At the “Q3/2025 Real Estate Market Overview” event, Mr. Dinh Minh Tuan, Southern Regional Director of Batdongsan.com.vn, revealed that Q3/2025 market data paints a clear picture: instead of focusing on central urban areas, real estate demand and investment are shifting significantly to suburban regions. These areas offer ample growth potential and increasingly developed inter-regional infrastructure.

Northern Region: Hai Phong, Hoa Binh, and Bac Giang Take the Lead

According to Batdongsan.com.vn data, interest in the two central urban hubs during Q3 showed signs of stagnation. In Hanoi, interest dropped by 22% compared to the same period in 2024, while Ho Chi Minh City remained flat (+0%) or saw slight declines in new areas (-1%).

In contrast, neighboring provinces emerged as “bright spots.” Suburban areas around Hanoi grew by 11%, and despite some regions in the South experiencing up to 12% declines, many localities still demonstrated significant resilience.

The Q3/2025 real estate landscape in the North highlights a pronounced shift away from Hanoi. Hai Phong, Hung Yen, Hoa Binh, and Bac Giang emerged as “hotspots,” capturing 80% of the region’s total interest. Hai Phong led with an index of 100, followed by Hung Yen (62) and Bac Ninh (35).

In terms of growth since the beginning of the year, Hoa Binh topped the list with +65%, followed by Bac Giang (+61%), Hai Phong (+50%), and Bac Ninh (+48%). Other localities such as Quang Ninh, Hung Yen, and Vinh Phuc maintained growth rates of 26-42%. This surge reflects the trend of capital moving to satellite cities around Hanoi, where prices remain competitive, infrastructure connectivity is favorable, and long-term expansion potential is high.

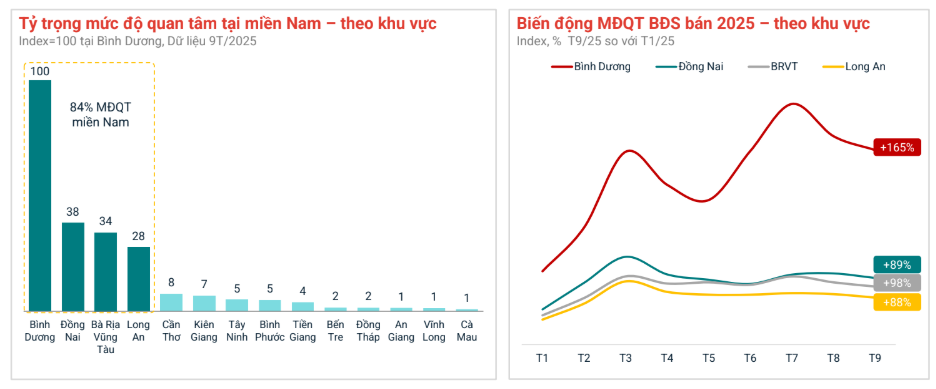

Southern Region: Former Binh Duong Leads the Charge

While the North witnessed the rise of Hanoi’s satellite provinces, the South saw vibrant real estate activity in the satellite markets of Ho Chi Minh City prior to its merger. Specifically, the former Binh Duong emerged as a “shining star,” capturing 84% of the region’s total interest and leading with an index of 100. Other localities such as Dong Nai (38), Ba Ria – Vung Tau (34), and Long An (28) also featured prominently, forming a dynamic “satellite belt” around Ho Chi Minh City.

Compared to the beginning of the year, Binh Duong experienced a remarkable 165% growth, far outpacing other areas. Dong Nai grew by 89%, Ba Ria – Vung Tau by 98%, and Long An surged by 88%. This momentum reflects the strong shift of capital away from Ho Chi Minh City toward areas with increasingly complete transportation infrastructure, ample land reserves, and prices with room for growth. These factors effectively meet both actual living needs and long-term investment demands.

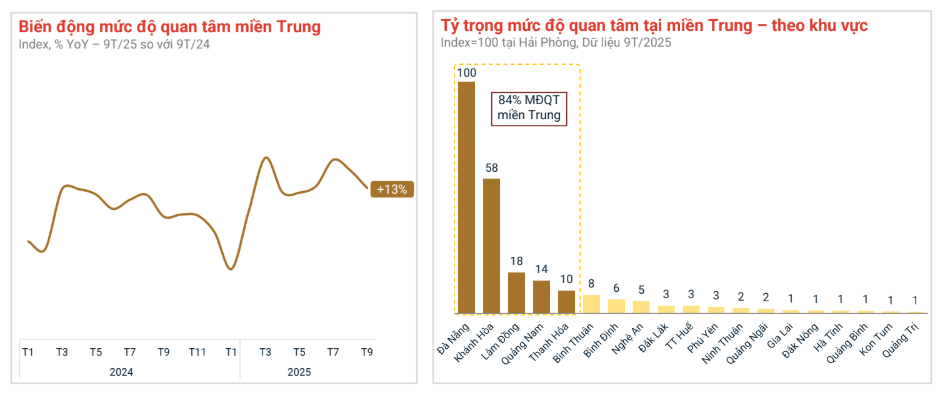

Central Region: Da Nang and Khanh Hoa Lead the Way

Meanwhile, the Central region maintained a steady growth pace, with interest rising by 13% compared to the same period in 2024. Da Nang and Khanh Hoa continued to play a “leading role,” capturing 84% of the region’s total interest. Da Nang led with an index of 100, followed by Khanh Hoa with 58; Lam Dong (18), Quang Nam (14), and Thanh Hoa (10) also showed signs of improvement.

In terms of pricing, Khanh Hoa led with a 34% increase, Quang Nam continued to surprise with +44%, and Da Nang rose by 25%. Thanh Hoa and Lam Dong saw more modest increases of 4% and 13%, respectively. These figures indicate a strong capital shift toward coastal markets with high potential, closely tied to tourism and rapidly developing infrastructure.

Revolutionary Projects by Vingroup, Sun Group, Ecopark Shake Up the Market, Redefining the Real Estate Investment Landscape

A wave of mega-projects from real estate giants has been shaking up the market lately. Wherever a blockbuster development emerges, it attracts a flood of investment, drawing in both investors and brokers, transforming the area into a vibrant new hotspot.

Who’s Buying and Selling Apartments at $100 Million per Square Meter?

The real estate market is experiencing a pricing frenzy, with recent project launches boasting rates ranging from $4,000 to $12,000 per square meter. This surge has made homeownership increasingly elusive, as the gap between income and property prices continues to widen.