Market breadth has been consistently narrowing since early August.

As of the close of trading on October 3rd, less than 25% of stocks on the HOSE showed short-term upward momentum (above the 20-day moving average, MA20), indicating a significant weakening in market breadth.

Notably, this ratio has been declining since the beginning of August, even as the VN-Index continued to reach new highs, peaking at 1,711.49 points. This suggests that the market’s recent gains have been driven primarily by a few leading stocks, while the majority of stocks have lost their upward momentum.

Divergence between VN-Index movement and market breadth

|

This ratio is not unprecedented in 2025. In April, when the market was shocked by news of retaliatory tariffs from the U.S., the percentage of short-term gaining stocks on the HOSE remained below 20% for nearly the entire month. This period also saw a sharp decline in the VN-Index, marking one of the most notable events of 2025.

Compared to that time, the current context differs significantly: the VN-Index is now trading sideways near its peak, without a deep correction. While market breadth has narrowed, it remains higher than the April lows.

Although real estate, public investment, and securities stocks have experienced sharp declines, there has been no widespread sell-off.

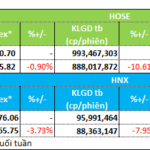

However, the prolonged narrowing of market breadth over two months, coupled with the index trading sideways at its peak, indicates weakening market momentum. According to HOSE data, average daily trading volume in September 2025 was 1,167 million shares, down 33.53% from the previous month.

When will this challenging phase end?

Mr. Bùi Văn Huy, Vice Chairman of the Board and Director of Investment Research at FIDT Corporation, notes that the market’s sideways movement within a narrow range reflects caution and underlying risks following a period of euphoria. The VN-Index has been oscillating around 1,660 points, with alternating ups and downs, indicating a dominant sideways trend and growing caution.

Liquidity has weakened significantly, with average matched orders of just 25–27 trillion VND per session, down sharply from 40–45 trillion VND in August. This reflects a slowdown in speculative capital and hesitation in new investment decisions, as many stocks have already risen significantly without clear new catalysts.

Additionally, foreign investors have maintained net selling of 1,000–2,000 billion VND per session, focusing on blue-chip stocks. This suggests foreign capital is reassessing its positions, possibly due to profit-taking after a strong rally or international ETF rebalancing as Vietnam’s market is re-evaluated. Concerns about high exchange rates and forex risks further hinder long-term positions in the domestic market.

“Capital is now selective, not sustainably ‘comfortable.’ In the short term, the dominant trend remains sideways accumulation, as investors await clearer signals from Q3 earnings and new policy support,” Mr. Huy added.

Mr. Nguyễn Thế Minh, Director of Analysis at Yuanta Vietnam, emphasizes that the continuous weakening of market breadth since early August is a critical signal to monitor closely.

“Narrowing market breadth while the index reaches new highs reflects imbalanced capital flow. If this persists, the market may face a short-term correction to rebalance,” Mr. Minh observed.

According to Mr. Minh, the VN-Index is currently trading sideways near its peak, with no clear negative reversal signals. However, the likelihood of breaking into new highs is low without a strong catalyst. The most critical short-term variable is FTSE Russell’s reclassification decision, expected on October 8.

“The market is holding steady thanks to large-cap stocks, particularly the Vingroup, while capital avoids mid- and small-cap stocks. I expect market sentiment to improve in the second half of October 2025, supported by potential market upgrades and Q3 GDP growth of 8.22% year-on-year,” Mr. Minh analyzed.

– 07:30 07/10/2025

Market Pulse 07/10: Sellers Dominate, VN-Index Closes in the Red

After a day of intense volatility, the index weakened and closed below the reference point. A clear downtrend dominated the afternoon session. At the close, the VN-Index dropped 10 points to 1,685, while the HNX-Index fell nearly 2% to 273.

Vietstock Daily 08/10/2025: Caution Prevails Ahead of Potential Upgrade Announcement

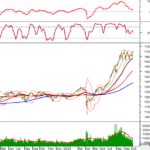

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (1,700-1,711 range). Sustaining a position above the Bollinger Bands’ Middle Line remains critical for maintaining the index’s short-term recovery outlook. Currently, the Stochastic Oscillator has generated a fresh buy signal, while the MACD is narrowing its gap with the Signal Line, potentially triggering a similar indication in upcoming sessions.

Technical Analysis for the Afternoon Session of October 7th: Re-testing the September 2025 Peak

The VN-Index is currently retesting its September 2025 peak (around 1,700-1,711 points). The outcome of this test will determine the short-term trend. Meanwhile, the HNX-Index is also retesting the Middle Bollinger Band, leading to intense volatility.