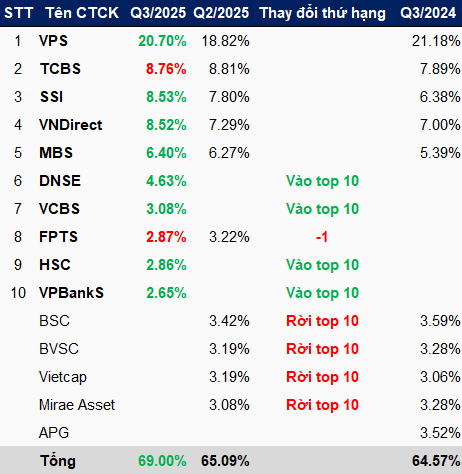

According to the HNX report, the Q3/2025 market share rankings for listed stocks showed no changes in the top 5 positions compared to the previous quarter. The leading companies are VPS Securities with 20.7%, Techcombank Securities (TCBS) at 8.76%, SSI Securities with 8.53%, VNDirect Securities at 8.52%, and MB Securities (MBS) at 6.4%. Notably, TCBS was the only firm to experience a decline in market share.

In contrast, the lower half of the rankings saw significant shifts. BIDV Securities (BSC), Bao Viet Securities (BVSC), Vietcap Securities, and Mirae Asset (Vietnam) dropped out of the top 10, making way for DNSE Securities (6th), VietinBank Securities (VCBS, 7th), Ho Chi Minh City Securities (HSC, 9th), and VPBank Securities (VPBankS, 10th).

FPT Securities (FPTS) maintained its top 10 position at 8th place, down one spot from the previous quarter, with its market share dropping from 3.22% to 2.87%.

Collectively, the top 10 firms now control 69% of the market, a notable increase from 65.09% in the previous quarter and 64.57% in the same quarter last year.

|

Significant Shifts in the Lower Half of HNX Rankings

Source: HNX, Author’s Compilation

|

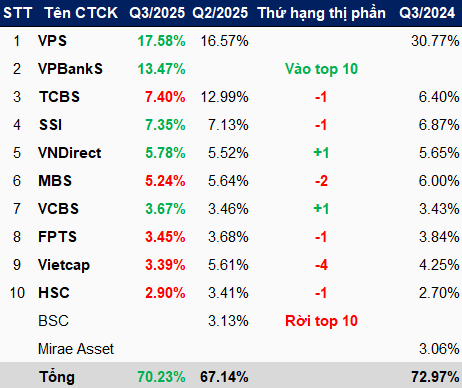

On the UPCoM market, VPS remains the leader with a 17.58% market share, up from 16.57% in the previous quarter. However, VPBankS emerged as the new runner-up with a 13.47% share, closely trailing VPS and significantly outpacing TCBS. Despite a sharp decline from 12.99% to 7.4%, TCBS retained its third-place position.

The entry of new firms into the top 10 displaced others, notably BSC, which held the 10th position in Q2 with a 3.13% share.

Most other rankings saw minor fluctuations, except for Vietcap, which dropped four places to 9th, with its market share falling from 5.61% to 3.39%.

In summary, the top 10 firms on UPCoM now hold 70.23% of the market, up from 67.14% in the previous quarter, thanks to VPBankS’ strong performance offsetting TCBS’ decline. Compared to Q3 last year, when the top 10 held 72.97%, their collective market share has decreased.

|

VPBankS Surges to Second Place in UPCoM Market Share

Source: HNX, Author’s Compilation

|

– 3:15 PM, October 7, 2025

Billion-Dollar Steel Giant Eyes IPO, Posing as a Formidable Rival to Hoa Sen Group and Nam Kim Steel

This steel enterprise boasts an impressive annual capacity of 800,000 tons, positioning itself as a formidable competitor to Hoa Sen Group and Thép Nam Kim in the fiercely contested Vietnamese galvanized steel sheet market.

Vietnam’s Largest Stock Market Deal in History Set to Launch in Days

VPBankS is set to redefine the financial landscape with its groundbreaking IPO, marking a historic milestone in the securities industry. This unprecedented offering promises to be a game-changer, setting new benchmarks for scale, innovation, and investor opportunity.