Specifically, the company is offering 10 million bonds under the code DSE125018, with a face value of 100,000 VND per bond, aiming to raise 1,000 billion VND. These are non-convertible bonds, without warrants or collateral, and have a 24-month term from the issuance date.

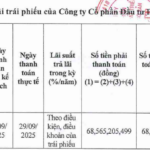

The DSE125018 bonds offer an interest rate of 8.3% per annum for the first two interest periods, followed by a floating rate for the remaining periods. The floating rate is calculated as the sum of 3.5% per annum and the average 12-month personal deposit interest rate at Vietcombank, BIDV, Vietinbank, and Agribank. DNSE guarantees interest payments every six months, ensuring a stable cash flow for investors.

The registration and payment period for purchasing bonds is from October 6, 2025, to October 27, 2025. The minimum purchase quantity for individual and institutional investors is 10 bonds, equivalent to 1 million VND.

Investors can purchase bonds by submitting their registration documents at DNSE’s headquarters, its branches, or through the distribution agent, Vina Securities Corporation (VNSC).

The proceeds from this bond issuance will be used by DNSE to invest in advance payment activities and securities margin trading.

|

This bond issuance is part of DNSE’s plan approved by the 2025 Annual General Meeting of Shareholders earlier this year. DNSE plans to issue a maximum of 1,200 billion VND in corporate bonds in 2025. Additionally, DNSE intends to offer 85.65 million shares to existing shareholders at a minimum price of 12,500 VND per share this year.

With the stock market’s liquidity booming in Q2 and Q3 of 2025, DNSE’s margin lending and brokerage activities have seen significant growth. These capital-raising activities will enable DNSE to promptly supplement its capital to meet investor demands.

In terms of business performance, DNSE’s cumulative revenue for the first eight months of the year reached 936 billion VND, an 81% increase compared to the same period in 2024 and 98% of the annual plan. Pre-tax profit for the first eight months reached nearly 350 billion VND, a 98% increase year-over-year and 107% of the full-year 2025 target.

DNSE also recorded a record-high margin debt of 6,591 billion VND.

Furthermore, DNSE maintains its position as one of the top players in new securities account openings. As of August 2025, DNSE has over 1.2 million accounts, representing 12% of the total securities accounts in the market.

In the derivatives segment, DNSE continues to hold the second position in market share, with a 24% share in August 2025.

Recently, leveraging its leading technology platform, DNSE was among the top distributors of Technocom Securities JSC (TCBS) IPO shares, with a fully online, simplified distribution process. DNSE plans to continue participating in upcoming IPO share distributions, capitalizing on its strong online system.

Given the stock market’s positive liquidity and impressive growth drivers, coupled with DNSE’s strong business performance, this public bond issuance will help the company raise capital for its core operations and expand its product offerings to deliver optimal returns to investors.

|

Investors, please refer to the DSE125018 bond purchase guide from DNSE Securities Corporation here. |

– 09:16 07/10/2025

Vietnam’s Largest Stock Market Deal in History Set to Launch in Days

VPBankS is set to redefine the financial landscape with its groundbreaking IPO, marking a historic milestone in the securities industry. This unprecedented offering promises to be a game-changer, setting new benchmarks for scale, innovation, and investor opportunity.

VPBankS Sets IPO Date for 375 Million Shares

VPBankS is set to launch its Initial Public Offering (IPO) of 375 million shares at a price of 33,900 VND per share, commencing on October 10, 2025.