Military Commercial Joint Stock Bank (MB – stock code: MBB) has successfully offered over 55.98 million shares of MB Securities (stock code: MBS) via order matching on the stock exchange from September 3, 2025, to October 2, 2025.

Following this transaction, MB’s ownership in MBS decreased to approximately 381.4 million shares, equivalent to 66.58% of the charter capital.

MB’s move came after MBS finalized its dividend payment rights. Specifically, on August 20, MBS closed its final registration list to distribute a 12% cash dividend for 2024 (1,200 VND per share).

The payment is scheduled for September 19, 2025. With nearly 573 million outstanding shares, MBS will allocate around 687 billion VND for this dividend, of which MB will receive over 520 billion VND.

On the stock market, MBS shares closed at 32,700 VND/share on October 3, 2025. MB is estimated to earn over 1,800 billion VND from reducing its stake in MBS.

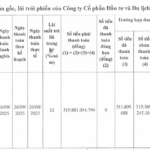

In 2025, MBS plans to offer 68.7 million shares at 10,000 VND/share. The rights ratio is 100:12 (shareholders holding 100 rights can purchase 12 new shares).

Additionally, the company intends to issue 17.18 million shares to increase equity from owner’s capital (bonus shares). The rights ratio is 100:3, meaning shareholders holding 100 shares will receive 3 new shares.

MBS also plans to issue 8.59 million shares under its Employee Stock Ownership Plan (ESOP) at 10,000 VND/share. This issuance will follow the completion of the existing shareholder offering and bonus share issuance.

If all three issuances are completed, MBS’s outstanding shares will increase from 572.8 million to 667.3 million, with a charter capital of 6,673 billion VND.

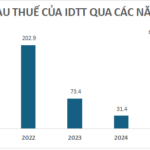

For the first half of 2025, MBS reported operating revenue of 1,461 billion VND, a 6% decrease year-over-year. However, efficient cost management boosted profit before tax by 22% to 611 billion VND.

For 2025, MBS targets total revenue of 3,370 billion VND and pre-tax profit of 1,300 billion VND, up 8% and 40% respectively from 2024. As of the first six months, MBS has achieved 47% of its annual profit goal.

Hải An Logistics to Issue Nearly 2.5 Million ESOP Shares

Hải An Port Services (HAH) is set to launch an ambitious Employee Stock Ownership Plan (ESOP), offering approximately 2.5 million shares to its employees at a price of 10,000 VND per share. This represents an astonishing 81% discount compared to the current market price of HAH shares, providing employees with a unique opportunity to invest in the company’s future at an exceptionally favorable rate.