Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank – Code: STB) has recently updated its list of shareholders owning at least 1% of the bank’s charter capital.

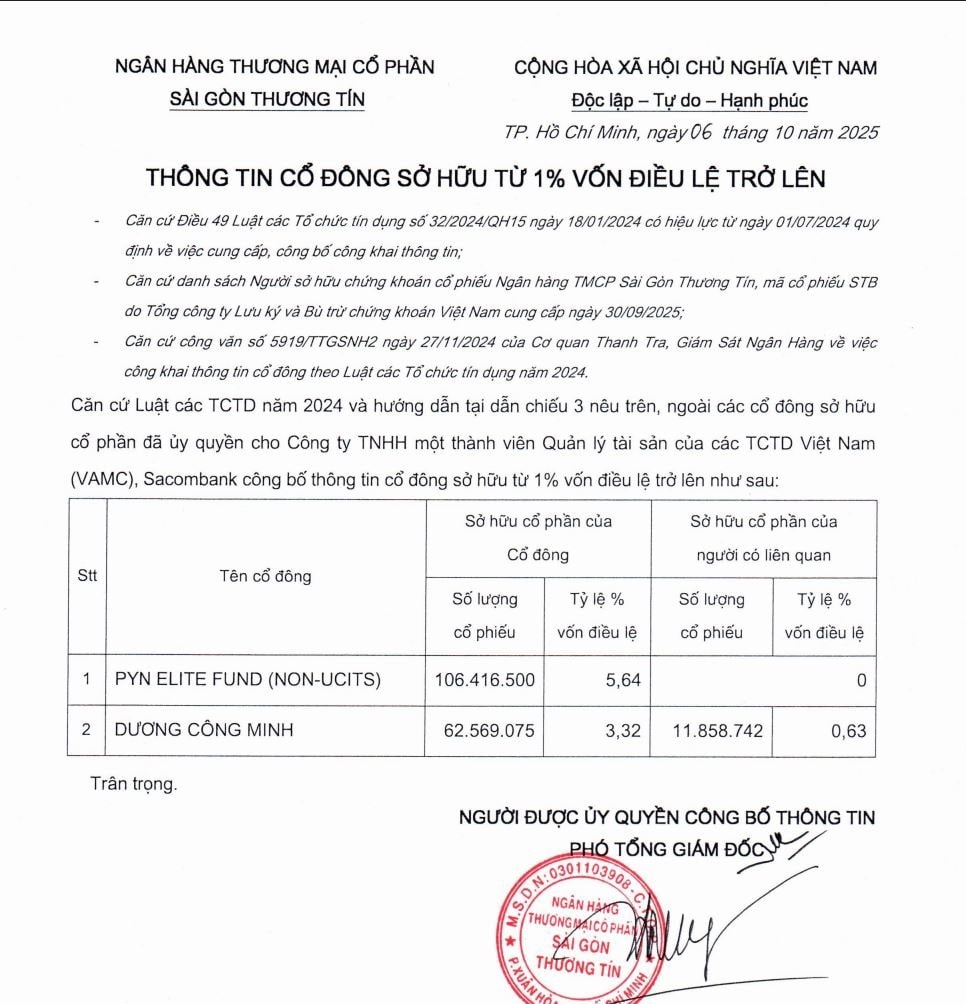

List of shareholders owning at least 1% of Sacombank’s charter capital, announced on October 6, 2025

According to the latest update, the number of shareholders holding more than 1% of Sacombank’s charter capital has decreased from 6 to 2. These include Pyn Elite Fund and Sacombank’s Chairman, Duong Cong Minh. Pyn Elite Fund currently holds over 106.4 million shares, equivalent to 5.64% of the bank’s charter capital. Compared to the last announcement on August 7, 2025, Pyn Elite Fund has increased its holdings by 5 million shares.

Mr. Duong Cong Minh holds over 62.5 million shares, representing 3.32% of Sacombank’s charter capital. His associate, Mrs. Duong Thi Liem, owns 11.8 million shares, or 0.63% of the bank’s capital.

Combined, Pyn Elite Fund and Mr. Duong Cong Minh, along with his associate, hold over 168.9 million shares, equivalent to 8.96% of Sacombank’s charter capital.

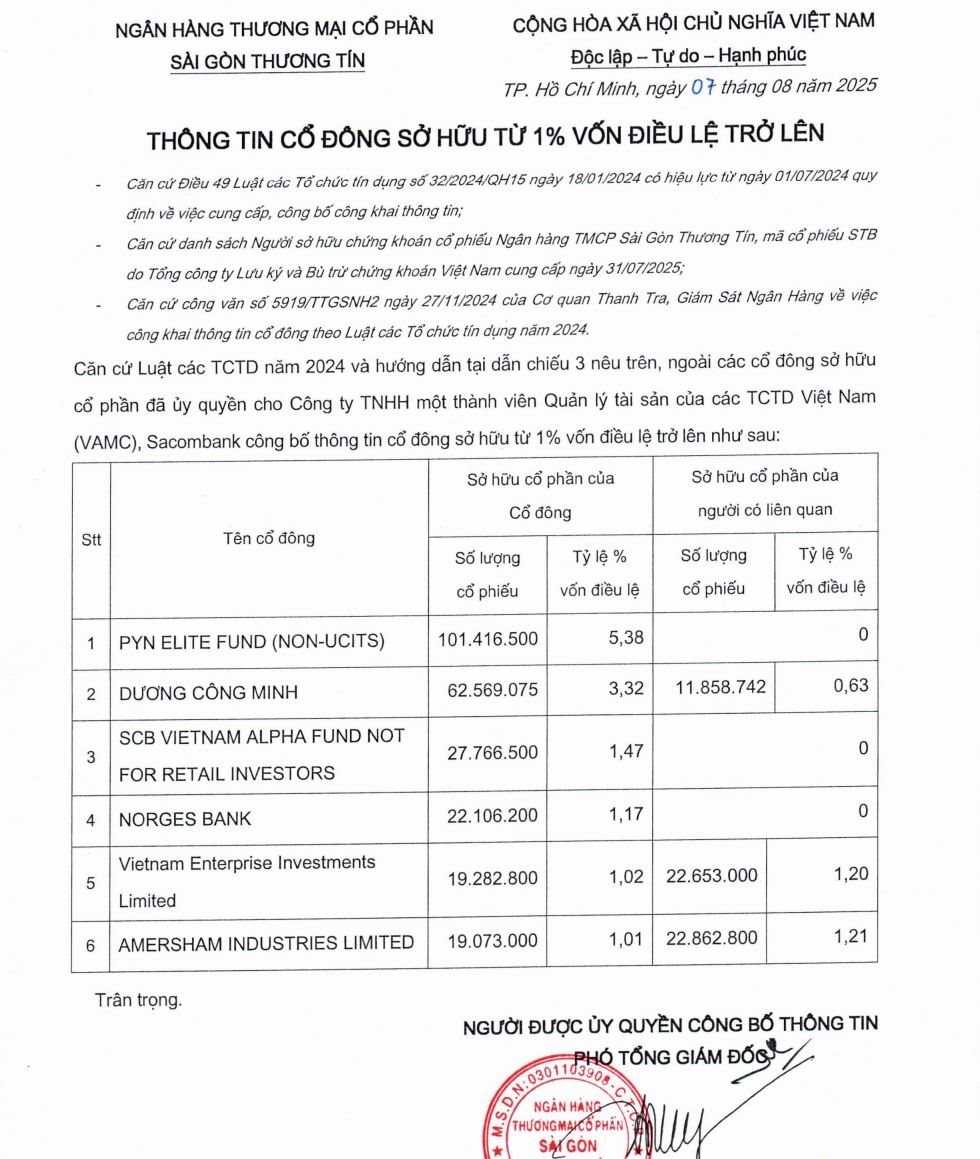

List of shareholders owning at least 1% of Sacombank’s charter capital, announced on August 7, 2025

Notably, the current list no longer includes Dragon Capital’s funds such as Vietnam Enterprise Investments Limited (VEIL), Norges Bank, Amersham Industries Limited, and SCB Vietnam Alpha Fund Not For Retail Investors. Previously, VEIL held nearly 19.3 million shares (1.02%), with its associates holding an additional 22.7 million shares (1.2%).

Norges Bank held over 22.1 million shares (1.17%), while Amersham Industries Limited held more than 19.07 million shares (1.01%), with its associates holding over 22.86 million shares (1.21%).

In the first half of 2025, Sacombank’s pre-tax profit reached 7,331 billion VND, achieving 50% of the annual plan. As of June 30, 2025, the bank’s total assets stood at 807,339 billion VND (up 7.9% year-to-date), with customer loans increasing by 9% and customer deposits rising by 10.1%. The non-performing loan ratio was maintained at 2.14%.

In a recent report, Yuanta Securities predicted that Sacombank’s full-year 2025 pre-tax profit could reach 17,200 billion VND, a 35% increase from the previous year and exceeding the target of 14,600 billion VND.

“The restructuring process is nearly complete, and Sacombank’s credit growth is expected to rebound, potentially outpacing the industry average. The bank is likely to fully recognize bad debt recoveries from the sale of Phong Phu Industrial Park. In Q1 2025, Sacombank received 1,600 billion VND, and we anticipate the remaining 6,300 billion VND to be recognized in 2H 2025 or early 2026,” Yuanta Securities stated.

CC1 Secures Impressive $77 Million Credit Line

CC1 has recently secured a credit limit of VND 1.8 trillion from Sacombank, with the primary purpose of utilizing these funds for lending and guarantee services.

Big4 Bank Set to Pay Over 2.4 Trillion VND in Cash Dividends, Scheduled for November Disbursement

Previously, Vietcombank announced a shareholder list closure on October 6, 2025, for a 4.5% cash dividend distribution. Shareholders holding one share will receive 450 VND, with the payment scheduled for October 24, 2025.

Sacombank Secures Spot Among Vietnam’s Top 50 Most Efficient Companies in 2025

Sacombank has once again secured its position in the Top 50 Most Effective Business Companies in Vietnam (TOP50) for 2025, ranking 14th—a remarkable 11-place leap from 2024. This achievement underscores Sacombank’s exceptional management efficiency and sustainable growth capabilities, even amidst a highly volatile market landscape.