.9% per annum); and Advance interest ranges from 2.25% to 4.2% per annum.

Furthermore, ACB offers the Phúc An Lộc and Future Accumulation savings packages, with interest rates up to 4.7% per annum.

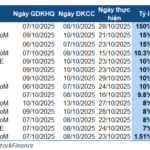

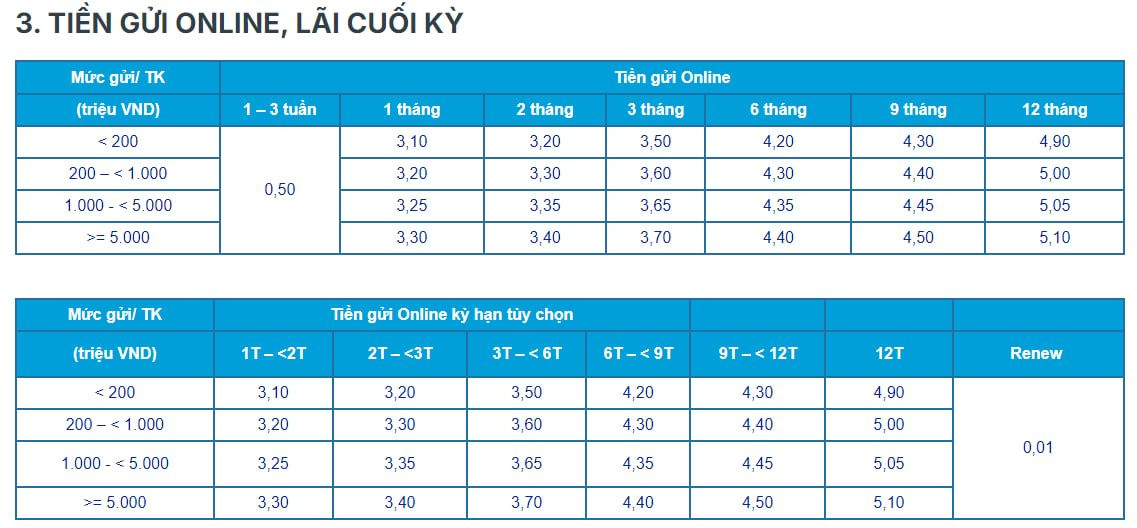

ACB Online Deposit Rates for October 2025

For online deposits via the bank’s app, ACB’s interest rates range from 0.5% to 5.1% per annum for end-of-term interest.

Specifically, ACB applies a 0.5% per annum rate for 1-3 week deposits. Other terms have tiered rates based on deposit amounts:

For deposits under 200 million VND: 1-month deposits at 3.1% per annum; 2-month deposits at 3.2% per annum; 3-month deposits at 3.5% per annum; 6-month deposits at 4.2% per annum; 9-month deposits at 4.3% per annum; and 12-month deposits at 4.9% per annum.

For deposits from 200 million VND to under 1 billion VND: 1-month deposits at 3.2% per annum; 2-month deposits at 3.3% per annum; 3-month deposits at 3.6% per annum; 6-month deposits at 4.3% per annum; 9-month deposits at 4.4% per annum; and 12-month deposits at 5.0% per annum.

For deposits from 1 billion VND to under 5 billion VND: 1-month deposits at 3.25% per annum; 2-month deposits at 3.35% per annum; 3-month deposits at 3.65% per annum; 6-month deposits at 4.35% per annum; 9-month deposits at 4.45% per annum; and 12-month deposits at 5.05% per annum.

For deposits of 5 billion VND or more: 1-month deposits at 3.3% per annum; 2-month deposits at 3.4% per annum; 3-month deposits at 3.7% per annum; 6-month deposits at 4.4% per annum; 9-month deposits at 4.5% per annum; and 12-month deposits at 5.1% per annum.

Thus, 12-month online deposits currently offer the highest interest rates at ACB, ranging from 4.9% to 5.1% per annum, depending on the deposit amount.

ACB Online Deposit Rates for September 2025

Source: ACB

HDBank Interest Rates October 2025: Which Term Deposit Offers the Highest Returns?

At the beginning of October 2025, HDBank offered the highest interest rate of 6.1% per annum for regular deposits.

ACB Unveils Exclusive Gold Bar Brand Under Chairman Tran Hung Huy, Resumes Operations from October 10th

Asia Commercial Bank (ACB) has announced the relaunch of its gold trading services starting October 10th, marking a significant milestone as the first bank to introduce its own branded gold bars.

Upgrade to iPhone with ACB: 0% Down Payment, Stress-Free Installments

It takes the average Vietnamese worker a staggering 99 days of wages to afford an iPhone 17 Pro, a stark contrast to the mere 3 days for Luxembourgers and 4 days for Americans. Yet, the allure of the iPhone remains unwavering, as evidenced by over 100,000 pre-orders on the first day of availability.