Starting October 10, Decree 232/2025/NĐ-CP, amending Decree 24/2012/NĐ-CP on gold trading management, officially takes effect. The State Bank of Vietnam (SBV) is expected to soon issue a circular guiding the implementation of Decree 232. The gold market anticipates significant changes as the monopoly mechanism is abolished, allowing multiple qualified entities to produce gold bars, narrowing the gap with global prices.

Licensed Entities Can Produce Immediately

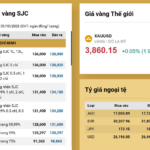

By the end of October 6, SJC gold prices surged to a record high of VND 138.1 million per tael for buying and VND 140.1 million per tael for selling, a VND 1.5 million increase in just one day. Not only gold bars but also 99.99% gold rings and jewelry saw similar rises, reaching VND 134.3 million per tael for buying and VND 137 million per tael for selling, VND 1.4 million higher than the previous day. Meanwhile, global gold prices also soared to a historic high of USD 3,942 per ounce, still VND 14-15 million lower than SJC gold prices per tael.

Despite this, the market eagerly awaits a major turning point as Decree 232/2025, which eliminates the state monopoly on gold bar production, takes effect on October 10. The decree allows eligible businesses and commercial banks to import raw gold, produce, and trade gold bars. This is seen as a crucial step to increase supply, reduce price gaps, and restore gold’s status as a commodity and asset.

After October 10, SJC gold bars will no longer dominate the market. Photo: LAM GIANG

In recent developments, several financial institutions and precious metal companies are preparing to re-enter the gold bar market after over a decade of absence. Asia Commercial Bank (ACB), which previously produced Bông Lúa and ACB Star gold bars before 2012, is awaiting SBV’s circular to register for gold bar production and trading. “Currently, ACB trades two types of gold bars: SJC and ACB gold bars produced before 2012,” an ACB representative stated.

A representative from another commercial bank revealed they are collaborating with international partners to import raw gold and are ready to produce gold bars under their own brand. “The upcoming market will be highly competitive, and we aim to secure a position in the branded gold bar segment,” they said.

Additionally, Saigon Jewelry Company (SJC) confirmed it already has production lines and has previously manufactured gold bars for SBV. Now, they only need to complete licensing procedures and import gold to start production immediately to meet market demand.

At the Q3/2025 banking sector press conference, Mr. Đào Xuân Tuấn, Director of the Foreign Exchange Management Department (SBV), stated that the department is urgently drafting a circular to implement Decree 232. According to Mr. Tuấn, licensing for gold imports and production will ensure transparency, market compliance, and alignment with monetary policy. “Gold supply will be guaranteed to meet actual demand. All trading processes will be transparent and standardized, enhancing market clarity,” he affirmed.

Awaiting Competitive Signals

Dr. Nguyễn Duy Quang from the University of Economics and Finance, Ho Chi Minh City, expects the domestic gold bar market to enter a vibrant competitive phase post-October 10, with brands like SJC, ACB, DOJI, and PNJ participating. “With more suppliers, consumers will have more choices, narrowing the buy-sell spread and increasing liquidity. Counter and digital banking transactions will become more active, facilitating faster capital flow, reducing price gaps, and curbing speculation,” Dr. Quang predicted.

He also believes that transparent information and trading regulations will limit “black market” activities, enabling SBV to manage foreign currency flows and monetary policies effectively. However, he forecasts short-term price volatility due to initial market hesitation. “Bank involvement will optimize transaction costs, enhance reliability, and gradually align SJC gold prices with global rates,” he added.

Assoc. Prof. Dr. Ngô Trí Long, an economist, commented, “With expanded supply, artificial shortages and price speculation will be minimized. Gold will regain its status as a commodity and investment asset, free from exaggerated psychological influences.”

However, he noted that gold policy is just one aspect of macroeconomic management. “To stabilize the market, managing inflation expectations is crucial. SBV should regularly publish core inflation and gold price indices, helping the public understand that gold price increases do not necessarily indicate inflation. Strengthening trust in the local currency will reduce gold’s appeal as a short-term hedge,” he advised.

According to Dr. Long, opening the gold market will not only cool SJC prices but also attract dormant capital as people shift from gold hoarding to investment, savings, or consumption. Additionally, new gold bar brands will foster healthy competition, encouraging companies to innovate, improve customer service, and enhance digital transactions.

Many Entities Fail to Meet Requirements

However, Decree 232 mandates a minimum charter capital of VND 1,000 billion for companies and VND 50,000 billion for commercial banks to produce gold bars. Consequently, few entities meet these criteria. A commercial bank executive stated that despite their gold trading experience and former gold trading platform operation, their charter capital falls short of VND 50,000 billion, preventing gold bar production. “We will focus on distributing and custodial services for major gold bar brands,” they said.

The CEO of a Ho Chi Minh City-based gold company also mentioned that their firm does not meet production criteria and will instead become a distributor for licensed brands.

ACB Unveils Exclusive Gold Bar Brand Under Chairman Tran Hung Huy, Resumes Operations from October 10th

Asia Commercial Bank (ACB) has announced the relaunch of its gold trading services starting October 10th, marking a significant milestone as the first bank to introduce its own branded gold bars.

Central Bank Withdraws Over 27 Trillion VND from Open Market Operations

During the week of September 15–22, 2025, the State Bank of Vietnam (SBV) significantly reduced its reliance on the forward purchase channel, despite substantial maturities occurring within this channel.