The Macro Picture Remains Positive

|

In a conversation with the author, Mr. Huynh Anh Huy – CFA, Director of Securities Industry Analysis at KAFI, stated that Vietnam’s macroeconomic landscape continues to demonstrate resilience, positioning it among the top performers in Southeast Asia. With robust GDP growth and well-controlled inflation, the economy provides a stable foundation for business operations and investor confidence. This advantage positions Vietnam as an attractive destination for foreign capital in the coming period.

Following a strong rally that elevated valuations, sustaining the appeal and capital inflows into Vietnam’s stock market hinges on corporate profit growth in the final months of the year. This growth will help normalize valuations, reinforcing investor expectations.

Additionally, the promising outlook for market upgrades, coupled with the Federal Reserve’s potential rate cuts in the new cycle, will significantly bolster foreign capital inflows.

Echoing the positive macroeconomic sentiment, Mr. Tran Thai Binh – CFA, Senior Director of Securities Analysis at OCBS, anticipates GDP growth of 7-8% in 2025. This optimism is driven by strong exports, particularly in electronics and textiles, a robust recovery in international tourism, steady domestic consumption, and active public investment disbursement.

|

On the global front, a stable U.S. economy and easing U.S.-China trade tensions are expected to support Vietnam’s supply chains in the final months of the year.

Vietnam’s stock market has experienced its most impressive rally since 2021 and awaits the potential upgrade results in October, which could mark a new turning point. “The upgrade discussion has been ongoing for years, and Vietnam now holds a significantly different position on the global financial map. The upgrade is just a matter of time and is expected to be the biggest catalyst for the market,” Mr. Binh remarked.

In the medium term, corporate earnings prospects and monetary policy direction will be pivotal in shaping market trends.

Countdown to the Upgrade: What’s Next for the VN-Index?

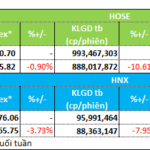

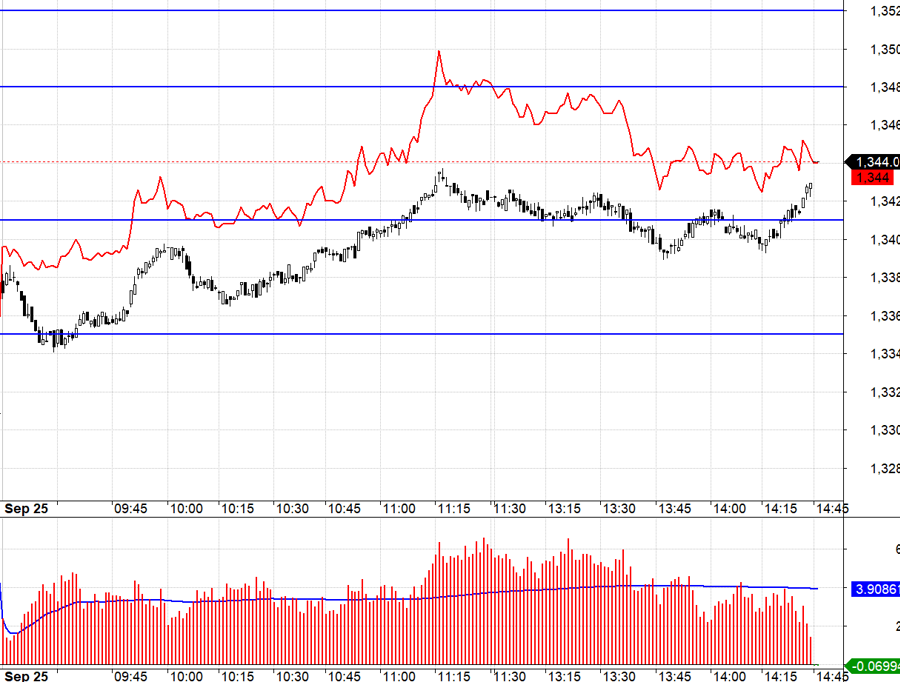

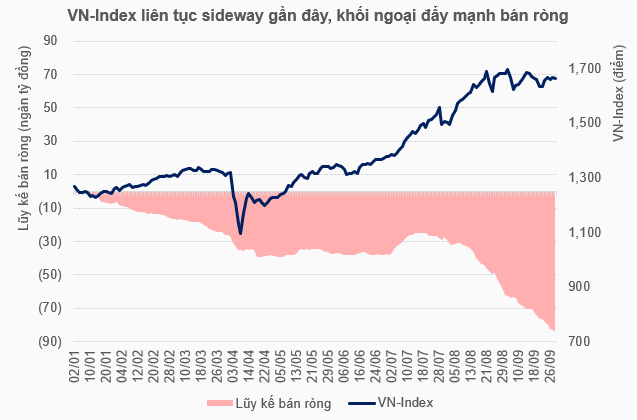

In recent weeks, the market has struggled to maintain its strong upward momentum, trading within a narrow range. Mr. Tran Thai Binh attributes this to a distribution phase, where most stocks lack significant catalysts and require time to consolidate. Additionally, persistent net selling by foreign investors and lackluster domestic capital have hindered further market breakthroughs.

Source: VietstockFinance

|

In an optimistic scenario, a successful upgrade in the upcoming review could propel the VN-Index above 1,700 points, potentially approaching 1,800 in the short term.

In a less likely scenario, if the upgrade is delayed, the market might retreat below 1,600 points, with a possible drop to 1,500 points if supportive news is absent.

Despite the focus on FTSE Russell’s upgrade decision, OCBS experts believe that a delay in October, while disappointing, would not be catastrophic. A sharp decline could present a buying opportunity for investors. The key is to remain proactive in adjusting portfolio weights based on market trends, allocating capital to high-quality companies, and maintaining liquidity for flexibility.

Currently, investors should focus on selective sectors and stocks rather than broad diversification. The market still harbors risks and sectoral disparities, even within the same industry. Selective investing optimizes portfolio efficiency and risk management.

Promising long-term sectors include banking, which stands to benefit directly from market upgrades and easing interest rates. Priority should be given to banks with strong credit growth and stable asset quality. The securities sector also holds long-term growth potential, benefiting from digital investment trends and market upgrades.

Other promising sectors include industrials and manufacturing, logistics with stable order books, and consumer goods, driven by recovering domestic demand. Investors should focus on industry leaders with strong brands and extensive distribution networks.

October’s upgrade results are projected to have a short-term impact on the VN-Index

|

Mr. Huynh Anh Huy outlines three scenarios for the VN-Index in October. In the most favorable scenario, with a 50% probability, the index could surpass 1,700 points and test 1,800, contingent on a successful market upgrade, returning foreign capital, and robust earnings from key sectors.

In the base scenario, with a 25% probability, the market is expected to trade between 1,600 and 1,700 points, reflecting neutral news that neither sparks a breakthrough nor creates negative pressure. A sideways market will gradually enhance valuation attractiveness as earnings improve.

Lastly, with a 25% probability, a pessimistic scenario could unfold if corporate growth falls short of expectations, upgrade news remains unfavorable, and investor sentiment is cautious. In this case, the 1,600-point level may be vulnerable, with a potential test of 1,450 points.

According to KAFI experts, during this accumulation phase and while awaiting critical information, investors should focus on fundamentally strong stocks, purchasing at optimal price levels to ensure sustainable profitability when the market enters a new uptrend. Margin trading can enhance returns but should be managed prudently.

A flexible strategy, such as taking short-term profits and re-entering at lower prices during corrections, can optimize capital efficiency and mitigate margin pressure.

For optimal results, investors should not only diversify across sectors but also select sectors with strong prospects. Real estate and infrastructure are benefiting from supportive policies and large-scale public investment. Banking remains a profit leader due to stable credit growth, while retail is accelerating due to recovering consumer demand and completed corporate restructurings.

Vietnam’s Stock Market Maintains Long-Term Outlook Despite October Upgrade Results

– 09:00 07/10/2025

Market Explodes in Opening Session, VN-Index Surges Close to 1,700 Points

The stock market kicked off the week with a spectacular surge, as the benchmark VN-Index skyrocketed nearly 50 points, closing in on the 1,700 milestone.