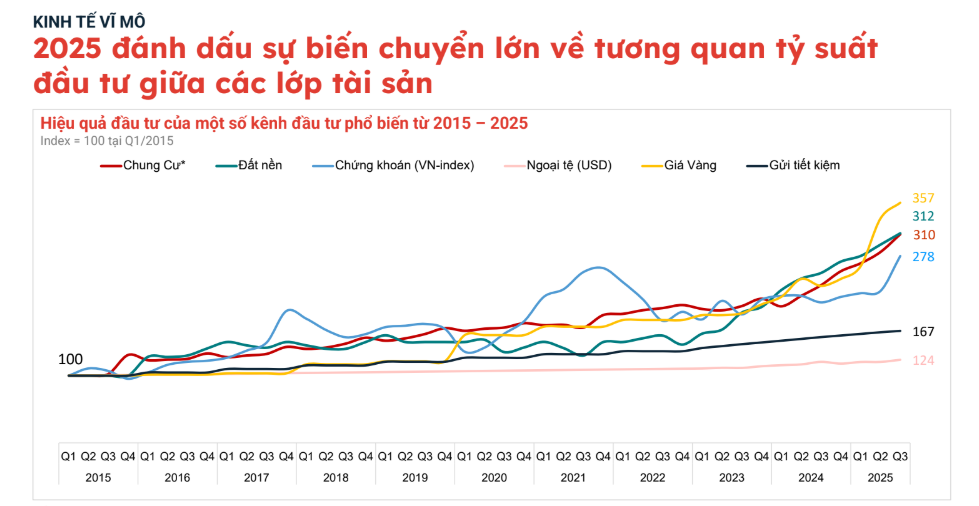

Sharing insights on investment channels, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, stated: “A notable point is that during the 2015-2025 period, investment channels in Vietnam experienced significant differentiation, with 2025 marking a major shift in the yield correlation among various asset classes,” said Mr. Quoc Anh.

According to Mr. Quoc Anh, gold emerged as the leader, surging 3.57 times compared to 2015, followed by land plots with a 3.12-fold increase, reflecting substantial capital inflows into tangible assets tied to infrastructure expectations and long-term accumulation. Apartments, while not the top performers, also accelerated, gradually catching up with land plots by meeting both real housing needs and investment potential. Securities closely followed with a 2.78-fold increase, reaffirming their appeal as an attractive investment channel amidst economic recovery and global volatility.

Conversely, savings deposits and USD became less competitive, rising only 67% and 24% respectively, indicating that interest rates and foreign currencies are no longer effective safe havens. Overall, 2025 signifies a rebalancing among asset classes, with gold, land plots, and apartments taking the lead, while securities maintain stability, and savings deposits and USD become low-yield areas.

At the event, Mr. Dinh Minh Tuan, Regional Director for the Southern Region at Batdongsan.com.vn, noted that the real estate market in Q3/2025 showed a clear distinction between the buying/selling and rental segments.

Following a volatile Q2 with macroeconomic fluctuations, interest in property sales rebounded swiftly, led by apartments, while townhouses and private homes also began showing improvement. Several areas recorded an 11-22% increase in interest compared to the beginning of the year.

In contrast, the rental segment declined post the Ghost Month, particularly for dormitories and guesthouses. Interest in September 2025 dropped by 8-24% across various types compared to the previous month.

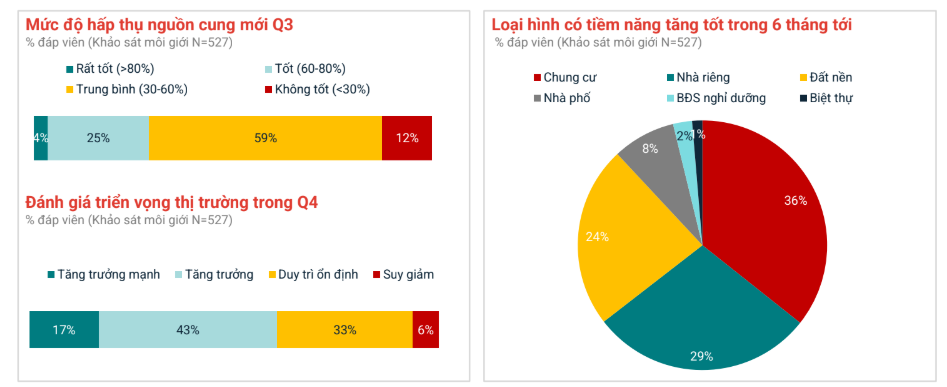

However, Batdongsan.com.vn’s Q3/2025 broker survey revealed that new supply absorption remained positive, with nearly 90% of respondents rating it from average to good, including 4% as “very good” and 25% as “good.” Only 12% found absorption less favorable.

Looking ahead to Q4, 60% of brokers anticipate continued market growth, with 17% expecting strong growth. About one-third predict stability, while only 6% express concerns about a potential downturn.

Notably, apartments were rated highest for growth potential in the next 6 months at 36%, followed by private homes (29%) and land plots (24%). Other types like townhouses, resort properties, or villas held smaller shares, reflecting capital concentration in products meeting real housing needs and high liquidity.

The $214 Million Bridge Spanning Thi Vai River Sets Southeast Asia’s Longest Span Record: Who’s Behind It?

The main span of the bridge stretches over 1 kilometer, with its central arch boasting a staggering 250-meter gap between the main pillars – the widest in Southeast Asia to date.

Vietnam to Lead East Asia and Pacific Growth in 2025, Says World Bank

The World Bank (WB) has revised its economic growth forecast for the East Asia and Pacific region in 2025 upward to 4.4%, marking a 0.2 percentage point increase from its previous projection. Notably, Vietnam is poised to lead the East Asia and Pacific region in growth during 2025, according to the WB’s latest predictions.

Early Restrictions on Vehicle Fuel Consumption

Numerous countries have implemented stringent automotive fuel consumption standards aimed at reducing emissions and safeguarding the environment.