In September, the average registered capital per newly established enterprise reached VND 9.9 billion, a 38.1% decrease compared to the previous month but a 19.2% increase year-over-year. Additionally, 10.7 thousand businesses resumed operations nationwide, down 13.6% month-over-month but up 65.7% year-over-year.

During the same month, 4,564 businesses registered for temporary suspension, a 30.1% monthly decline but a 7.8% annual increase; 6,160 ceased operations pending dissolution procedures, down 10.4% and 16.9% respectively; and 4,182 completed dissolution, up 9.1% and 160.6%.

In the first nine months of 2025, 145 thousand new enterprises registered with a total capital of VND 1,420.2 trillion and 874 thousand employees, marking increases of 18.9% in enterprises, 22.6% in capital, and 18.9% in labor compared to the same period in 2024.

The average registered capital per new enterprise in this period was VND 9.8 billion, up 3.1% year-over-year. Total additional capital injected into the economy reached VND 4,720.5 trillion, a 104.3% surge. Meanwhile, 86.4 thousand businesses resumed operations (up 41.3%), bringing the total of new and reactivated enterprises to 231.3 thousand, a 26.4% increase. On average, 25.7 thousand enterprises were established or reactivated monthly.

Source: General Statistics Office

|

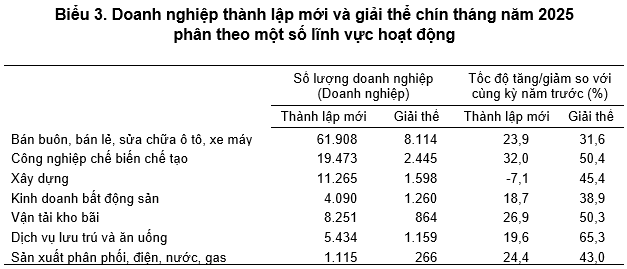

By sector, 1,332 new enterprises were established in agriculture, forestry, and fisheries (up 10.6%); 32.4 thousand in industry and construction (up 14.5%); 111.3 thousand in services (up 20.4%); and nearly 4.1 thousand in real estate (up 19%).

Over the nine months, 99.5 thousand businesses temporarily suspended operations (up 14.5%); 53.2 thousand ceased operations pending dissolution (down 13.5%); and 22.3 thousand completed dissolution (up 45%). On average, 19.4 thousand businesses exited the market monthly.

– 13:32 06/10/2025

Vietnam’s Q3 GDP Growth Hits Record High Since 2011: What Does This Mean for 2025’s First Nine Months?

The latest report from the General Statistics Office (Ministry of Finance) on the socio-economic situation highlights that Vietnam’s economy in the third quarter and the first nine months of 2025 has achieved remarkably positive results, with each month and quarter showing continuous improvement. This progress is particularly notable given the ongoing uncertainties in the global and regional economic landscape.

September 2025: Local Highlights Shine Across Regions

In the first nine months of 2025, numerous regions reported robust growth momentum, paralleled by accelerated public investment disbursement. This synergy has catalyzed a ripple effect, invigorating both production-business activities and infrastructure development.

Unveiling the Strategic Moves of Industry Giants in Khánh Hòa Province

Khánh Hòa is poised to become Vietnam’s next high-growth hub, boasting a modern, smart, and sustainable urban ecosystem rich in cultural identity. This burgeoning region is increasingly captivating visionary Vietnamese investors with its unique appeal and strategic advantages, making it a land of promise for those seeking to make a distinctive impact.

Top 7 Stocks with Strong Fundamentals and Positive Q3/2025 Earnings Outlook: Ideal Picks for October Investment

Agriseco identifies several positive factors influencing the market, including the gradual release of Q3 business results, the anticipated economic acceleration in the final quarter, and the potential for a ratings upgrade.