Vietnam’s stock market has just witnessed a rare surge after a prolonged period of stagnation. The VN-Index soared by nearly 50 points, equivalent to over 3%, with green dominating the board. This robust rally not only dispelled concerns about retesting the 1,600-point bottom but also opened up opportunities for the VN-Index to surpass the 1,700 mark.

Not only leading stocks but also mid and small-cap stocks saw impressive gains, indicating that capital flow is not concentrated solely on “blue chips” but is spreading across the entire market. This unanimous uptrend creates a sense that the market is entering a new wave, rather than just a quick “hit and run” rally.

This surge is not coincidental. Domestic and international investors are betting on Vietnam’s potential upgrade by FTSE Russell in the announcement scheduled for October 8. If this scenario materializes, it will mark a historic milestone after over a decade of waiting, opening a new chapter for Vietnam’s stock market.

VN-Index Could Soon Surpass Historical Peak if Upgraded

According to Mr. Bui Van Huy, Vice Chairman of FIDT, an upgrade by FTSE Russell in this review could symbolize the beginning of a new growth cycle for Vietnam’s economy.

The upgrade narrative goes beyond the expected influx of billions in foreign capital; it also affirms Vietnam’s institutional quality and financial market status, marking a significant step toward becoming a modern market economy with the private sector at its core.

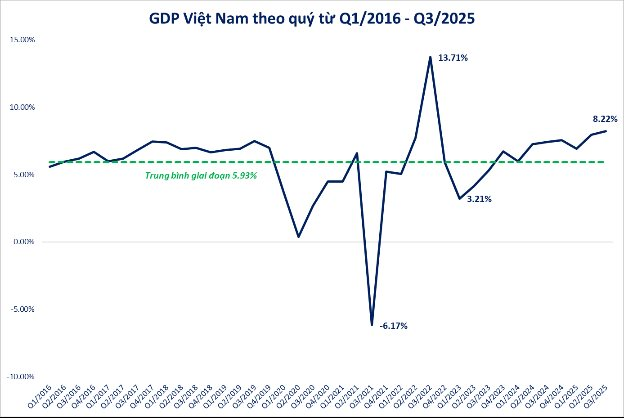

The current context further bolsters this confidence, as Vietnam targets GDP growth above 8% in 2025 and aims for double-digit growth in 2026–2030, focusing on institutional reforms, capital market development, and private investment attraction.

If upgraded, the VN-Index could break its historical peak in the short term, driven by domestic capital and active funds. In the medium to long term, passive capital from global ETFs is expected to flow in gradually over 6–12 months, providing sustainable support for the market.

Conversely, if the upgrade does not occur, the market may face short-term correction pressure due to accumulated expectations, leading to strong psychological reactions. However, the risk of a deep decline is minimal, thanks to stable macroeconomic fundamentals, cooling exchange rates, low interest rates, and better-than-expected GDP growth. Any correction could serve as a necessary “cooling-off” period, consolidating price levels and laying the groundwork for the next growth phase.

Nevertheless, Mr. Huy believes Vietnam has a solid foundation to expect an upgrade from FTSE Russell, as most key criteria have been met and international investor confidence is rebounding strongly.

Will There Be an “Upgrade Wave”?

Despite positive trading, experts note that liquidity, at around VND 30 trillion, remains significantly lower than the vibrant August period (VND 45–50 trillion). This suggests that “smart money” has yet to fully engage.

However, FIDT experts anticipate that capital flow trends will persist for at least the next six months, supported by robust macroeconomic fundamentals. The government maintains aggressive monetary and fiscal policies to bolster economic growth. Notably, savings interest rates remain low at around 5%, prompting idle capital to shift toward the stock market, which is expected to offer more attractive returns.

The sustainability of capital flow during this period hinges on two key catalysts: (1) the market upgrade outcome and (2) the upcoming Q3 earnings reports of listed companies. These will determine whether capital shifts from short-term speculation to value-based investing.

Historically, “upgrade waves” in markets like Qatar or China typically form 3–6 months before the official announcement and peak upon confirmation. However, applying this model to Vietnam’s stock market requires caution, as its structure and dynamics have evolved significantly.

A notable factor is capital flow. Foreign investors have consistently net sold since late 2023, reducing their ownership to a record low of 15.4% (as of October 6, 2025, according to Fiinpro), reflecting caution and skepticism about external upgrade expectations.

In contrast, the recent market rally has been primarily driven by domestic capital, supported by the government’s accommodative policies and strong institutional reforms (such as Resolution 68 and measures to boost investment and market confidence).

Thus, Vietnam’s stock market trend is seen as driven by domestic economic strength and supportive policies, rather than solely relying on external factors. In this context, the upgrade narrative acts as a positive catalyst, attracting quality capital, but it is not the core driver of the current wave’s peak or trough.

Foreign Block’s Massive Sell-Off: Unloading 1.3 Trillion VND in the Week’s Final Session – What’s Driving the Sell-Off?

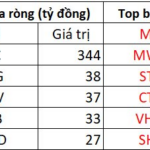

In the afternoon trading session, VIC emerged as the most heavily bought stock across the entire market, with a staggering net buying value of 344 billion VND.

Vietnam’s Stock Market: Scaling New Heights in a Historic Ascent

According to HSC Securities experts, while short-term weakening signals or the possibility of breaching the 1,600-point support level exist, they do not alter the positive long-term outlook for Vietnam’s stock market.