Financial Challenges for Khang Dien (KDH) as Interest Expenses Remain High and Operating Cash Flow Stays Negative

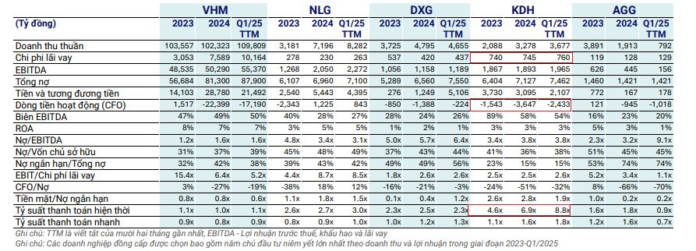

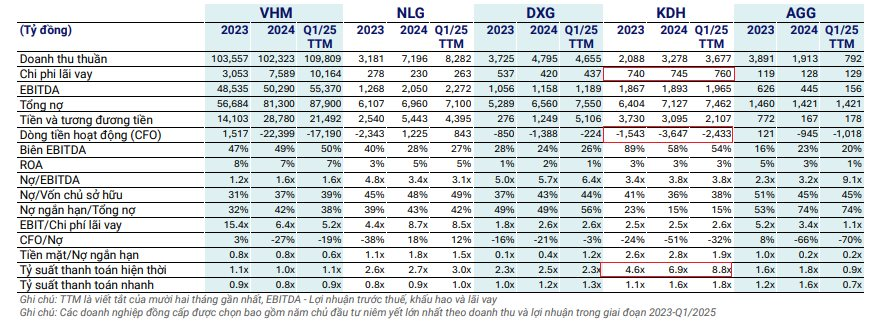

A comparison of Khang Dien’s interest expenses, operating cash flow, and current debt repayment capacity with industry peers Nam Long, Dat Xanh, and An Gia. (Source: VIS Ratings)

The recently published report on real estate sector credit ratings by VIS Ratings revealed that Khang Dien Joint Stock Company (HoSE: KDH), a leading real estate investment and trading company, is facing significant financial challenges. The company’s interest expenses remain high, with a tight debt service coverage ratio, and negative operating cash flow for consecutive periods.

From 2023 to Q1 2025 (TTM), Khang Dien’s interest expenses fluctuated between VND 740 billion and VND 760 billion, with a slight increase: VND 740 billion in 2023, VND 745 billion in 2024 (+0.7%), and VND 760 billion as of Q1 2025 TTM (+2.7%). While there were no abrupt changes, these figures are substantial compared to the company’s current revenue and profit levels.

Additionally, Khang Dien’s EBIT/interest expense ratio stood at approximately 2.5-2.6 times in the last three years, significantly lower than its peer, Nam Long (NLG), which had a ratio of around 8.5 times. This indicates that Khang Dien generates only slightly more than double the cash flow needed to cover its interest payments, falling below the common safety threshold (above 3 times). This situation leaves the company vulnerable to rising interest rates or profit declines.

Notably, Khang Dien’s operating cash flow (CFO) remained negative in 2023, 2024, and Q1 2025 TTM, signaling challenges in sales, cash collection, or a lack of completed projects for revenue recognition. The persistent negative cash flow forces the company to rely on additional borrowing or capital raising to cover operational expenses, further increasing financial pressure.

As of Q1 2025 TTM, Khang Dien’s debt/EBITDA ratio reached 5.0 times, placing it in the medium-to-high range. Meanwhile, short-term debt is on the rise, while short-term assets have slightly decreased. This capital structure heightens liquidity risk, especially with no apparent improvement in cash flow.

In comparison to industry peers like Nam Long, Khang Dien exhibits less competitive financial metrics in terms of profitability, cash flow quality, and financial safety. While interest expenses are similar, Khang Dien’s capital efficiency and debt management capabilities raise concerns.

The data from the VIS Ratings report suggests that while Khang Dien is not in a critical financial situation, the current indicators paint a picture of gradually weakening financial health. With the real estate market still recovering slowly, Khang Dien’s failure to improve sales velocity and cash flow from project deliveries could lead to mounting short-term debt and interest payment pressures, resulting in potential medium- and long-term risks.

According to the consolidated financial statements as of March 31, 2025, Khang Dien’s total assets amounted to VND 30,202 billion, a slight decrease of 1.8% from the beginning of the year. This included VND 2,107 billion in cash and cash equivalents, VND 3,303 billion in short-term receivables, VND 1,035 billion in long-term work-in-progress, and notably, VND 22,405 billion in inventory, representing nearly 74% of total assets. This high inventory level indicates that a significant portion of the company’s resources is tied up in uncompleted or ongoing projects.

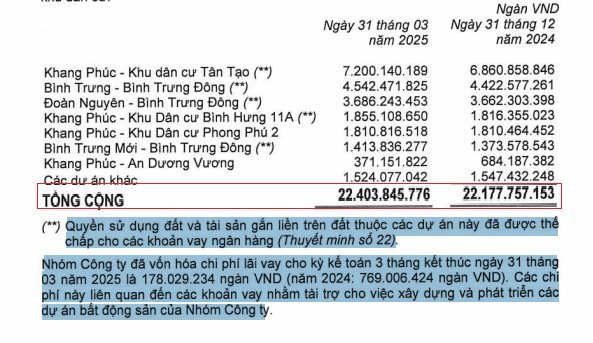

Khang Dien’s inventory continues to grow, with the Tân Tạo Residential Area project leading the way.

Breaking down the inventory composition, the Tân Tạo Residential Area project, developed by Khang Dien’s wholly-owned subsidiary, Khang Phuc, takes the top spot with a value of over VND 7,200 billion. This is followed by the Bình Trưng Đông project by Bình Trưng Company (VND 4,542 billion), the Bình Trưng Đông project by Đoàn Nguyên Company (VND 3,686 billion), the Bình Hưng 11A Residential Area project (VND 1,855 billion), the Phong Phú 2 Residential Area project by Khang Phúc Company (VND 1,810 billion), and the Bình Trưng Đông project by Bình Trưng Mới Company (VND 1,413.8 billion), among others.

Notably, the land use rights and attached assets of these projects have been largely mortgaged to secure bank loans.

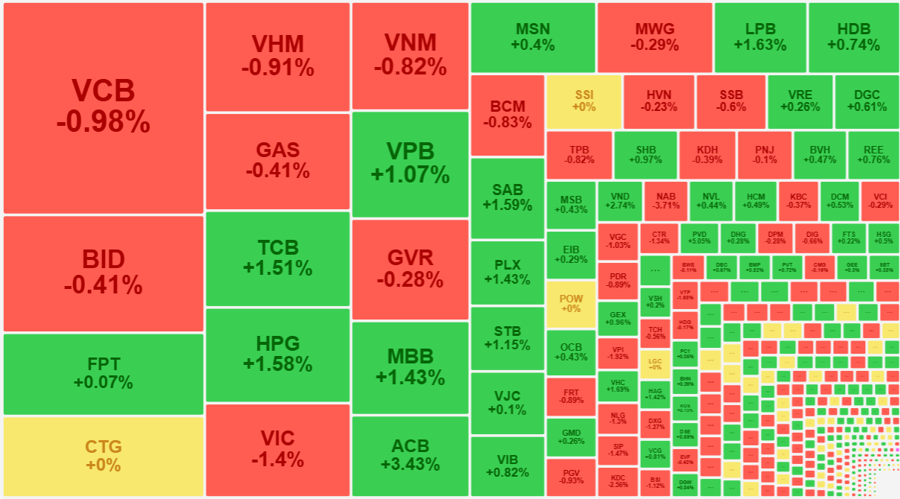

In the stock market, KDH shares closed at VND 30,000 per share on June 18, 2025, up 1.01% from the previous session, with a trading volume of nearly 3.2 million shares.

National Housing Fund: A Non-Profit Initiative

“The Deputy Prime Minister, Ho Duc Phoc, announced the establishment of a National Housing Fund, a non-profit initiative primarily funded by the government’s budget. The fund aims to provide much-needed support for the construction of social and affordable housing for those in need.”

“The Novaland Group Defaults on Debt Payments”

Novaland Group is on a path to recovery, but there are still risks associated with debt negotiations and restructuring. The group has communicated its current financial limitations, stating that it is not yet in a position to settle its debts. As a result, the majority of its loan and bond obligations will be addressed from late 2026 to 2027.