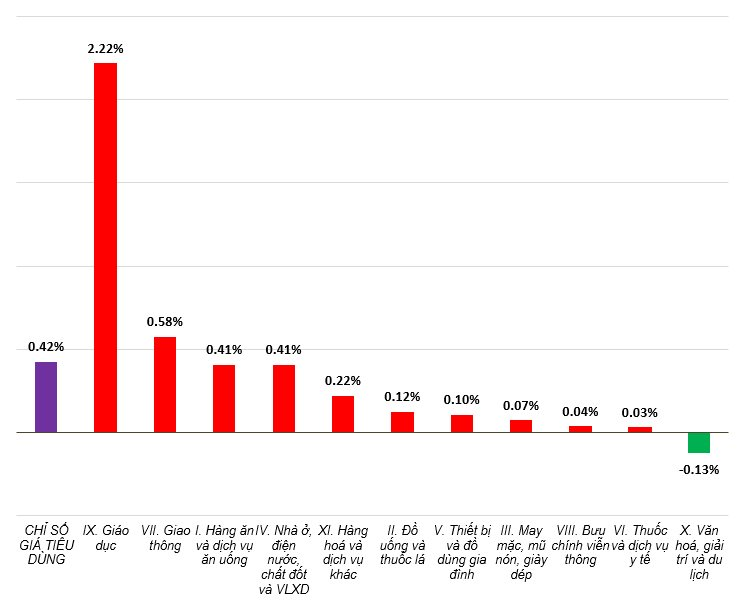

The latest data from the Statistics Bureau (Ministry of Finance) reveals that the Consumer Price Index (CPI) for September rose by 0.42% compared to the previous month. This increase is attributed to rising costs in private education services, food prices, and home maintenance materials. September’s CPI increased by 2.61% compared to December 2024 and by 3.38% year-over-year.

Within the 0.42% CPI increase in September, 10 goods and services categories saw price rises, while the culture, entertainment, and tourism category experienced a decline. Specifically, the 10 categories with price increases are:

– Education: +2.22%, with education services rising by 2.43%.

– Transportation: +0.58%, contributing 0.06 percentage points to the overall CPI increase.

– Food and catering services: +0.41% (adding 0.14 percentage points to CPI), including: Food +0.49% (contributing 0.11 percentage points); grains -0.01%; dining out +0.39%.

– Housing, utilities, fuels, and construction materials: +0.41%.

– Other goods and services: +0.22%, primarily driven by select items.

– Beverages and tobacco: +0.12%, fueled by increased summer demand, the Ghost Festival, and higher production costs. Specifically: Fruit juices +0.43%; energy drinks +0.29%; alcoholic beverages +0.20%; mineral water +0.14%; tobacco +0.10%; beer +0.08%.

– Household equipment and furnishings: +0.10%.

– Garments, hats, and footwear: +0.07%, due to rising labor costs and back-to-school shopping.

– Postal and telecommunications: +0.04%.

– Medicines and healthcare: +0.03%, driven by higher import costs due to exchange rate fluctuations and seasonal demand for pain relief, fever reducers, respiratory medications, vitamins, and minerals.

CPI change rate in September 2025 compared to the previous month

The culture, entertainment, and tourism category decreased by 0.13%, with package tours dropping by 0.78% due to promotional discounts by travel companies. Conversely, photo development services rose by 0.59%; books, newspapers, and magazines by 0.46%; flowers and plants by 0.36%; toys by 0.15%; and hotels by 0.02%.

The average CPI for Q3/2025 increased by 3.27% year-over-year. Key contributors include: Medicines and healthcare +12.69%; housing, utilities, and construction materials +6.98%; education +3.13%; other goods and services +2.93%; food and catering +2.52%; beverages and tobacco +2.28%; culture, entertainment, and tourism +1.78%; household equipment +1.71%; garments and footwear +1.42%; postal and telecommunications -0.53%; transportation -1.42%.

Core inflation rises 3.19% in the first 9 months of 2025

On average, CPI for the first 9 months of 2025 increased by 3.27% compared to the same period in 2024, driven primarily by:

– Housing, utilities, and construction materials: +6.14%, contributing 1.16 percentage points to CPI, due to rising rental and home maintenance costs. Electricity prices rose by 7.05%, adding 0.23 percentage points, following EVN’s retail price adjustments on October 11, 2024, and May 10, 2025.

– Food and catering services: +3.30%, contributing 1.11 percentage points, with food prices rising by 3.59% (adding 0.76 percentage points). Key drivers include pork prices +10.10%; cooking fats +13.08%; dining out +3.72%; and grains +0.69%.

– Medicines and healthcare: +13.48%, contributing 0.73 percentage points, following the Ministry of Health’s Circular No. 21/2024/TT-BYT dated October 17, 2024.

– Other goods and services: +5.37%, contributing 0.19 percentage points, led by notary fees, insurance, and other services +11.23%; personal items +5.0%; and ceremonial services +2.64%.

– Household equipment: +1.63%, contributing 0.11 percentage points.

– Education: +1.81%, contributing 0.11 percentage points, due to tuition hikes at private universities, high schools, and kindergartens for the 2025-2026 academic year.

Factors mitigating CPI growth include: Transportation -2.90% (reducing CPI by 0.28 percentage points), with fuel prices down 10.63%; and postal and telecommunications -0.47% (reducing CPI by 0.01 percentage points) due to lower prices for older phone models.

Core inflation in September rose by 0.20% month-over-month and by 3.18% year-over-year. For the first 9 months of 2025, core inflation increased by 3.19% year-over-year, slightly below the overall CPI increase of 3.27%. This is primarily because food, electricity, healthcare, and education—key drivers of CPI—are excluded from the core inflation calculation.

Q3 2025 CPI Surges 3.27% Year-Over-Year

According to the Statistics Bureau, the Consumer Price Index (CPI) for September rose by 0.42% compared to the previous month. The average CPI for Q3/2025 increased by 3.27% year-over-year from Q3/2024. Over the first nine months of 2025, the CPI climbed 3.27% versus the same period last year, while core inflation advanced 3.19%.

Anticipated Adjustment to Personal Income Tax Deduction Threshold in October 2025

According to the Ministry of Finance, the Standing Committee of the National Assembly is expected to review and adopt a Resolution on adjusting the family deduction threshold for personal income tax during its 50th session in October 2025.