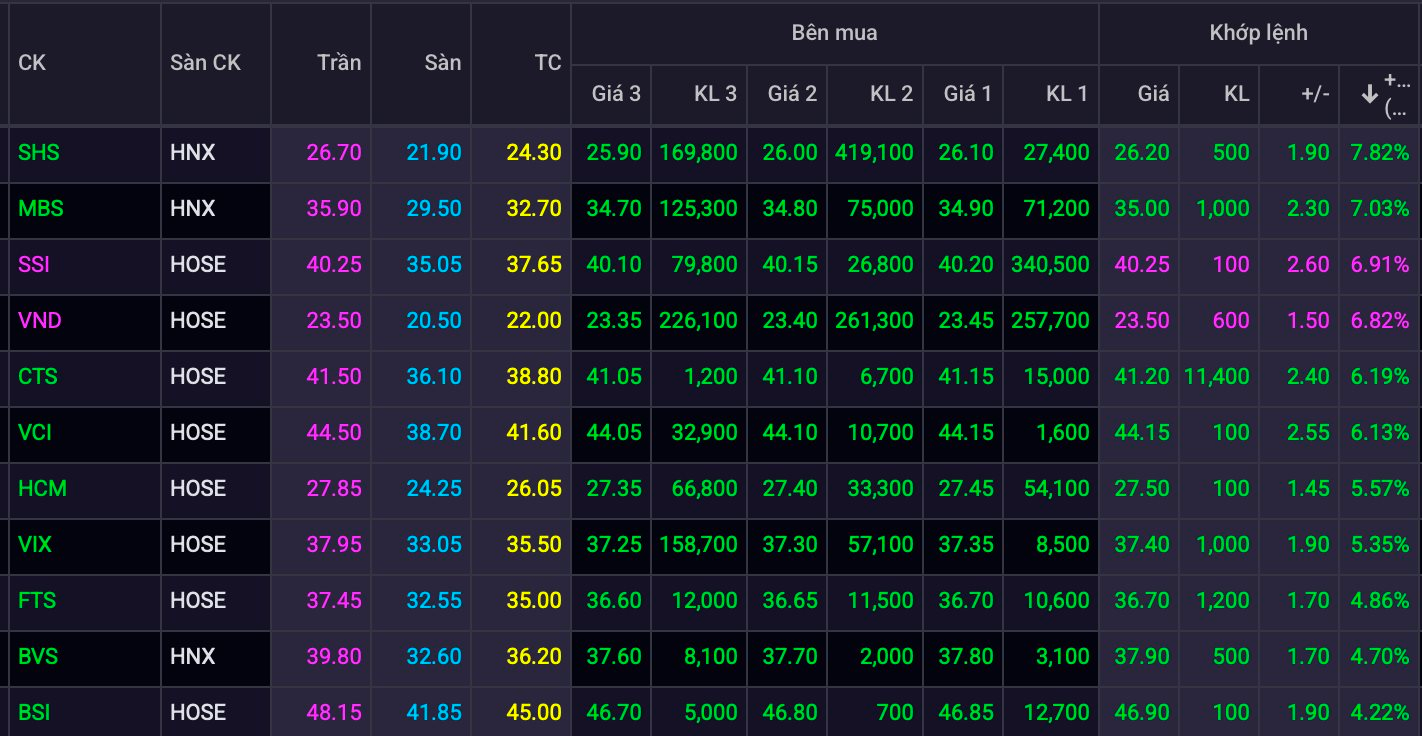

After a prolonged period of dormancy, securities stocks have suddenly become the market’s focal point, attracting strong investment right from the start of the week.

A surge of capital flowed into leading stocks such as CTS, SSI, and VND, causing them to hit their upper limits simultaneously, with no sellers in sight. Familiar names like HCM, FTS, and VIX also recorded impressive gains of 4-6%, while liquidity exploded, with SSI, VND, VIX, and SHS dominating the market’s trading volume.

Securities stocks exploded ahead of the anticipated market upgrade announcement. On the morning of October 8th, Vietnam time (after the US stock market closed on October 7th), FTSE Russell will release the FTSE Country Classification Report for September 2025. Notably, Vietnam is currently on the Watch List and is highly likely to be reclassified from Frontier to Secondary Emerging Market status.

At the recent Q3 regular press conference of the Ministry of Finance, Deputy Minister Nguyen Duc Chi affirmed that the government has implemented various solutions to promote the sustainable and synchronized development of the market. The government has issued amended laws, along with accompanying decrees and circulars, and the State Bank has closely coordinated efforts.

“I believe this process is being implemented very well and effectively. Although the final decision rests with the competent authorities, I affirm that the State Securities Commission will continue to closely coordinate with relevant agencies and international organizations to ensure that the Vietnamese stock market is evaluated objectively, fairly, and transparently,” said the Ministry of Finance leader.

Deputy Minister Nguyen Duc Chi also stated that market upgrading is just the beginning; afterward, we must maintain our position and continue striving for higher levels in the future: “This is a crucial milestone for the development of the stock market, making it more transparent to support businesses in capital mobilization, thereby promoting the development of the capital market and the economy,” said the Deputy Minister of Finance.

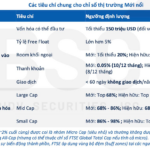

Sharing a positive outlook, Vietcap Securities believes that FTSE Russell will deliver a favorable outcome for Vietnam on October 8th. If the upgrade scenario succeeds, approximately 30 Vietnamese stocks will be added to index funds’ portfolios, potentially attracting at least $1 billion in passive capital.

According to Vietcap, FTSE Russell selects stocks based on various criteria, including minimum foreign ownership ratio, size, liquidity, and free float.

Domestically, major securities companies have also prepared their NPF (Non-Resident Foreign) capabilities to welcome the capital inflow. Currently, 10 securities companies offer this service with a total capacity of 132 trillion VND (approximately $5 billion), sufficient to meet the net buying demand of funds. The top 3 companies alone, accounting for 66% of the foreign investor market share, can provide around 40 trillion VND ($1.5 billion).

Vietcap predicts that a series of securities stocks will benefit from the upgrade news, including SSI, VIX, VND, VCI, and HCM.

HoSE Brokerage Market Share Q3/2025: SSI Hits 5-Year High, MBS Surges to Push VNDirect Out of Top 6

In Q3 2025, the top 10 brokerage firms dominated the HoSE market, collectively commanding a staggering 69.05% share of trading volume in stocks, fund certificates, and covered warrants.

Vietnamese Securities Upgrade: Top 20 Stocks Poised to Benefit, According to Brokerages

According to BSC, if Vietnam is upgraded, large-cap stocks could attract hundreds of millions of USD from global ETF funds.