The stock market continued its positive momentum in the first session of the week on October 6th, with a notable focus on securities stocks. The VN-Index surged by nearly 50 points, closing at 1,695.50. Market breadth on HOSE leaned positive following a period of adjustment, with 249 stocks advancing. Securities, banking, real estate, construction, port, and technology sectors led the rally. However, foreign investors remained net sellers, offloading a total of VND 1,902 billion across the market.

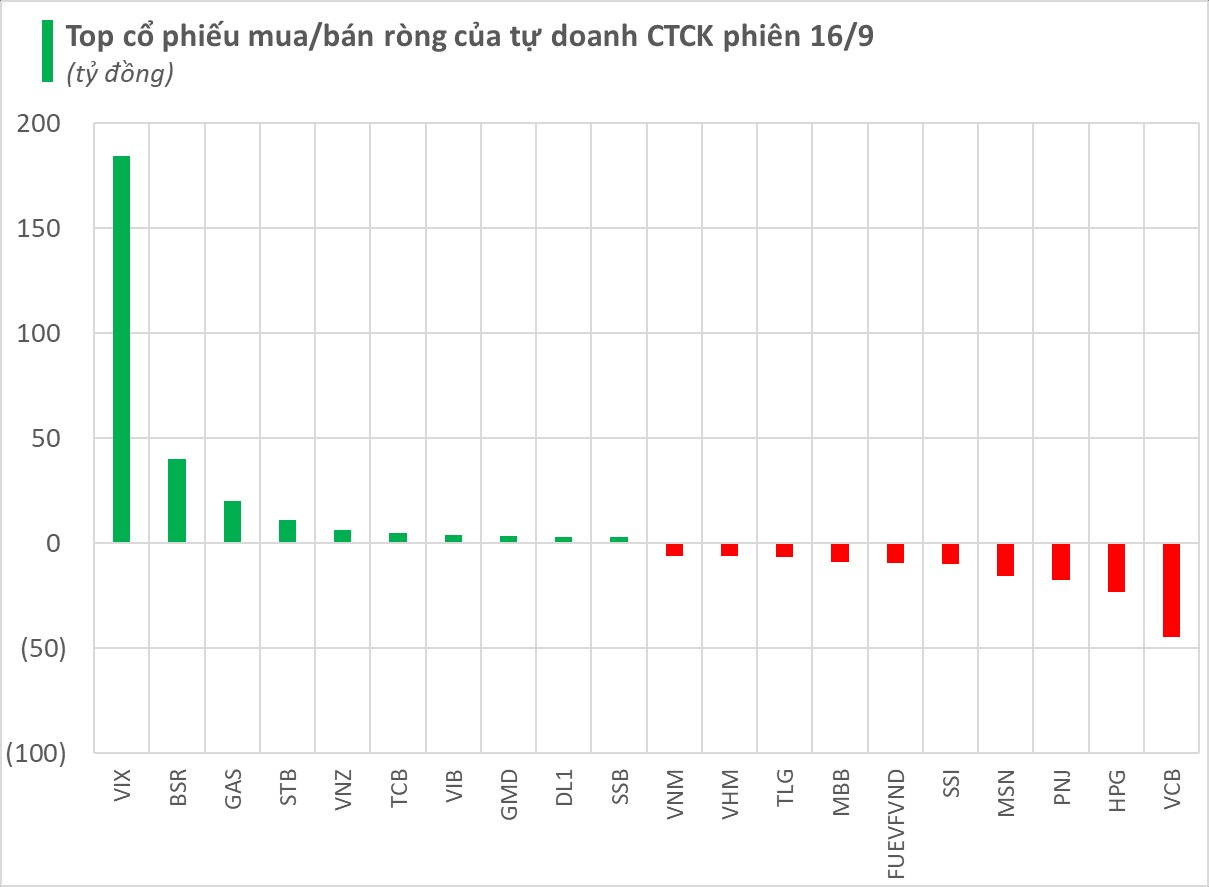

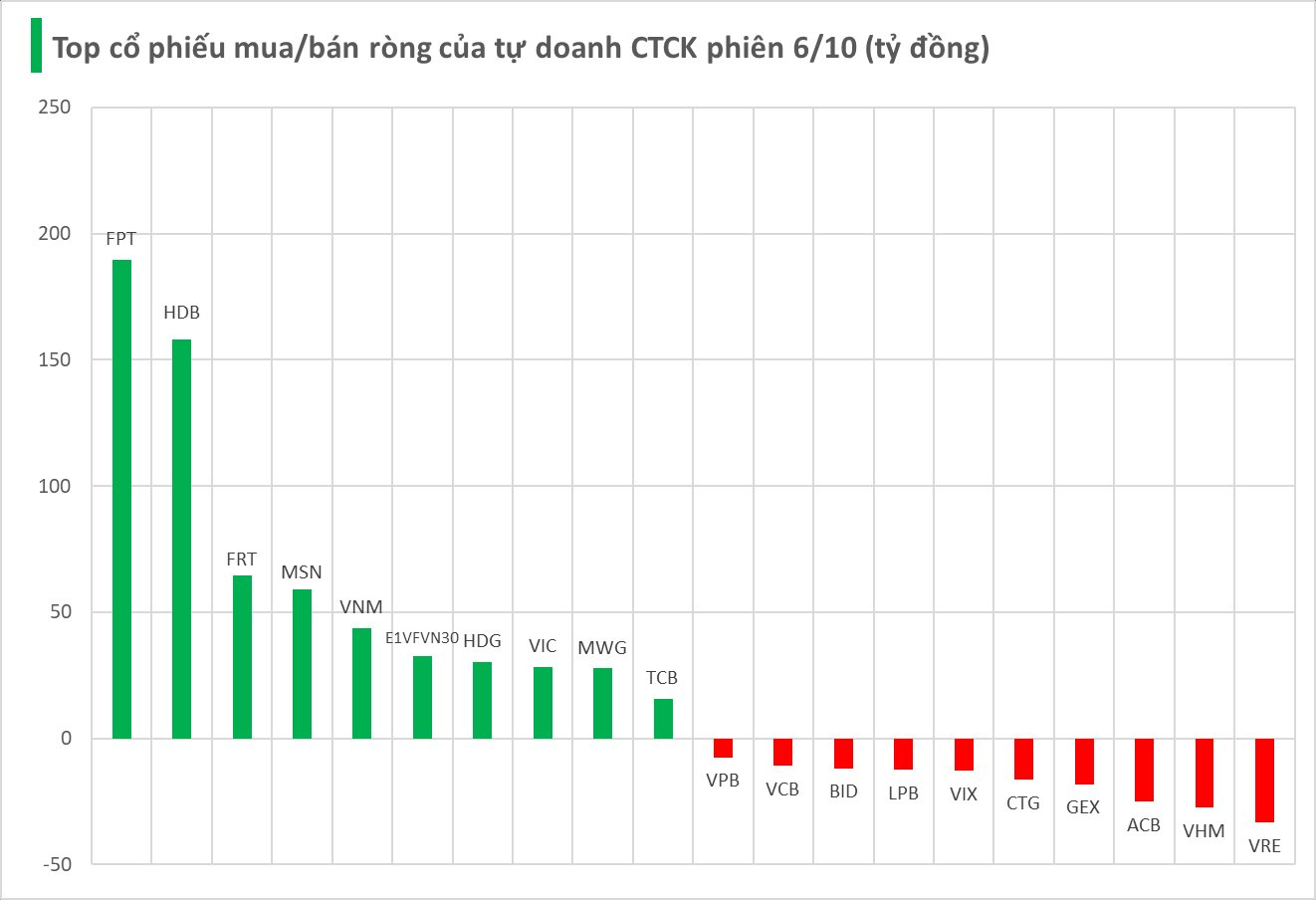

Proprietary trading firms recorded a net purchase of VND 392 billion on HOSE.

Specifically, FPT and HDB were net bought with values of VND 190 billion and VND 158 billion, respectively. They were followed by FRT (VND 64 billion), MSN (VND 59 billion), VNM (VND 44 billion), E1VFVN30 (VND 32 billion), HDG (VND 30 billion), VIC (VND 28 billion), MWG (VND 28 billion), and TCB (VND 16 billion), all of which saw strong buying from proprietary trading firms.

Conversely, the most significant net selling by trading firms was observed in VRE, with a value of -VND 33 billion, followed by VHM (-VND 27 billion), ACB (-VND 25 billion), GEX (-VND 18 billion), and CTG (-VND 16 billion). Other stocks also recorded notable selling pressure, including VIX (-VND 13 billion), LPB (-VND 12 billion), BID (-VND 12 billion), VCB (-VND 11 billion), and VPB (-VND 8 billion).

Yuanta: Vietnam’s Stock Market Poised for Upturn by Mid-October

In its October report, Yuanta Securities characterizes the current market movement as a technical correction, affirming that the long-term upward trend remains intact.

Vietstock Daily 07/10/2025: Positive Signals Emerge

The VN-Index has surged, breaking above the Middle Bollinger Band. Trading volume exceeded the 20-day average, and the Stochastic Oscillator has signaled a buy, reducing short-term risk.