Supply Rebounds, Liquidity Remains Robust

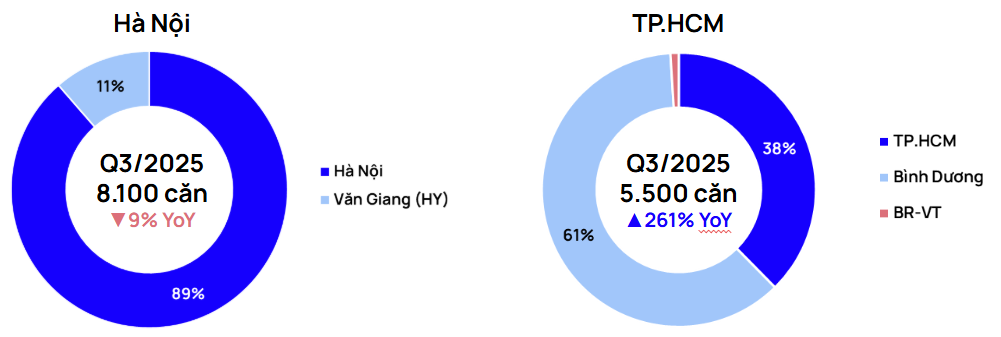

The Q3/2025 report from One Mount Group’s Market Research and Customer Insight Center highlights that Hanoi’s real estate market continues to thrive, with 8,100 newly launched apartment units—a slight 9% decrease from the same period last year but still higher than the 2023–2025 average.

Hanoi’s New Supply is primarily concentrated in the Eastern and Western districts, notably Van Giang (Hung Yen), accounting for 11% of total launches. Large-scale projects such as Lumière Prime Hills, Sun Feliza Suites, Kepler Land Mo Lao, and Masteri Trinity Square also stand out. The Western area remains the market leader, thanks to its well-developed infrastructure and abundant land reserves, contributing approximately 36% of the new supply.

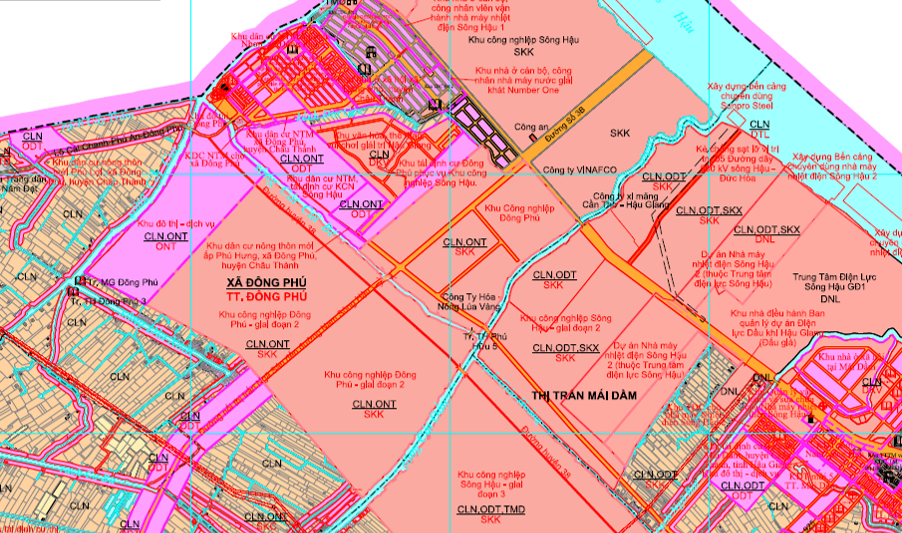

New apartment supply in Hanoi and Ho Chi Minh City in Q3/2025.

Meanwhile, Ho Chi Minh City, following its consolidation, witnessed a remarkable surge with 5,500 units—a 261% increase compared to Q3/2024, marking the highest recovery in three years. This growth is driven by new legal frameworks taking effect, gradually improving supply, though distribution remains uneven. Over 60% of new launches are in Binh Duong, while central HCMC still faces a scarcity of new projects due to prolonged legal procedures.

Average apartment prices in Hanoi and Ho Chi Minh City.

Average apartment prices in both major cities continued to rise sharply, exceeding 20% year-on-year. In Hanoi, the average price reached 85.6 million VND/m², up 23%, while in HCMC (pre-merger), it stood at 95.4 million VND/m², a 21% increase. New projects in Q3/2025 approached 108–131 million VND/m², reflecting a trend toward high-end products.

New apartment supply by price range in Hanoi and HCMC in Q3/2025.

Over 50% of new supply in both markets is priced above 100 million VND/m². Notably, in Western Hanoi, newly launched projects start at 104 million VND/m². Post-merger HCMC has a broader price range, from 30 to 200 million VND/m², though mid-range units are primarily in Binh Duong; the city center maintains the highest prices.

2025–2026 Outlook: Abundant Supply, Stabilizing Prices

Despite high prices, absorption rates for Q3/2025 launches remained impressive: 93% in Hanoi and 80% in HCMC. Total transactions reached 10,100 units in Hanoi (up 6.3% YoY) and 5,300 units in HCMC (up 65.2% YoY).

Absorption rates for new projects in Q3/2025.

Many projects in Hanoi and HCMC reported “sell-out” events on launch day, indicating strong real demand and stable investment flows, especially for projects with prime locations and clear legal status.

One Mount Group forecasts that in 2025, Hanoi’s primary supply will reach approximately 31,000 units, the highest in three years, while HCMC is expected to hit 28,000 units. In 2026, supply will stabilize at 32,000 units in Hanoi and 23,000 units in HCMC.

Projected new supply for 2025 and 2026.

Notably, Binh Duong will account for about 65% of the Southern region’s supply in 2025 and maintain around 50% in 2026, underscoring the trend of HCMC’s market expanding to the outskirts post-merger.

Mr. Tran Minh Tien, Director of One Mount Group’s Market Research and Customer Insight Center, commented: “In the first nine months of 2025, both Hanoi and HCMC saw significant price increases, with some central projects surpassing 100 million VND/m². However, average absorption rates remained above 80%, and many projects sold out within days. This reflects the enduring appeal of real estate in major cities, where genuine demand and investment interest remain high. By 2026, the market is expected to continue its robust recovery, with ample supply helping to stabilize prices in the medium term.”

With supply rebounding, high absorption rates, and restored confidence, Hanoi and HCMC’s real estate markets are entering a new growth cycle. Although prices remain high relative to average incomes, long-term investment trends, infrastructure development, and legal improvements will sustain these markets as Vietnam’s real estate leaders in 2026–2027.

The 21-Year Odyssey of Billionaire Pham Nhat Vuong: Pursuing the World’s Tallest Sea-Reclaimed Tower

Vinhomes Green Paradise stands as the pinnacle of 2025’s real estate achievements, boasting a sprawling expanse three times the size of the former District 1 and a staggering investment of over $9 billion. To bring this visionary project to life, Vingroup dedicated 21 years to navigating intricate legal frameworks and meeting stringent environmental impact assessments, ensuring a development that redefines luxury and sustainability.

Power Outage in Hanoi: 14,000 Customers Affected by Flooding

As of 12:00 PM on October 7th, 13,943 customers in Hanoi remain temporarily without power due to severe flooding.