Property Prices Surge, Yet Transactions Remain Robust

The Q3/2025 report by One Mount Group’s Market Research and Customer Insight Center reveals that Hanoi and Ho Chi Minh City’s real estate markets remain vibrant, despite record-high property prices.

In Hanoi, the new apartment supply reached 8,100 units, a slight 9% decrease compared to the same period last year but still higher than the 2023–2025 average. The Eastern and Western districts of Hanoi continue to be the focal points.

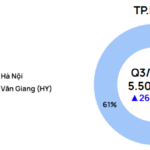

The Western district accounts for 36% of the total supply, thanks to its well-developed infrastructure and abundant land reserves. Meanwhile, Van Giang (Hung Yen) contributes approximately 11% of the new launches, indicating a growing trend of urban expansion into the outskirts.

Ho Chi Minh City, post-merger, witnessed a remarkable surge with 5,500 new apartment units launched, a 261% increase compared to the same period in 2024—the highest recovery rate in the past three years. This upswing is attributed to new legal regulations that have streamlined project approvals and implementations. However, the supply remains unevenly distributed: the former Binh Duong area accounts for over 60% of the new launches, while central Ho Chi Minh City faces shortages due to prolonged legal hurdles in many projects.

Apartment prices in Ho Chi Minh City and Hanoi continue to rise in Q3

Average apartment prices in both major cities surged by over 20% year-on-year. Hanoi reached an average of 85.6 million VND/m², while Ho Chi Minh City (former) hit 95.4 million VND/m².

Multiple Projects Surpass 100 Million VND/m²

Newly launched projects in Q3 approached the 108–131 million VND/m² mark, reflecting the strong growth of the high-end segment. Notably, over 50% of the new supply in both markets exceeded 100 million VND/m².

In Western Hanoi, several first-time launches listed prices starting at 104 million VND/m². In Ho Chi Minh City, prices ranged from 30 to 200 million VND/m², with mid-range apartments primarily concentrated in Binh Duong, while the city center maintained the highest price levels.

According to Tran Minh Tien, Director of One Mount Group’s Market Research and Customer Insight Center, a middle-income household (earning 200 million to 1.3 billion VND annually) would need 9–10 years of work to afford a standard 70m² apartment (priced at 85–95 million VND/m², excluding VAT). Meanwhile, households earning less than 200 million VND annually are virtually unable to access commercial housing, requiring over 35 years of savings to achieve financial feasibility.

“The gap between income and housing prices is widening, making homeownership more challenging than ever. However, market demand remains stable, driven by genuine housing needs and projects with transparent legal frameworks and integrated infrastructure,” Mr. Tien noted.

One Mount Group indicates that Hanoi and Ho Chi Minh City’s real estate markets are in a clear recovery phase, but the rapid price increases pose significant challenges to sustainable housing development, particularly for middle- and low-income groups in these special urban areas.

Flood Warnings from Rain-Prone Residential Areas in Hanoi

The torrential rains unleashed by Typhoon No. 10 have left numerous streets and urban areas in Hanoi submerged, painting a stark picture of the city’s vulnerability. Beyond being an alarming situation, this serves as a critical wake-up call, exposing the underlying weaknesses in the capital’s urban management system.

Massive Capital Influx into Real Estate Sparks Expert Warnings of Potential Market Bubble

Amidst the surge of capital flowing into real estate, which risks driving up prices and creating artificial scarcity, thereby reducing liquidity and threatening the stability of the credit system, experts warn that appropriate regulatory measures must be implemented promptly to mitigate these risks.