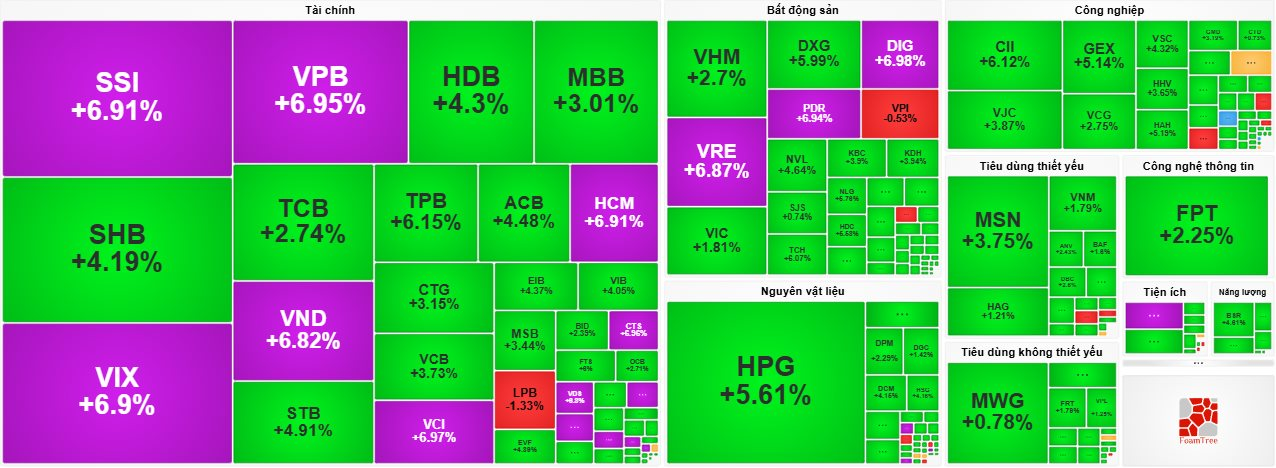

After several volatile sessions, the stock market witnessed a surge in buying pressure during the first trading day of the week (October 6th), completely overwhelming selling forces. A sea of green dominated most sectors, with securities, banking, and real estate stocks leading the charge, many hitting their ceiling prices.

By the close of October 6th, the VN-Index climbed 49.68 points to reach 1,695.5 points. The HNX-Index rose 8.94 points to 274.69 points, and the UPCoM-Index gained 0.8 points, settling at 109.82 points.

Market liquidity exploded, with total trading value across all three exchanges nearing 34.6 trillion VND. The HoSE alone saw nearly 31.8 trillion VND change hands, a 7.2 trillion VND increase compared to the previous session.

The stock market experienced a trading frenzy during the first session of the week on October 6th.

Securities stocks became the focal point, attracting significant investor interest and surging across the board. Many hit their ceiling prices, including: HCM (+6.91%), CTS (+6.96%), VDS (+6.8%), DSE (+6.93%), ORS (+6.72%), AGR (+6.76%), TCI (+6.96%), DSC (+6.93%), VCI (+6.97%), VND (+6.82%), SSI (+6.91%), VIX (+6.9%), and more.

Banking stocks also experienced a strong rally, with VPB leading the pack at its ceiling price of +6.95%. Other notable gainers included: TPB (+6.15%), HDB (+4.3%), SHB (+4.19%), STB (+4.91%), EIB (+4.37%), VIB (+4.05%), MSB (+3.44%), CTG (+3.15%), VCB (+3.73%), TCB (+2.74%), MBB (+3.01%), and others.

After several volatile sessions, real estate stocks saw a resurgence in investor interest during the first trading day of the week. Notable gainers included: VRE (+6.87%), PDR (+6.94%), DIG (+6.98%), followed by VIC (+1.81%), VHM (+2.7%), NVL (+4.64%), DXG (+5.99%), NLG (+4.76%), TCH (+6.07%), KDH (+3.94%), and more.

Additionally, large-cap stocks across various sectors contributed significantly to the overall market rally, including: HPG (+5.61%), DCM (+4.16%), BSR (+4.81%), MSN (+3.75%), FPT (+2.25%), HDG (+7%), VNM (+1.79%), VJC (+3.87%), HaH (+5.19%), GEX (+5.14%), VGC (+3.58%), and others.

On the downside, LPB shares of LPBank led the decliners, falling 1.33% to 51,800 VND, putting pressure on the benchmark index. Other notable decliners included VPI, TDP, PAN, GEE, all adjusting less than 1%.

Foreign investors continued their net selling spree, offloading nearly 1.7 trillion VND worth of stocks today. MWG bore the brunt of the selling pressure, with over 310 billion VND sold. Other heavily sold stocks included MBB (278.82 billion VND), STB (211.9 billion VND), VRE (196.43 billion VND), HDB (164.17 billion VND), VHM (163.01 billion VND), TCB (128.43 billion VND), and CII (105.72 billion VND).

On the buying side, foreign investors actively accumulated HPG shares, investing over 147 billion VND. Other stocks attracting foreign buying interest were VIX (147.57 billion VND), ACB (46.13 billion VND), and GEX (43.77 billion VND).

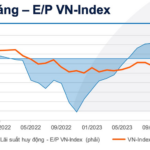

Analysts attribute the VN-Index’s nearly 50-point surge in the first session of the week, coupled with robust liquidity, to renewed investor confidence following a prolonged period of volatility. The strong performance of leading sectors like securities, banking, and real estate sets the stage for the index to challenge the 1,700 resistance level in the near term.

However, investors should remain cautious about the persistent net selling pressure from foreign investors, especially given the ongoing global market uncertainties.

Which Stock Codes Were the Focus of Securities Companies’ Proprietary Trading Accumulation in the First Session of the Week on October 6th?

Proprietary trading desks at securities companies recorded a net purchase of VND 392 billion on the Ho Chi Minh City Stock Exchange (HOSE).

Which Stock Codes Were the Heroes Behind VN-Index’s Near 50-Point Surge in the Week’s Opening Session?

Today’s VN30 basket closed with 29 stocks in unanimous ascent, led by SSI, VPB, and VRE hitting their upper limits, firmly bolstering each upward stride of the benchmark index.