I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 7, 2025

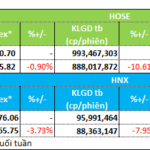

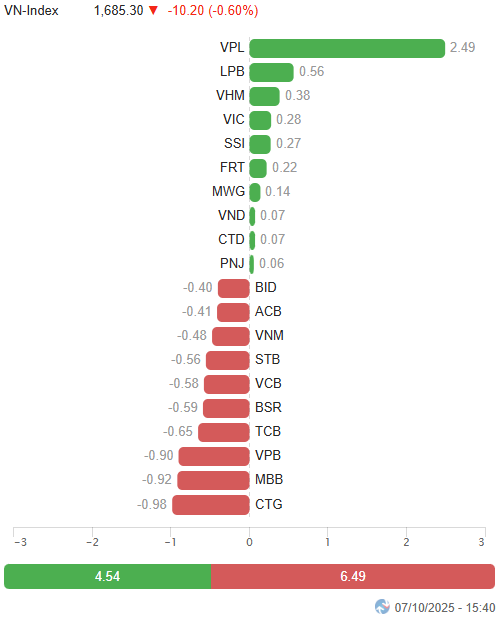

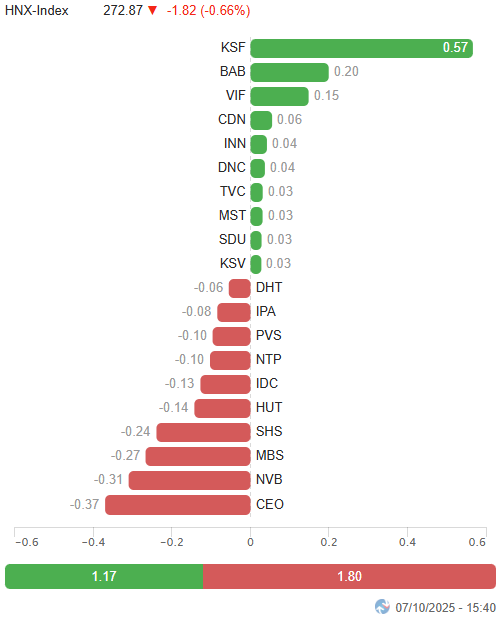

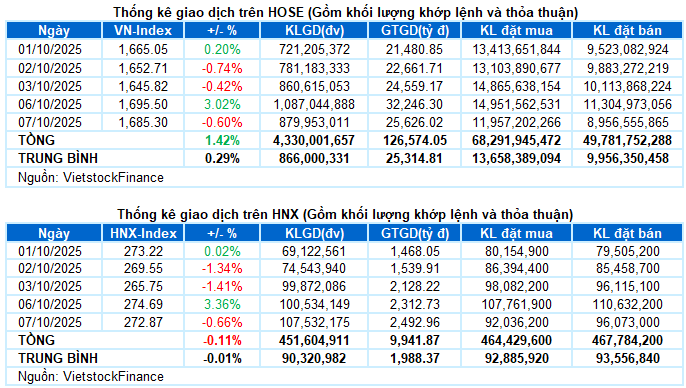

– Major indices collectively adjusted during the October 7 trading session. Specifically, the VN-Index declined by 0.6%, closing at 1,685.3 points, while the HNX-Index also dropped by 0.66%, settling at 272.87 points.

– Matching volume on the HOSE decreased by 20.5%, reaching over 799 million units. The HNX recorded more than 79 million matched units, a 16.7% decrease compared to the previous session.

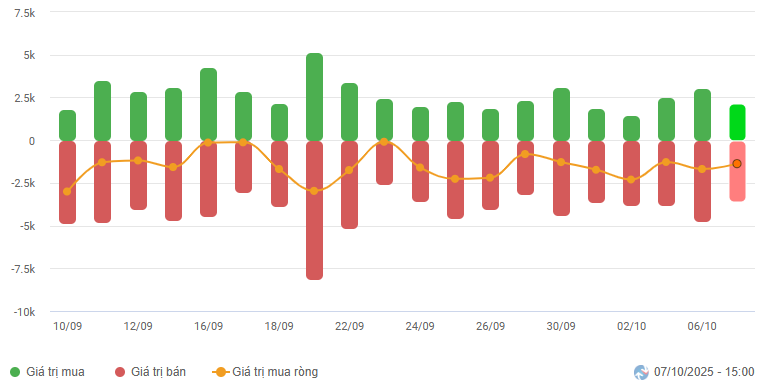

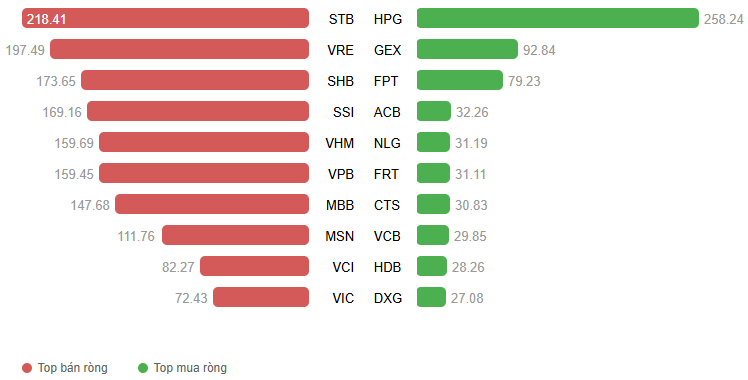

– Foreign investors continued to net sell, with a value exceeding VND 1.3 trillion on the HOSE and over VND 37 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market returned to a cautious state after yesterday’s exuberance, as investors eagerly await the results of FTSE Russell’s reclassification review, set to be announced early tomorrow morning (Vietnam time). During the October 7 session, the VN-Index opened above the 1,700-point mark but quickly weakened thereafter. Despite moderate selling pressure, buying interest became significantly more subdued, with the index hovering around the reference level until the end of the morning session. The lackluster sentiment persisted into the afternoon, with liquidity failing to improve. The VN-Index gradually declined, closing at 1,685.3 points, a 0.6% decrease from the previous session.

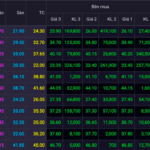

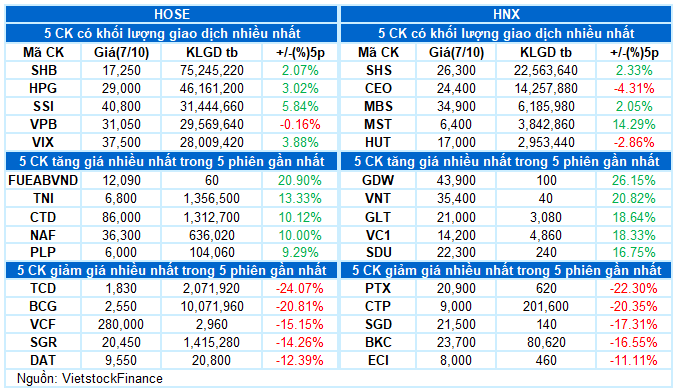

– In terms of impact, CTG, MBB, and VPB were the most negatively influential stocks, collectively subtracting nearly 3 points from the VN-Index. Conversely, VPL was the sole bright spot, contributing 2.5 points to the index, though it was insufficient to buoy the market.

Top Stocks Influencing the Index. Unit: Points

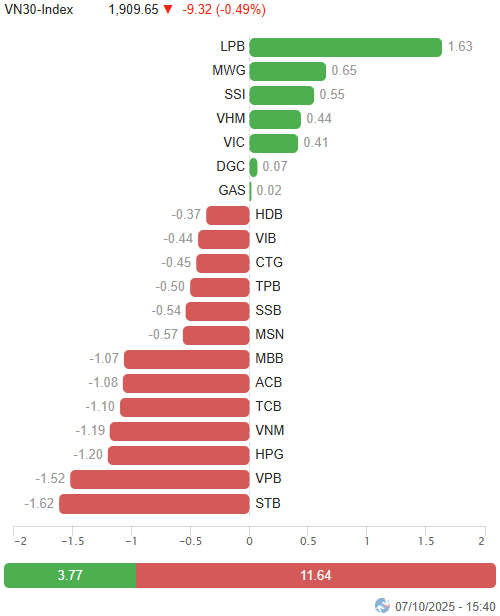

– The VN30-Index closed down 9.32 points at 1,909.65. The basket’s breadth favored sellers, with 21 decliners, 7 gainers, and 2 unchanged stocks. Notably, TPB and SSB faced significant pressure, both declining by 2.5%. They were followed by STB, MBB, VIB, VPB, and VNM, all adjusting downward by over 1.5%. On the positive side, LPB and SSI were the only stocks to maintain gains above 1% by session’s end.

Most sectors were dominated by red ink. The energy sector was the worst performer, declining by 1.75%, as leading stocks such as BSR (-3.12%), PLX (-0.73%), PVS (-0.93%), PVD (-1.64%), and PVT (-1.65%) all experienced deep corrections.

The financial sector weighed heavily on the broader index, with widespread declines. Numerous stocks adjusted downward by over 1%, including CTG, TCB, VPB, MBB, STB, ACB, VIB, TPB, EIB, VIX, SHS, VCI, and MBS. Only a few names bucked the trend, such as SSI (+1.37%), VND (+0.85%), LPB (+1.54%), BAB (+2.22%), and PGB (+1.23%).

Conversely, the non-essential consumer sector was a rare bright spot, surging by 2.52%, driven primarily by a few large-cap stocks like VPL, which hit its upper limit, MWG (+0.52%), PNJ (+0.83%), and FRT (+4.23%). However, the remainder of the sector’s performance was less encouraging, with notable declines in stocks such as HUT (-1.16%), DGW (-1.68%), HHS (-3.17%), TCM (-1.35%), PET (-2.5%), HTM (-5.66%), GIL (-2.05%), TNG (-1.53%), and CSM (-2.04%).

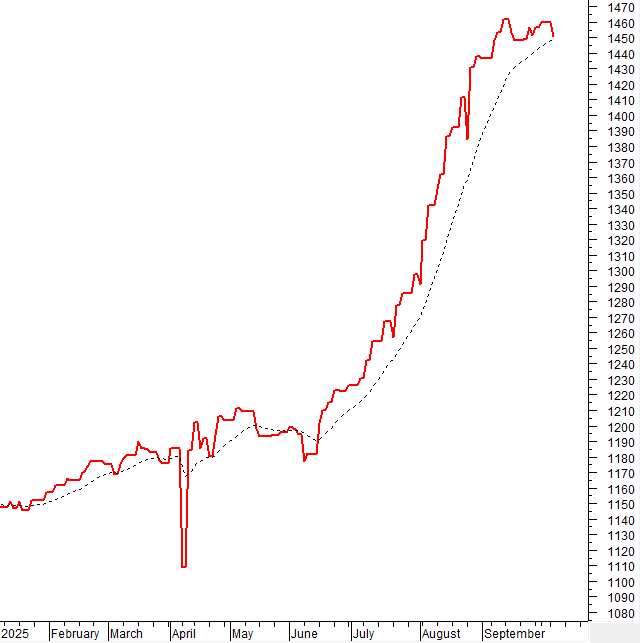

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (equivalent to the 1,700-1,711 range). Maintaining a position above the Middle line of the Bollinger Bands will be crucial for the VN-Index to sustain its short-term recovery prospects.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – MACD Narrowing Gap with Signal Line

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (equivalent to the 1,700-1,711 range). Maintaining a position above the Middle line of the Bollinger Bands will be crucial for the VN-Index to sustain its short-term recovery prospects.

Currently, the Stochastic Oscillator has issued a buy signal, while the MACD is narrowing its gap with the Signal line and may generate a similar signal in upcoming sessions.

HNX-Index – Stochastic Oscillator Issuing Buy Signal

The HNX-Index continues to test the Middle line of the Bollinger Bands amid declining liquidity below the 20-session average, indicating prevailing caution among investors.

However, the index’s short-term outlook is improving, as the Stochastic Oscillator has issued a buy signal.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors continued to net sell during the October 7, 2025 session. If overseas investors maintain this stance in upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS FOR OCTOBER 7, 2025

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:15 October 7, 2025

Portrait of a Thriving Stock Market

What defines a developed market? According to MSCI, there are 23 such markets globally, while FTSE Russell identifies 25. But what criteria determine this classification?