On October 3, EPC received a notice from the Hanoi Stock Exchange (HNX) regarding the delisting of its shares. The final trading session will take place on October 23. This decision follows the State Securities Commission’s issuance of a document revoking the company’s public status on September 24.

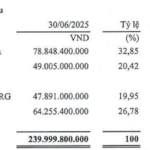

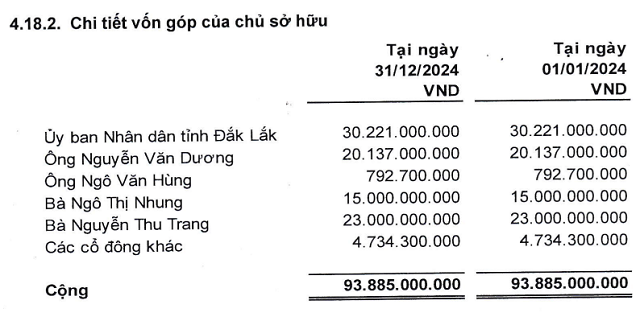

According to the 2024 audited financial report, the People’s Committee of Dak Lak Province holds 32.2% of EPC’s capital, Ms. Nguyen Thu Trang owns 24.4%, Mr. Nguyen Van Duong holds 21.4%, and Ms. Ngo Thi Nhung owns 15.9%. These four shareholders collectively control over 94% of the capital, while minority shareholders hold only 5.9%. This structure fails to meet the requirement of the 2019 Securities Law, which mandates that “at least 10% of voting shares must be held by a minimum of 100 investors who are not major shareholders,” resulting in the loss of public company status.

EPC has a concentrated shareholder structure. Source: EPC’s 2024 audited financial report

|

Ea Pôk Coffee was a state-owned enterprise privatized between 2017 and 2018, officially transitioning to a joint-stock company in November 2018 and listing on UPCoM the same year. Its predecessor, Ea Pôk Coffee Farm, was established after 1975 to fulfill economic and social objectives in the Central Highlands region.

The company currently engages in coffee cultivation, procurement, and processing, with the majority of its products exported to Japan and Europe. The remainder is supplied to domestic roasters. EPC operates two warehouses, wet and dry processing lines, and a 1.1-hectare cattle farm with approximately 500 head of cattle.

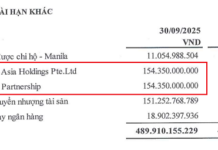

The company’s recent financial performance has been lackluster. In 2024, EPC reported revenue of VND 38 billion, an increase from previous years, but still incurred a net loss of VND 5 billion, the lowest loss in four years. As of the end of 2024, the company’s total assets amounted to over VND 66 billion, with equity of VND 39 billion but accumulated losses of VND 54 billion. Total liabilities reached nearly VND 23 billion, primarily short-term debts owed to employees. Notably, the company’s loan ledger lists Nguyen Thu Trang as the largest creditor with VND 6 billion, sharing the same name as a major shareholder holding 24.4% of the capital.

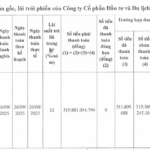

| EPC has reported losses for five consecutive years, except in 2020 |

According to EPC’s leadership, most of the current coffee trees are over 30 years old, resulting in low yields and significantly reduced output. The coffee cultivation area decreased from 363 hectares in 2019 to 207 hectares by the end of 2024, with fresh coffee berry production dropping from over 1,300 tons per year to 510 tons per year.

To address these challenges, the company plans to transition from a contract farming model to an “investment-based” model, where the company covers all production and harvesting costs, and then divides the output with a 60% share for the company and 40% for contracted households. The goal is to fully implement this model by the 2025-2026 crop year. EPC will also focus on wet-processed coffee production, develop high-value Honey coffee lines, gradually replant coffee gardens (targeting 50-60 hectares in 2025-2026), and introduce intercropping to optimize land use, mitigate risks, and increase worker income.

– 13:52 07/10/2025

Unveiling LPEX: The New Crypto Exchange and Its Founders

A newly established cryptocurrency asset company, founded in late September 2025, is making waves in the industry. This enterprise not only shares a similar name and headquarters with Loc Phat Joint Stock Commercial Bank of Vietnam (LPBank – Stock Code: LPB) but its shareholder structure also reveals ties to the ecosystem of LPBank’s Chairman, Mr. Nguyen Duc Thuy.