According to the regulations, female workers receive a monthly pension equal to 45% of the average monthly wage used for social insurance contributions, as outlined in Article 72 of the Law, corresponding to 15 years of contributions. For each additional year of contribution, an extra 2% is added, up to a maximum of 75%.

For male workers, the monthly pension is also 45% of the average monthly wage used for social insurance contributions, corresponding to 20 years of contributions. Each additional year of contribution adds 2%, up to a maximum of 75%.

In cases where male workers have contributed for 15 to 20 years, their monthly pension is 40% of the average monthly wage used for social insurance contributions, corresponding to 15 years of contributions. Each additional year adds 1%.

This means that, starting July 1, 2025, the 2024 Social Insurance Law introduces a new pension calculation method for male workers with 15 to 20 years of contributions, in addition to the existing provisions for female workers with at least 15 years of contributions under the 2014 Social Insurance Law.

Based on Articles 66 and 72 of the 2024 Social Insurance Law, the monthly pension for mandatory social insurance contributors is calculated as follows:

Monthly Pension = (Pension Rate) × (Average Monthly Wage for Social Insurance Contributions)

For workers under the state-regulated wage system, the average monthly wage for social insurance contributions is calculated based on the following periods:

– Before January 1, 1995: Average of the last 5 years’ monthly wages before retirement.

– January 1, 1995 – January 1, 2000: Average of the last 6 years’ monthly wages before retirement.

– January 1, 2001 – December 31, 2006: Average of the last 8 years’ monthly wages before retirement.

– January 1, 2007 – December 31, 2015: Average of the last 10 years’ monthly wages before retirement.

Therefore, female workers retiring in 2025 with 30 years of contributions will receive a pension at 75% of their average monthly wage.

Male workers with 30 years of contributions will receive a pension at 65% of their average monthly wage.

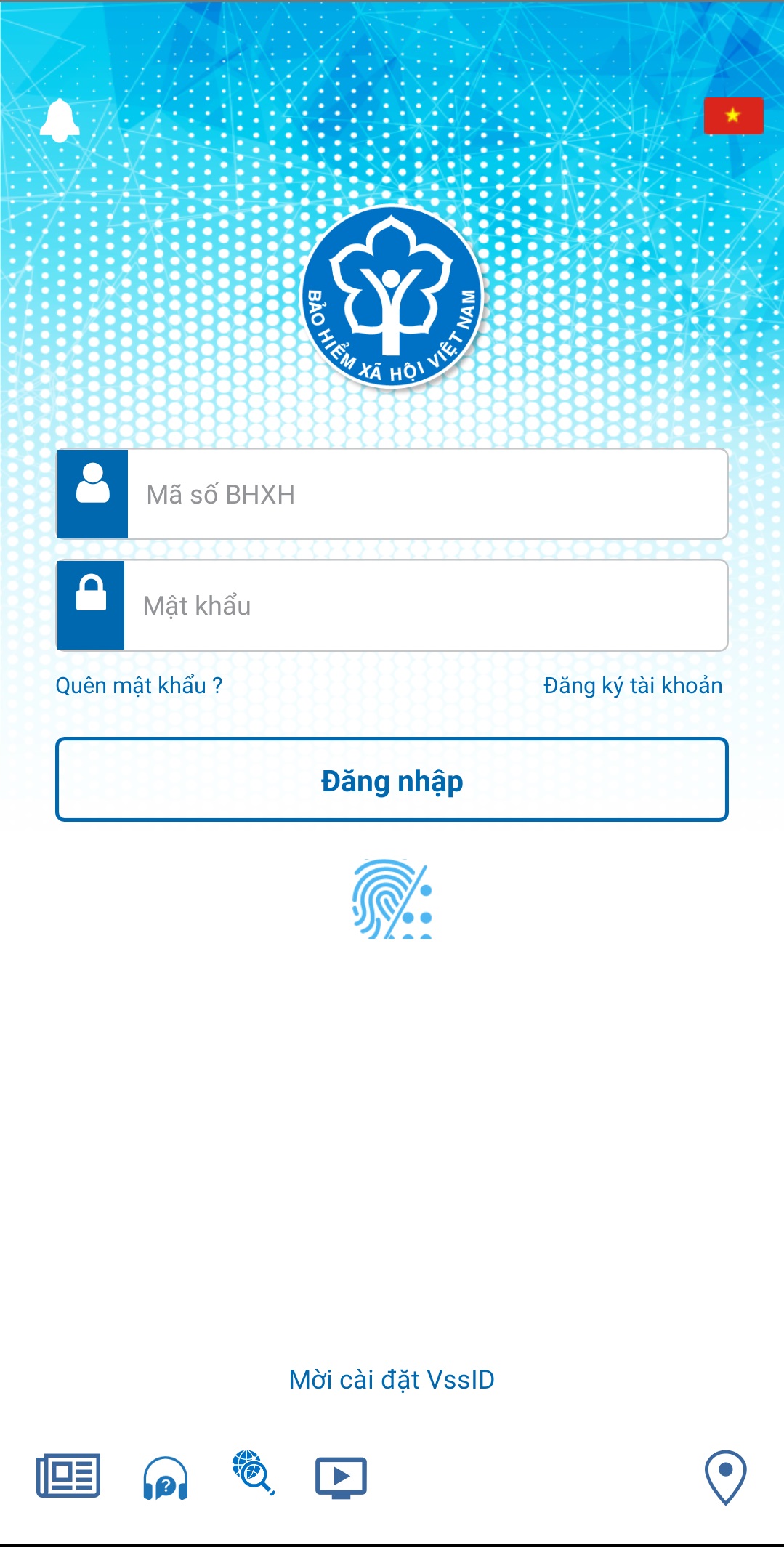

Guide to Checking Pension and Social Insurance Benefits on VssID

Step 1: Log in to the VssID app

Open the VssID app and log in using your provided username and password.

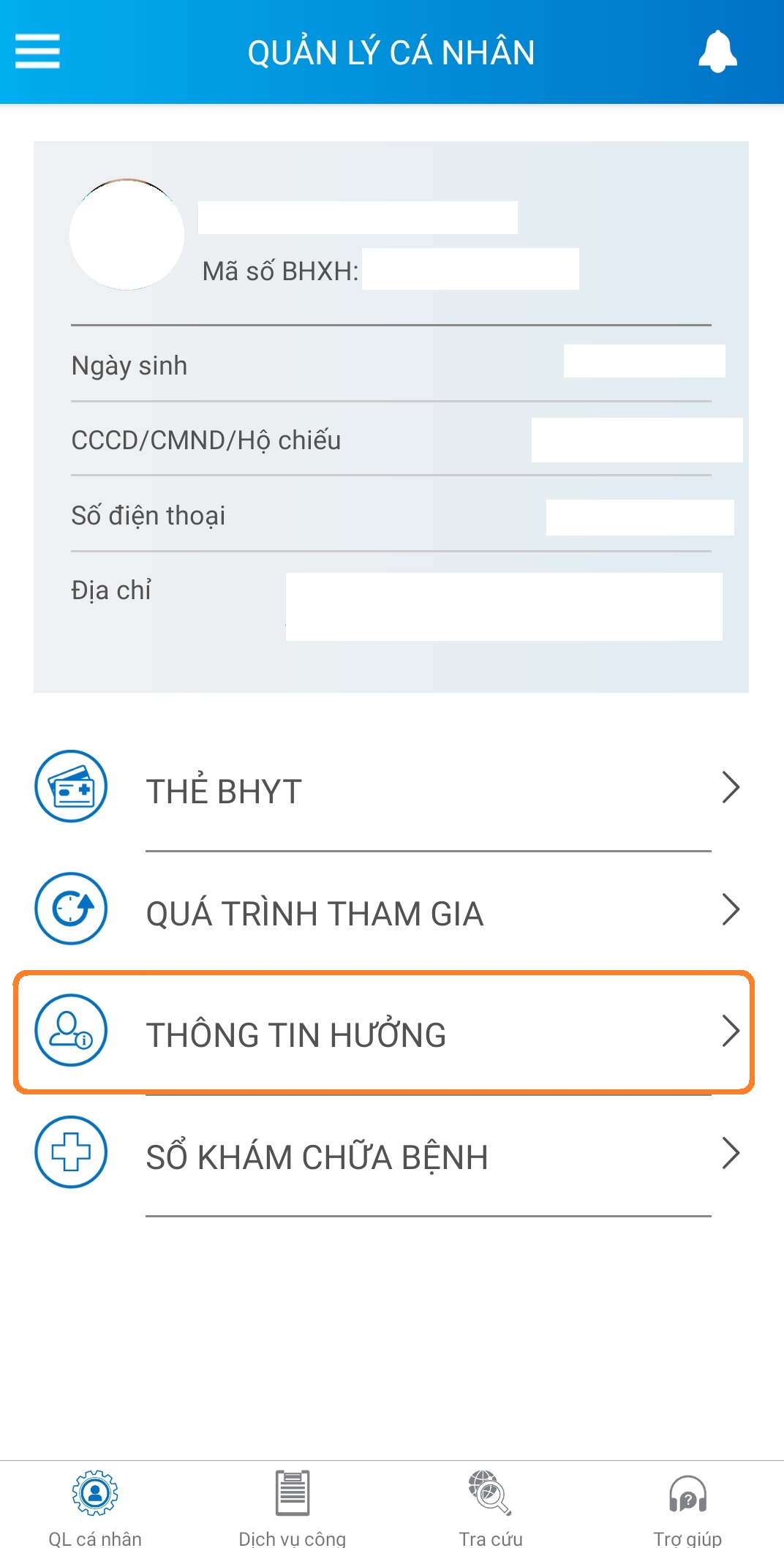

Step 2: View Benefit Information

On the Personal Management homepage, select “Benefit Information.”

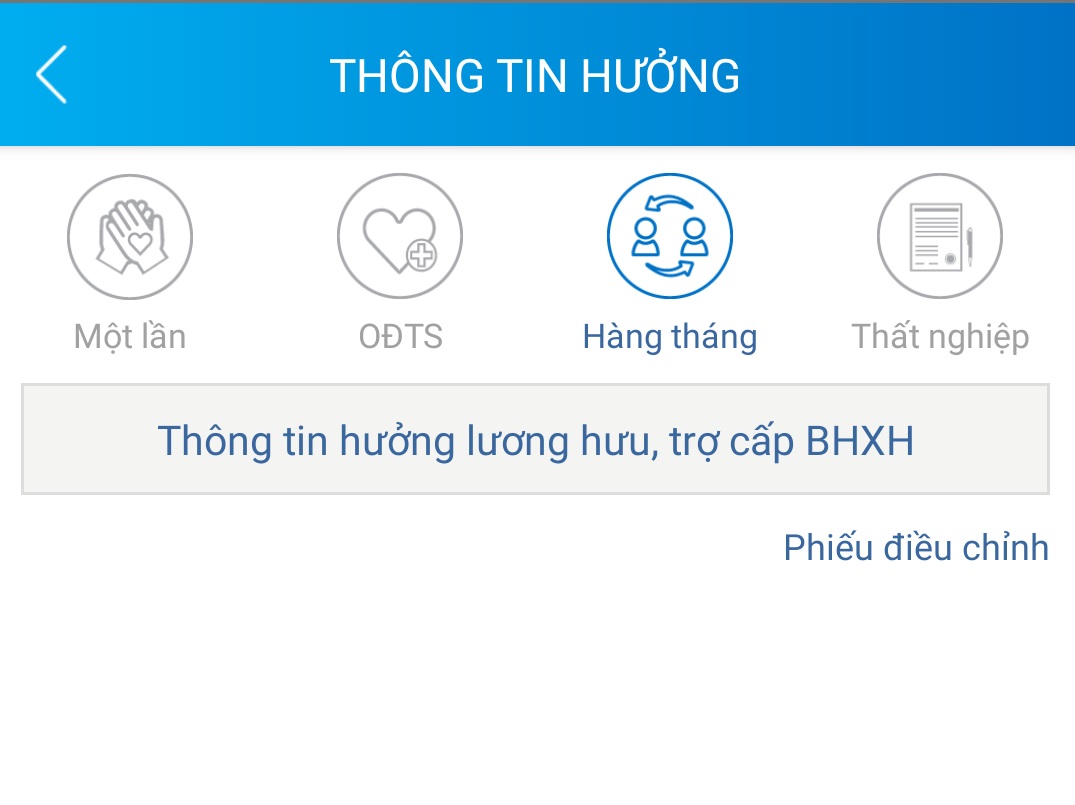

Step 3: Check Pension and Social Insurance Benefit Details

After selecting “Benefit Information,” the system will display the following options:

- One-time Social Insurance Benefit Information

- Sick Leave and Maternity Benefit Information

- Monthly Pension and Social Insurance Benefit Information

- Unemployment Insurance Benefit Information

Step 4: Select “Monthly” to View Pension and Social Insurance Benefit Details

“Retirement in 2025: Unlocking the Pension Mystery”

The retirement age for workers in normal working conditions will increase to 61 and a half years for men and 57 years for women by 2026, according to Decree 135/2020/ND-CP, Article 4, Clause 2. This raises an important question: how will retirement benefits be calculated for those who meet these eligibility requirements and have contributed to social insurance (SI) for 26 years?

Why Do Localities Apply Different Levels of Social Retirement Benefits?

“A number of provinces and cities have taken the initiative to increase social retirement allowances beyond the standard government regulations. They are taking steps to ensure that their elderly citizens are provided for, with some areas offering more generous benefits than others.”