Housing Price Surge Driven by Supply-Demand Imbalance

Over the past year, Vietnam’s real estate market, particularly apartments in Ho Chi Minh City (HCMC), has shown signs of recovery with significant price increases. The primary cause is limited supply. Mr. Su Ngoc Khuong, Senior Director of Investment Advisory at Savills Vietnam, noted that historically, the average financial capacity of buyers calculated apartment prices in major cities at around VND 50–70 million per square meter.

Housing prices can only decrease when the market achieves supply-demand balance, especially in the affordable segment. Illustrative photo: DNCC |

However, due to prolonged procedures or high land costs, the limited supply has forced developers to adjust prices to match market conditions. As the market operates on supply and demand dynamics, with more buyers than sellers, this imbalance has led to continuous price hikes in HCMC.

“Market prices have been accepted, with some areas seeing increases of 30-40%. The most concerning issue now is the affordability challenge for residents, as incomes struggle to keep pace with rising housing costs,” emphasized Mr. Su Ngoc Khuong.

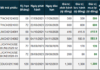

According to Nha Tot, a real estate technology platform, the Q2 report highlights a trend of shifting demand away from HCMC’s central areas, benefiting from major infrastructure projects like Long Thanh Airport and Ring Road 3. Primary sale prices rose 22% quarter-on-quarter, primarily in the two-bedroom apartment segment, priced at VND 1–2 billion in satellite provinces and VND 2–3 billion in HCMC.

In Hanoi, land plots remain the focal point, with project sale prices surging 50% year-on-year to an average of VND 49.3 million per square meter. Meanwhile, the apartment and low-rise housing segments experienced more stable dynamics, with demand concentrated on two-bedroom apartments priced at VND 3–5 billion and small low-rise homes priced at VND 5–7 billion.

According to Mr. Dinh Minh Tuan, Regional Director of batdongsan.com.vn in the South, housing prices can only decrease when the market achieves supply-demand balance, especially in the affordable segment. Currently, the three largest cost components are land, legal procedures, credit capital, and construction, with land and legal procedures being the most significant barriers. To achieve sustainable price reductions, coordinated efforts are needed among the government, businesses, and the credit system.

Rising Construction Costs in Real Estate

Experts note that in the cost structure of real estate products, construction and labor costs are difficult to adjust, but the most decisive factor is land prices. Land is directly tied to planning and typically accounts for a large portion of total project costs. Therefore, to create products suitable for the majority, planning must ensure land funds for middle- and low-income groups.

Another factor is prolonged procedures. When projects are delayed, capital costs, management expenses, and opportunity costs all increase, driving up final sale prices and burdening buyers. Thus, streamlining processes and controlling timelines are direct solutions to reduce prices.

Additionally, credit capital plays a crucial role. Commercial banks not only provide capital for developers but also support homebuyers through loans. However, credit cannot be the sole solution, added Mr. Su Ngoc Khuong.

Mr. Tran Duc Vinh, Chairman of Tran Anh House Real Estate JSC, believes reducing housing prices requires shortening administrative procedures, which currently take 5–10 years and often increase costs by 30–50%.

Furthermore, companies with available land and financial capacity should receive priority permits within 3–6 months, avoiding years-long planning delays that drive up bank loan interest costs. Simultaneously, social housing and affordable homes in suburban areas, with units around 40 square meters priced at VND 500–700 million, should be encouraged to meet the purchasing power of workers.

Mr. Tran Van Hung, Sales Director at C-Holdings, shared that a typical real estate project comprises three main cost groups. Land and legal costs account for 20–30%, considered a “hard” component difficult to adjust without transparent and stable state mechanisms. Construction and infrastructure costs represent the largest share at 40–50%, where companies can optimize through construction technology, progress management, or material selection. Financial and project management costs account for 15–20%, heavily dependent on capital costs.

According to businesses, optimization potential primarily lies in construction and finance, while land and legal costs remain significant bottlenecks. If addressed through appropriate policies, the market will offer more reasonably priced products, better meeting the current high demand for actual housing needs.

Phu Dong Group, focused on mid-range housing, shares similar concerns. Mr. Ngo Quang Phuc, General Director, noted that housing prices are influenced by approximately seven cost factors, with land acquisition and land use fees being the most challenging.

For instance, as companies seek land funds, the supply of affordable housing land in urban areas is increasingly scarce. Meanwhile, suburban areas struggle to find suitable land compatible with regional planning. Currently, land prices rise 10–20% annually, alongside factors like land use conversion and fluctuating land price tables.

Phu Dong Group suggests increasing housing land funds in clearly planned areas to provide bidding opportunities for businesses. For land use fee calculations, they propose expedited land price appraisals and consultations, ensuring a balanced approach benefiting the state, businesses, and residents, while avoiding additional financial burdens on companies.

Moreover, rising costs such as construction, labor, and materials due to inflation can be controlled if lending interest rates prioritize mid-range investors over luxury segments.

To reduce housing costs, operational, project management, marketing, and expected profit margins (around 10–15%) can also be managed. However, Mr. Phuc notes that final housing prices remain unreasonable when land use fees, accounting for 20% of project costs, or construction costs, at 40–50%, continue to rise.

In response, expert Dinh Minh Tuan proposed solutions to alleviate supply shortages, such as addressing speculation, piloting taxes on vacant properties or second homes, and providing credit packages with preferential interest rates for affordable housing developers.

Input costs and loan interest rates heavily depend on disbursement status, licensing, and construction procedures. Therefore, early resolution of legal paperwork, faster project implementation, and increased supply will facilitate sales, contributing to market price reductions.

Hoang An

– 19:00 07/10/2025

Emerging Real Estate Hotspots: Hai Phong, Hung Yen, Dong Nai, Da Nang, and Khanh Hoa Take Center Stage

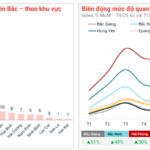

The real estate market in 2025 is witnessing a significant shift: capital is moving away from city centers and flowing into suburban areas. From Hai Phong, Hoa Binh, and Bac Giang in the North to Binh Duong, Dong Nai, and Khanh Hoa in the South, satellite localities are emerging as the new hotspots for both investors and homebuyers alike.

Transparent, Scientific, and Synchronized Mechanism Needed to Align Land Prices with True Market Value

Unlocking the complexities surrounding land pricing is a pivotal step toward fostering a sustainable real estate market, according to industry experts. By addressing these critical bottlenecks, we pave the way for robust economic and social development, ensuring long-term stability and growth.