|

Source: VietstockFinance

|

The market breadth leaned towards the downside, with over 460 declining stocks and 282 advancing stocks. Red dominated the market entirely. Only a few leading stocks in various sectors maintained their green status, including SSI, VND, VHM, VIC, VPL, MWG, CTD… This group somewhat mitigated the index’s decline but couldn’t resist the prevailing downward trend.

| Top 10 Stocks Impacting VN-Index on October 7, 2025 (in points) |

Most sectors ended in the red, with energy, insurance, and banking sectors leading the decline. Notably, several banking stocks contributed significantly to the index’s drop, including BID, ACB, STB, VCB, TCB, VPB, MBB, CTG… which collectively subtracted 6 points from the VN-Index.

The retail sector had a positive session, with FRT rising over 5%, and PNJ, MWG posting modest gains.

Foreign investors continued their net selling streak, offloading nearly 1.4 trillion VND today. Many large-cap stocks were heavily sold, with net selling exceeding 100 billion VND. Conversely, HPG saw net buying of nearly 260 billion VND. However, a single butterfly cannot bring spring, and the net selling trend persists.

Tomorrow, FTSE’s market upgrade results will be announced. The market is anticipating a positive outcome. Perhaps today’s decline is a pause as investors await clearer information.

Morning Session: Market Divergence, Cautious Trading

Red gradually gained dominance, putting significant pressure on the index. By the end of the morning session, the index closed at 1,694.87 points, down 0.6 points. The HNX-Index dipped 0.2 points to nearly 275 points.

Trading volume was notably lower than yesterday, reflecting cautious sentiment as the market upgrade announcement looms. The morning session’s trading value was only around 14 trillion VND.

The securities sector started positively but later diverged. Some stocks maintained green, such as SSI, VND, CTS, VDS, ORS… while others declined, including VIX, VCI, MBS, VFS, DSE, FTS…

Non-essential consumer stocks stood out. VPL hit its ceiling, while FRT, MWG rose 2-4%, and PNJ gained 1%.

The number of advancing and declining sectors was nearly equal, reflecting the current divergence. However, selling pressure prevailed, with 380 declining stocks versus nearly 260 advancing stocks.

VPL’s ceiling price and LPB’s near 3% gain were key supports preventing a deeper index decline.

| Top 10 Stocks Impacting VN-Index in the Morning Session of October 7, 2025 (in points) |

10:40 AM: Tug-of-War Around the Reference Level

With no clear upward momentum, the market entered a tug-of-war phase. By 10:40 AM, the VN-Index gained 2 points to 1,697.88, while the HNX-Index rose over 1 point to 276.1.

Declining stocks outnumbered advancing stocks, with over 300 versus 280. Selling pressure dominated, though some large-caps supported the market. VPL, LPB, VHM, VRE… contributed positively, with the top 10 stocks adding nearly 7 points.

VPL hit its ceiling in the first half of the morning, contributing over 2 points to the VN-Index.

Individual stocks in various sectors also performed well. CTD rose over 5%, FRT gained 4%, and VND increased by over 2%.

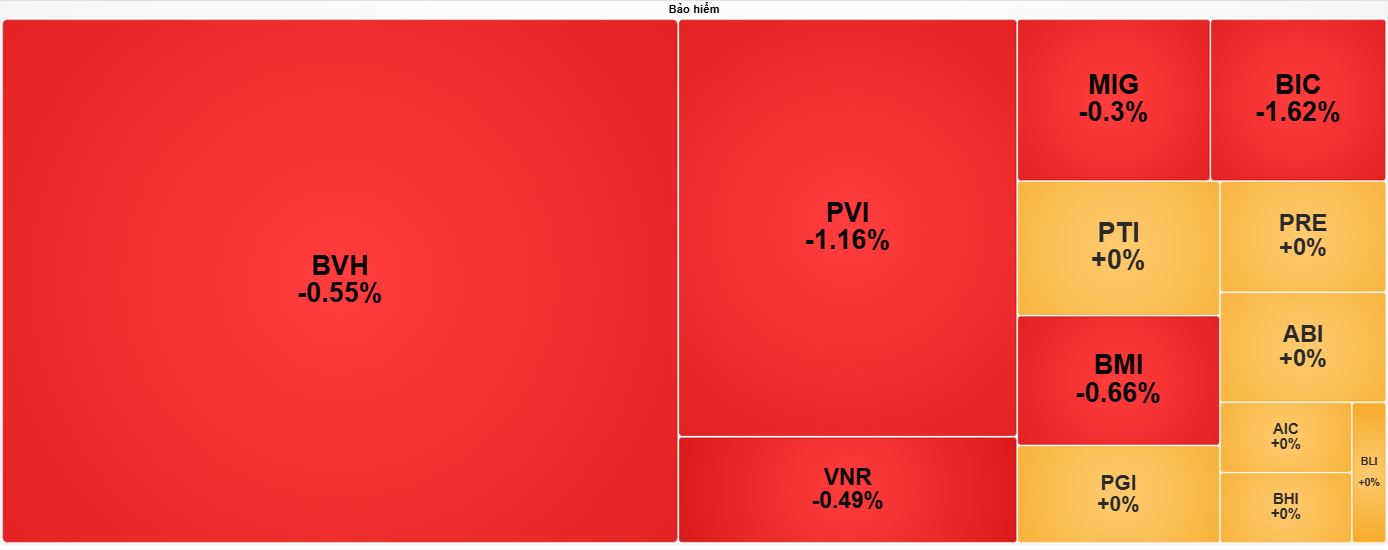

The insurance sector underperformed, with most stocks in the red or flat. BVH, PVI, MIG, BIC, BMI… declined 0.5-1%.

Source: VietstockFinance

|

Opening: Vingroup and Securities Sector Boost VN-Index Toward 1,700

The VN-Index briefly touched 1,700 at the open but was held back by spreading red.

The securities sector led today’s session, with SSI, SHS, VIX, VND… rising on strong liquidity. Banking stocks were less optimistic, with MBB, ACB, HDB, SHB, VIB… dipping slightly.

Divergence was widespread across sectors. In real estate, VRE, VHM, VIC, PDR… rose, while DIG, DXG, CEO, SGR, TCH… fell.

Vingroup stocks were the most positive influencers on the VN-Index. VHM, VRE, VIC, VPL led with over 3 points. The securities sector contributed SSI and VND.

Bamboo Capital stocks diverged, with BCG nearing its ceiling and TCD dropping sharply, even touching its floor.

– 15:53 October 7, 2025

Vietstock Daily 08/10/2025: Caution Prevails Ahead of Potential Upgrade Announcement

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (1,700-1,711 range). Sustaining a position above the Bollinger Bands’ Middle Line remains critical for maintaining the index’s short-term recovery outlook. Currently, the Stochastic Oscillator has generated a fresh buy signal, while the MACD is narrowing its gap with the Signal Line, potentially triggering a similar indication in upcoming sessions.

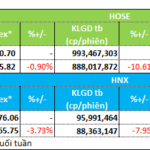

Liquidity Weakens Further as Capital Flows Diverge in Real Estate Sector

Market sentiment took a hit last week, with both indices and liquidity trending negatively. While a select few sectors saw modest inflows, the broader market was characterized by divergence and net outflows.