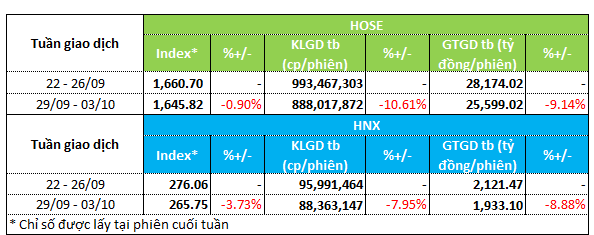

During the week of September 29 – October 3, the stock market continued its subdued performance. Both indices saw declines, accompanied by a noticeable drop in trading liquidity.

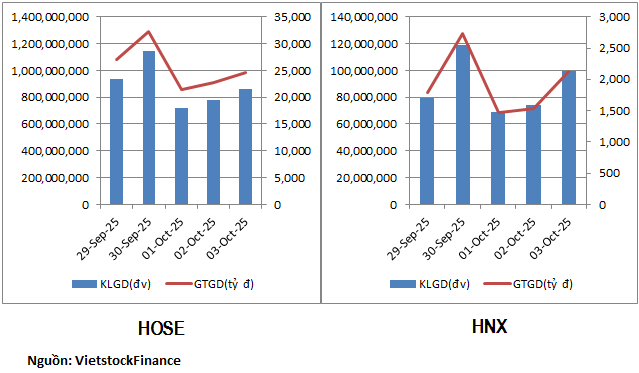

Specifically, the VN-Index fell by nearly 1% to 1,645.82 points. Meanwhile, the HNX-Index dropped by almost 4%, closing at 265.75 points. The HOSE market recorded a 10% decrease in both trading volume and value, with 888 million units per session and VND 25.5 trillion per session, respectively.

On the HNX, trading volume declined by 8% to 88.3 million units per session, while trading value fell by 9% to over VND 1.9 trillion per session.

|

Overview of Liquidity for the Week of September 29 – October 3

|

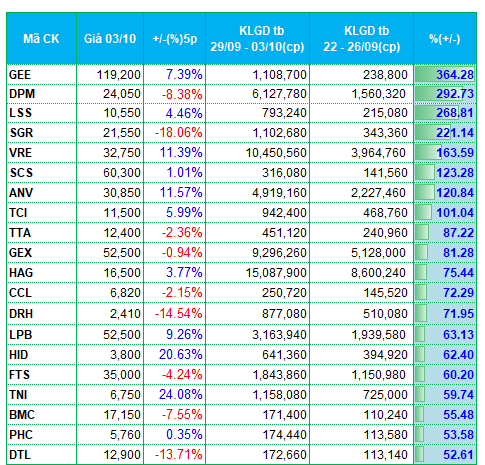

Amid the weak liquidity last week, no sector saw significant inflows. Only a few sectors, such as electrical equipment and metals, attracted modest interest. In the electrical equipment sector, notable stocks included GEE, GEX, MBG, and NAG. The GEE stock stood out with a remarkable 364% increase in trading volume, leading the HOSE market.

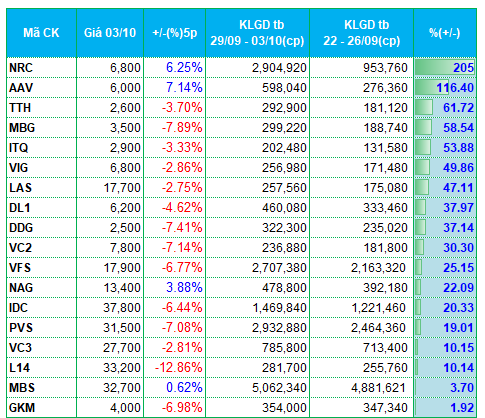

Metal stocks also saw slight inflows, with TNI, DTL, and ITQ recording liquidity increases of 55-60% compared to the previous week.

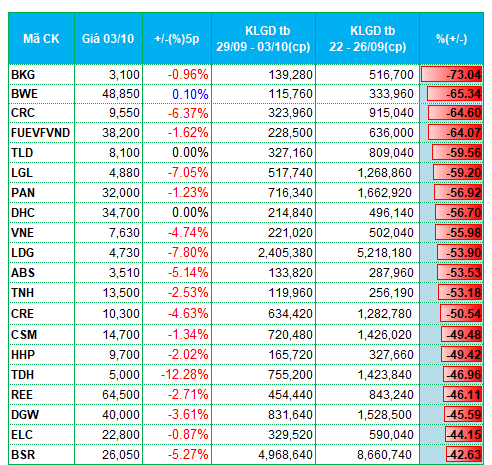

In the real estate sector, money flow was polarized. Stocks like SGR, VRE, CCL, DRH, NRC, AAV, VC3, and L14 attracted inflows, while LGL, LDG, CRE, TDH, CEO, IDJ, and DTD experienced significant liquidity declines.

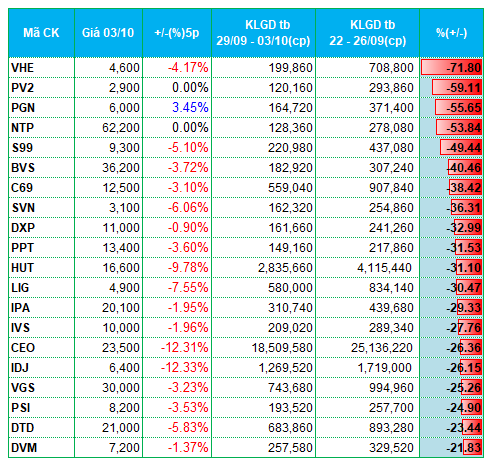

On the downside, several sectors showed poor performance. Many construction stocks, including VNE, S99, C69, and LIG, saw trading volume decreases of 30-55%.

Paper and timber production stocks, such as BKG, DHC, and HHP, also topped the list of stocks with sharply reduced liquidity last week.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX

|

The list of stocks with the highest liquidity increases/decreases is based on average trading volumes exceeding 100,000 units per session.

– 19:28 06/10/2025

Foreign Blockades Unleash 1.9 Trillion VND Sell-Off as VN-Index Surges 50 Points: Which Stocks Faced the Heaviest Dumping?

In the afternoon trading session, HPG and VIX emerged as the top net buyers in the market, with each stock attracting approximately VND 146-147 billion in net purchases.