After a period of stagnation, Vietnam’s real estate market is showing clear signs of recovery. A series of new data released at the event “Q3/2025 Real Estate Market Overview,” organized by Batdongsan.com.vn on the morning of October 7, reflects the market’s vibrant resurgence after a prolonged freeze.

Capital Flow Shifts from Hanoi, Ho Chi Minh City to Outlying Areas

Speaking at the event, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, noted that since Q4/2024, the market has begun to show positive signals, with a significant increase in listed and transacted properties.

Moving into 2025, the recovery momentum has not only been sustained but also broadened. From Q1 to Q3/2025, average property prices rose by 36%, while Q3 transaction volumes also surged, indicating that capital is returning to the market after a long period of caution.

The Deputy General Director of Batdongsan.com.vn observed that the distinguishing feature of this recovery cycle is that the market is no longer driven by short-term speculation but focuses on real occupancy segments. Buyers are now seeking suitable properties for living, prioritizing areas with well-developed infrastructure and reasonable prices. This foundation ensures a more sustainable and healthy recovery process.

While land plots were previously the “focal point” of land fever, apartments have now become the market-leading segment. According to Batdongsan.com.vn statistics, interest in apartments increased by 22% compared to the same period last year, while interest in private houses rose by 13%, and land plots continued to decline by 11%.

While overall interest in the Northern region increased by 11%, Hanoi alone saw a 22% decline.

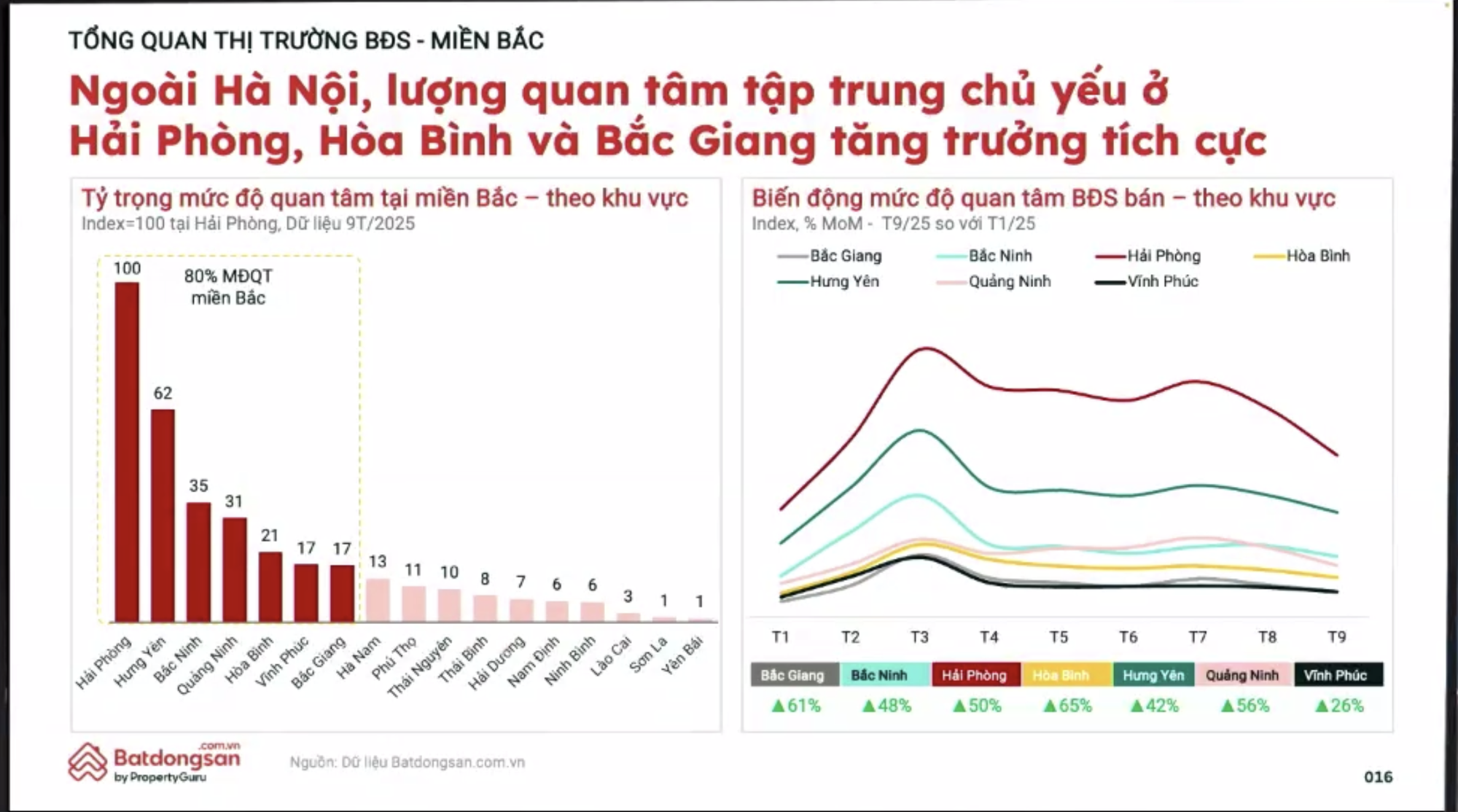

Regionally, the Northern market shows clear differentiation. While overall interest in the region rose by 11%, Hanoi alone saw a 22% decline, indicating that capital is moving away from the center to satellite provinces with greater development potential.

Hai Phong increased by 50%, Bac Giang by 61%, and Hoa Binh by 65%, becoming “new destinations” due to their extensive land funds, improved infrastructure, and more affordable prices compared to the capital.

In the South, localities bordering Ho Chi Minh City, such as Binh Duong, Dong Nai, Ba Ria – Vung Tau, and Long An, are attracting significant capital. Binh Duong leads with a 165% increase, followed by Ba Ria – Vung Tau (+98%), Dong Nai (+89%), and Long An (+88%).

According to Mr. Nguyen Quoc Anh, this growth stems from the strong development of inter-regional infrastructure and the emergence of large-scale urban projects, making these localities increasingly potential satellites of Ho Chi Minh City.

Hanoi Investors Shift Capital to the Central Region

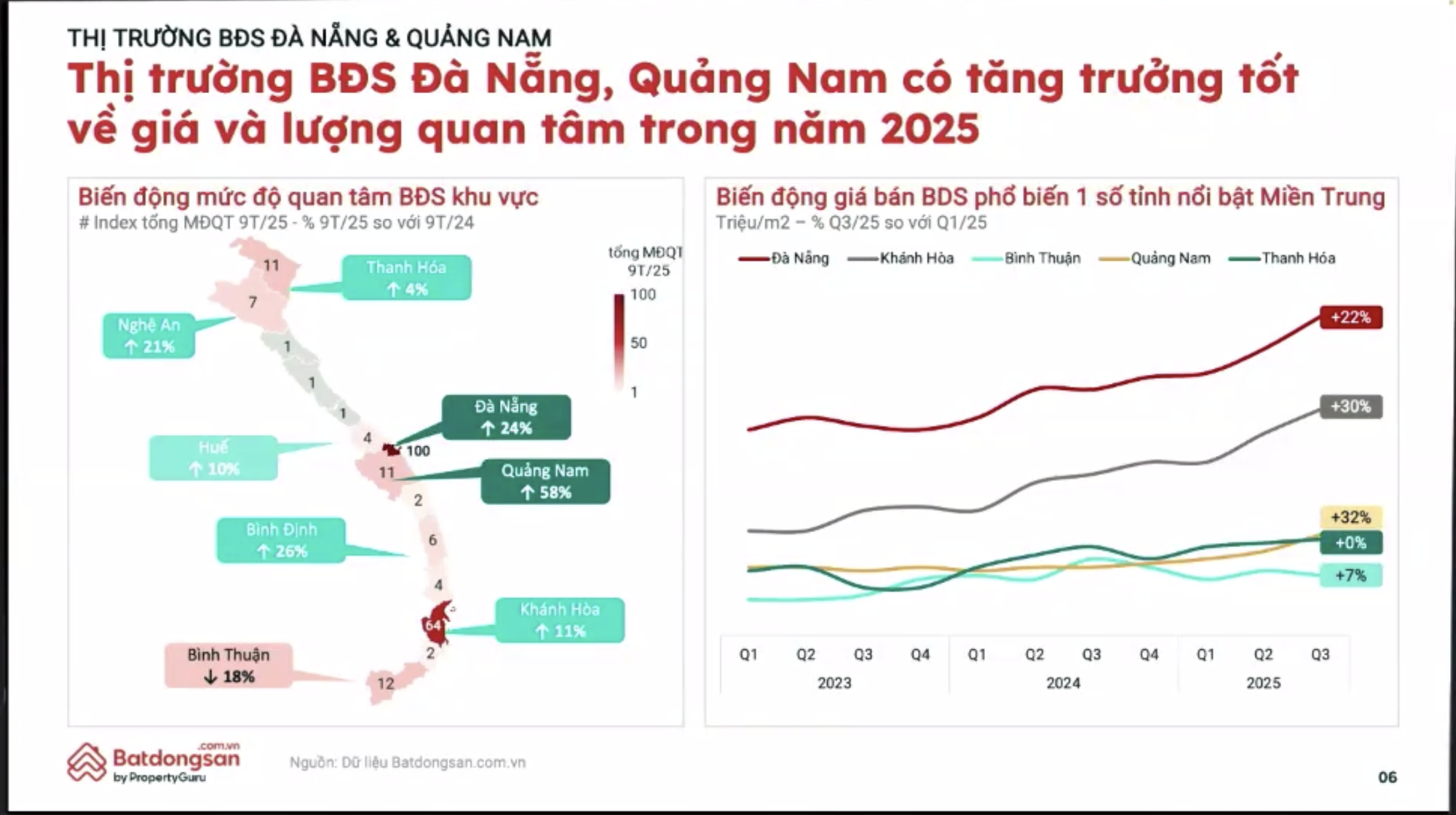

Beyond the North and South, the Central region, particularly Da Nang and Quang Nam, is emerging strongly in Vietnam’s real estate recovery map.

Mr. Ha Nghiem, Director of Batdongsan.com.vn’s Da Nang branch, noted that 2025 marks the region’s strongest recovery phase, driven by the combination of Da Nang’s modern infrastructure and Quang Nam’s abundant land resources, creating sustainable development momentum for the entire region.

In Q3/2025, interest in Da Nang real estate increased by 24%, while Quang Nam saw a 58% rise compared to the same period last year. Average selling prices in the Central region also surged: Quang Nam (+32%), Khanh Hoa (+30%), and Da Nang (+22%) over nine months.

In Da Nang, the average asking price currently stands at 79 million VND/m², up sharply from 51 million VND just two years ago.

As of September 2025, all property types in Da Nang recorded impressive growth. Land plots increased by 68%, apartments by 49%, and townhouses by a staggering 146%.

The apartment segment saw strong growth in most areas: Ngu Hanh Son (+122%), Son Tra (+78%), and Hai Chau (+77%). With an average selling price of 4.5 billion VND/unit and rental rates around 15 million VND/month, Da Nang currently ranks among the cities with the highest investment yields nationwide, surpassing Nha Trang and Phan Thiet.

The land plot segment is also making a strong comeback. In Q3/2025, interest surged in most districts, particularly Ngu Hanh Son (+48%) and Cam Le (+47%). Average selling prices increased in Son Tra (+41%), Lien Chieu (+37%), Hai Chau (+21%), and Ngu Hanh Son (+33%) compared to the beginning of the year.

This vibrancy is primarily driven by expectations of infrastructure development, especially projects like the expansion of Vo Nguyen Giap coastal road, the western ring road, and plans for new eco-urban areas.

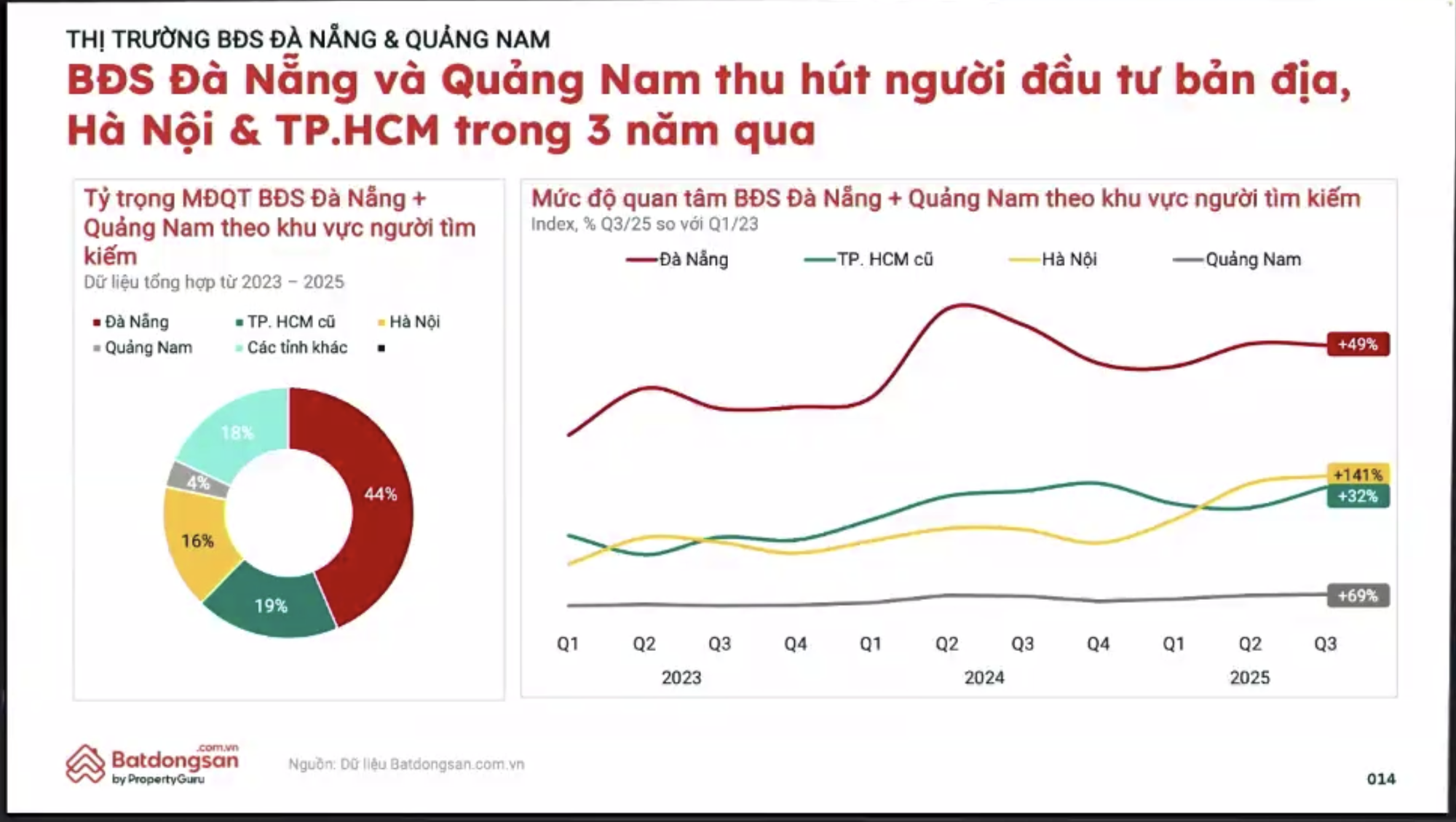

Interest from Hanoi investors in the Da Nang market increased by 141% from the beginning of 2023, accounting for 16% of total searches.

In Quang Nam, the land plot market also shows strong recovery. Areas like Hoi An (+36%), Tam Ky (+22%), Thang Binh (+20%), and Duy Xuyen (+10%) all recorded stable price increases. Average selling prices in Hoi An currently reach 34 million VND/m² – the highest in the province, while neighboring areas like Dien Ban and Nui Thanh maintain “soft” prices, offering significant opportunities for long-term investors.

Mr. Ha Nghiem emphasized: “Da Nang land prices compared to the 2019 peak are up by about 15%, and there are many advantages here in terms of mergers and regional planning being finalized, with the formation of a triangle for Trade – Tourism, Industry – Logistics, and Border Gate Economy. Therefore, the Da Nang – Quang Nam real estate market has not yet reached its peak and still has much room for growth.”

According to Mr. Ha Nghiem, Da Nang – Quang Nam real estate currently attracts primarily local market interest, accounting for about 50% of total searches. Notably, Hanoi investors are playing a significant role in the market’s growth trend, with interest increasing by 141% from the beginning of 2023, accounting for 16% of total searches.

Capital flow from the North is seen as a considerable driving force, boosting the recovery of the Central real estate market and contributing to the vibrant picture of Vietnam’s real estate market in 2025.

Why Do Property Prices Keep Rising? Exploring Effective Solutions to Curb the Trend

In recent years, the relentless surge in real estate prices, particularly in housing and condominiums, has far outpaced the average income of the majority of workers. Despite numerous aggressive and continuous solutions being implemented, the challenge of stabilizing property prices remains a complex puzzle yet to be solved.

Lotte Advances $870 Million Thu Thiem Project as Ho Chi Minh City Resolves Key Obstacles

At the meeting held on the afternoon of October 3, 2025, Ho Chi Minh City’s Chairman of the People’s Committee, Nguyễn Văn Được, affirmed that city leaders will collaborate closely with investors. They will also incorporate Lotte’s recommendations into proposals submitted to the Government to address existing challenges.

Successive Bank Auctions of Real Estate Properties

Recently, banks have been consecutively auctioning off real estate assets, notably reducing the listing prices compared to previous sales.