Illustrative Image

Rice prices in Bangladesh are surging, putting pressure on consumers despite record-high domestic production and imports.

A survey of retail markets in Dhaka reveals that coarse rice is selling at 58–62 taka/kg, medium-quality rice at 65–72 taka, and fine rice at 75–98 taka, marking a 2–3 taka increase in just two weeks.

The government has slashed rice import tariffs to nearly 0% for the current fiscal year. Since the season began, Bangladesh has imported approximately 0.35 million tons of rice, with the private sector accounting for 85%. Meanwhile, the Department of Agricultural Extension (DAE) forecasts a record-breaking 22 million tons for the Boro harvest this year.

The Directorate of Food has procured a record 1.7 million tons of Boro rice from May to August, boosting public stockpiles to around 1.6 million tons. The government also aims to import a total of 0.5 million tons for strategic reserves, with 50,000 tons already delivered. Procurement for the Aman harvest is set to begin in November, ensuring short-term supply stability.

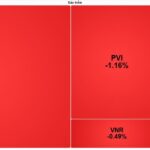

In contrast, global rice markets tell a different story. The FAO’s global rice price index dipped by 0.5% in September, down 24.2% year-on-year—the lowest in five years. Indica rice, popular in South Asia, saw the sharpest decline at 0.9%. Export prices from India, Vietnam, and Pakistan range between $364–390/ton.

Importers in Dinajpur report stable domestic prices, with a minimal 1–2 taka/kg difference between imported coarse and medium rice. Imports have helped prevent more severe market fluctuations.

However, the Bangladesh Consumers Association (CAB) argues that consumers are not benefiting from abundant supplies. SM Nazer Hossain, CAB Vice President, blames millers for controlling both domestic and imported rice, including government reserves, while market oversight remains weak.

Professor Rashidul Hasan, a value chain expert, notes that prices briefly dipped in June but rebounded during the Boro peak harvest. He attributes this to the government’s failure to establish an efficient mechanism for purchasing paddy directly from farmers, leaving the market dependent on millers.

Despite being the world’s third-largest rice producer, Bangladesh often fails to meet domestic demand, relying on imports from India, Thailand, Vietnam, and Myanmar. In the first eight months of the year, Vietnam’s rice exports to Bangladesh soared by 26,864% in volume and 16,371% in value, reaching 104,888 tons worth $49.86 million.

Southeast Asian Nation’s Woes as Vietnam’s Rice Staple Soars: Citizens Stunned by Skyrocketing Prices, High-Quality Supply Dwindles

Despite a surge in production and substantial reserves, rice prices are soaring to unprecedented highs across the nation.

“Unraveling the Opportunities and Challenges for the Textile and Footwear Industry in the Coming Years”

On September 9, at the Trade Promotion Conference with the Vietnamese Trade Offices Abroad for August 2025, chaired by the Minister of Industry and Trade, representatives from the Vietnam Textile and Apparel Association and the Vietnam Leather, Footwear and Handbag Association shared new challenges and proposed solutions to overcome difficulties, enhance competitiveness, and seize opportunities in the international market.

Vietnam Rice Prices Hit Eight-Month High

According to the Vietnam Food Association, 5% broken rice was offered at a price of $455-$460 per ton on August 28th, the highest it has been since the beginning of this year.