The VN-Index closed September at 1,661.70 points, marking a 1.2% decline compared to August 2025. Liquidity also decreased in September, indicating heightened caution among investors following four consecutive months of market gains.

In its October report, Yuanta Securities characterizes this as a technical correction, maintaining a long-term bullish outlook.

Historically, October tends to be a down month with a 54% probability of decline. However, analysts predict a potential market rebound from mid-October 2025. Key support levels for the VN-Index during this correction are identified at 1,600 points and 1,530 points. Yuanta views this adjustment as essential for solidifying the long-term upward trend.

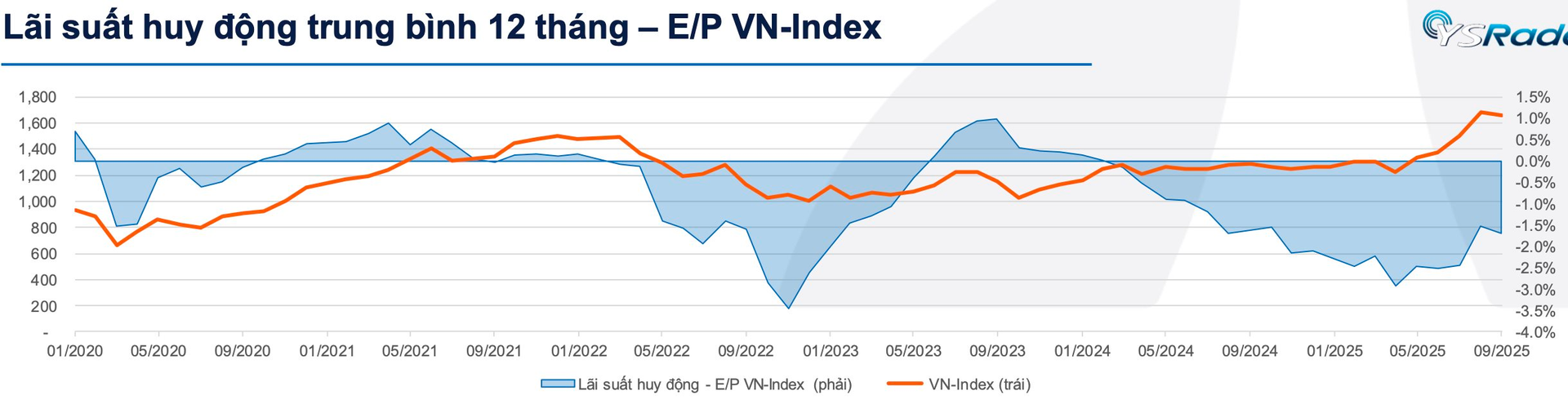

A positive note is the sustained long-term optimism. Yuanta analysts anticipate that the Federal Reserve’s rate cuts and Vietnam’s stock market upgrade narrative will bolster investor confidence. Additionally, the low-interest-rate environment is expected to maintain high market liquidity throughout 2025.

For October investment strategies, investors are advised to maintain a high equity allocation and leverage the early-month correction to increase holdings at support levels.

Yuanta favors banking stocks for their attractive valuations and market upgrade potential. Additionally, real estate, tourism, retail, and food production sectors are recommended based on their valuation correlations and growth prospects for October.

Vietstock Daily 07/10/2025: Positive Signals Emerge

The VN-Index has surged, breaking above the Middle Bollinger Band. Trading volume exceeded the 20-day average, and the Stochastic Oscillator has signaled a buy, reducing short-term risk.

Market Pulse 06/10: Green Dominates as VN-Index Surges Nearly 50 Points

At the close of trading, the VN-Index surged by 49.68 points (+3.02%), reaching 1,695.5 points, while the HNX-Index climbed 8.94 points (+3.36%) to 274.69 points. Market breadth was overwhelmingly positive, with 542 advancing stocks and only 194 declining ones. Similarly, the VN30 basket saw a dominant green trend, with 29 gainers and just 1 loser.