According to data from Batdongsan.com.vn, the real estate market in Q3/2025 shows a clear divergence between the sales and rental segments. Following a volatile Q2 marked by macroeconomic fluctuations, interest in property sales rebounded swiftly, with condominiums leading the charge. Townhouses and detached houses also began to show signs of improvement, with interest levels rising by 11-22% compared to the beginning of the year.

In contrast, the rental segment experienced a decline, particularly in the dormitory and guesthouse sectors. Interest levels in September 2025 dropped by 8-24% across various property types compared to the previous month.

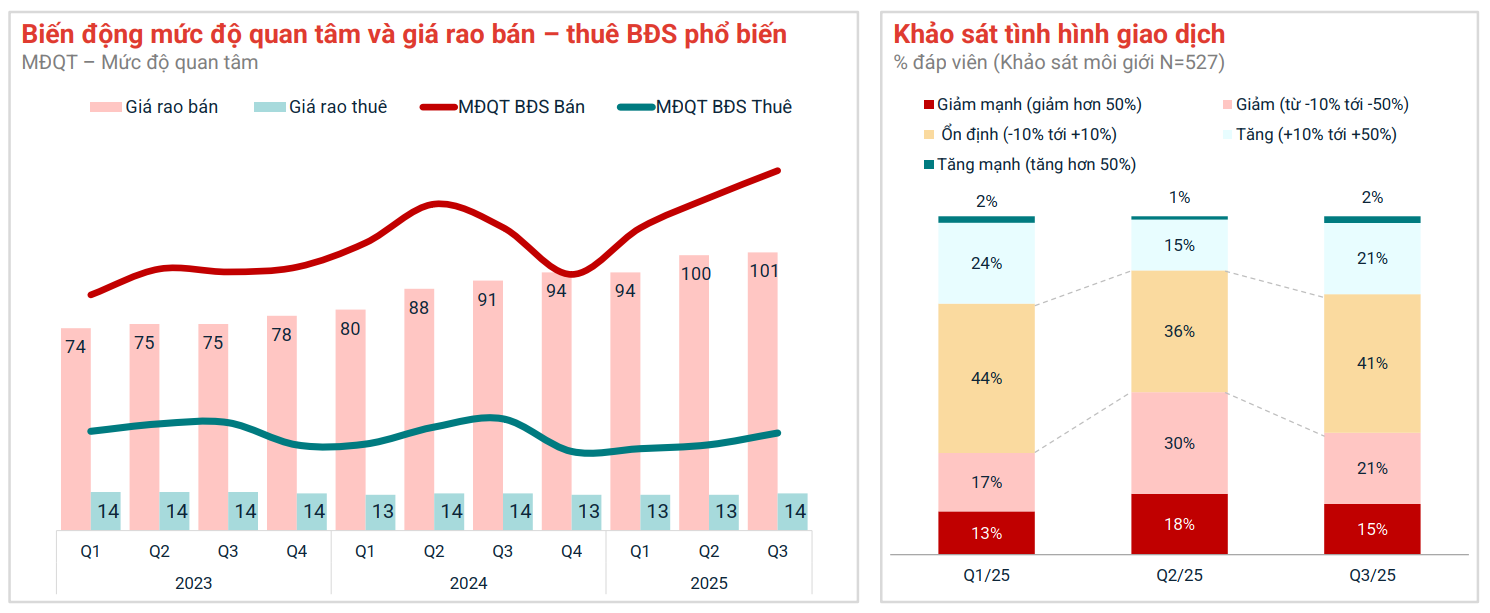

Mr. Nguyễn Quốc Anh, Deputy General Director of Batdongsan.com.vn, noted that the average property sales price nationwide has increased from 74 million VND/m² (Q1/2023) to 101 million VND/m² (Q3/2025), a 36% rise. Meanwhile, rental prices have remained stagnant.

Source: Batdongsan.com.vn

|

A Q3/2025 broker survey by Batdongsan.com.vn revealed that the absorption of new supply remains positive, with 88% of respondents rating it as average to good. Only 12% considered it less favorable. Looking ahead to Q4, 60% of brokers anticipate continued market growth.

Condominiums led the recovery with a 22% increase in interest, followed by detached houses (13%) and townhouses (11%). Land plots saw an 11% decline. Condominiums and detached houses are also projected to have the highest growth potential over the next six months.

Vietnam’s real estate market is expanding beyond the traditional hubs of Hanoi and Ho Chi Minh City. Interest in Hanoi decreased by 22% compared to the same period in 2024, while Ho Chi Minh City saw minimal changes or slight declines in new areas. Conversely, neighboring provinces emerged as bright spots, with areas surrounding Hanoi growing by 11%. In the South, some regions experienced a 12% decline, but many localities still demonstrated strong resilience.

Hanoi Slows Down, Ho Chi Minh City Gains Momentum

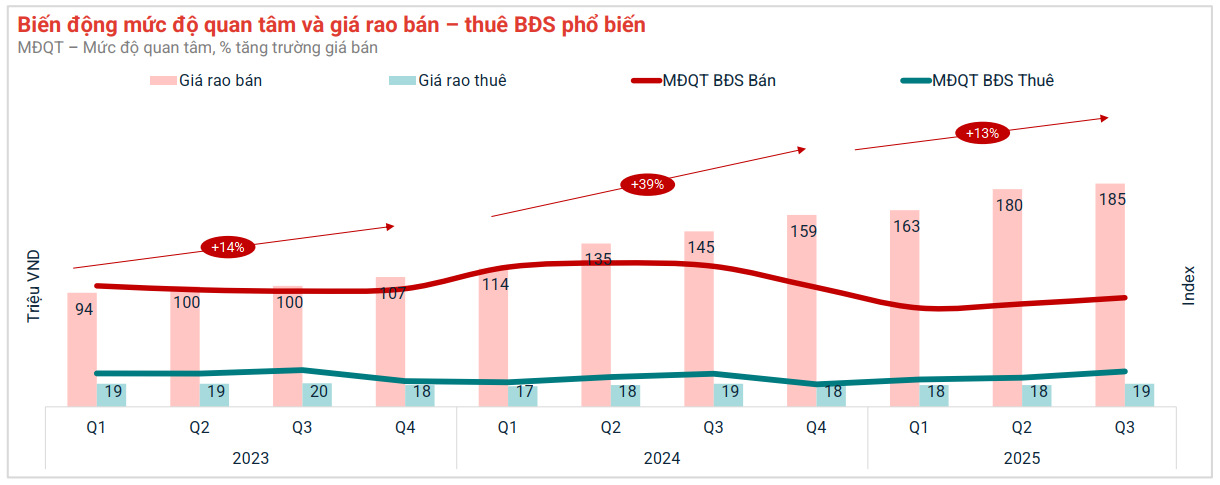

According to Mr. Đinh Minh Tuấn, Sales Director at Batdongsan.com.vn, Hanoi’s property prices increased by 14% in 2023, 39% in 2024, and continued to rise in 2025, albeit at a slower pace. The market has entered a selective phase, focusing on sustainable development.

Source: Batdongsan.com.vn

|

In Q3/2025, condominiums remained the leading segment, with prices surging 95% compared to Q1/2023. High-end condominiums in Tây Hồ and Ba Đình districts commanded prices ranging from 130 to 210 million VND/m². Conversely, affordable units (below 55 million VND/m²) saw impressive price increases (57-71% since Q1/2024) and maintained strong rental yields.

Investment capital shifted away from the city center to peri-central areas, where prices rose significantly. Thanh Trì (up 119% since Q1/2023), Gia Lâm (up 114%), and Bắc Từ Liêm (up 110%) experienced notable growth.

Detached houses increased by 82% compared to Q1/2023, driven by their perceived safety as an investment and the strong ownership preference among Hanoians. Land plots also rose by 50%, particularly in peri-central and suburban areas.

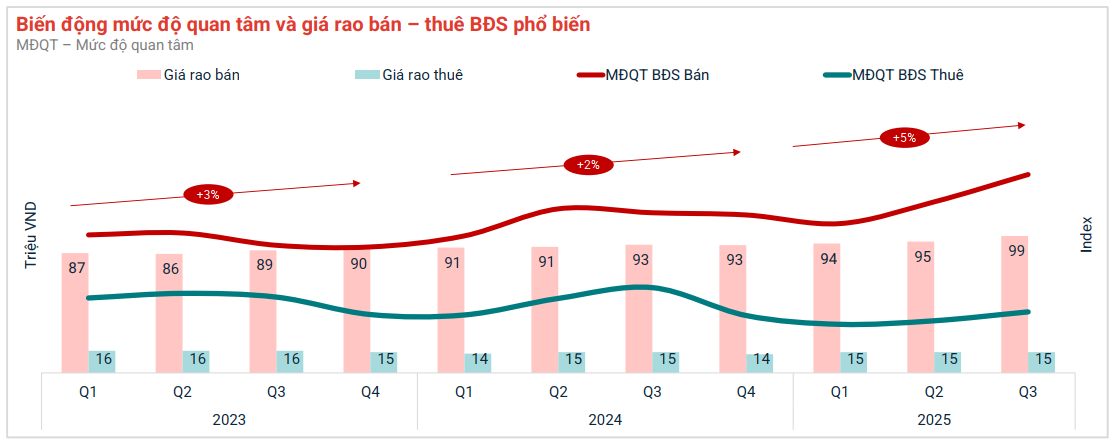

Ho Chi Minh City is entering a recovery phase, with both sales prices and investor interest on the rise. Q3/2025 data from Batdongsan.com.vn shows that following the city’s consolidation, average property prices reached 99 million VND/m², the highest since Q1/2023. Interest in property sales also hit a new peak. Condominiums, detached houses, and townhouses saw increases of 20%, 23%, and 19% respectively compared to the beginning of the year.

Source: Batdongsan.com.vn

|

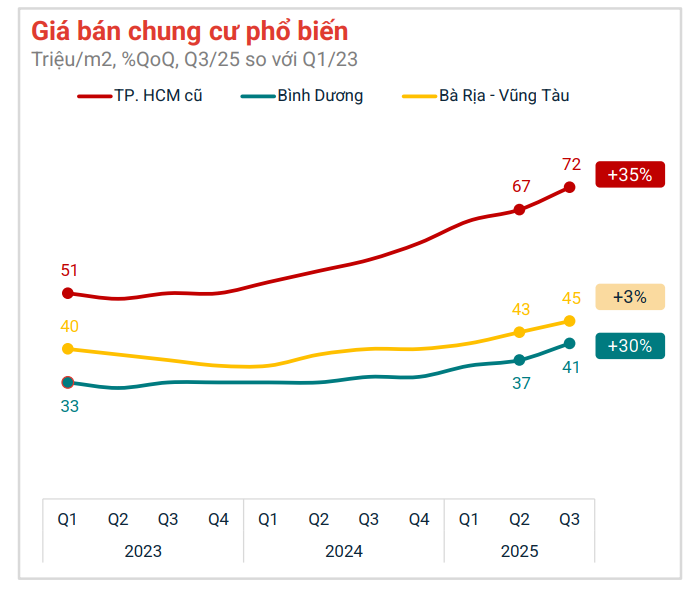

Condominium prices in the former Ho Chi Minh City area rose sharply from 67 to 72 million VND/m² in just one quarter. Luxury units in District 1 reached 222 million VND/m², a 39% increase since Q1/2023.

Bình Dương recorded a 48% surge in interest compared to the beginning of the year, with prices rising 30% since Q1/2023 to 41 million VND/m². In Thuận An and Dĩ An, prices reached 40-60 million VND/m², up from 36-38 million VND/m² last year.

Source: Batdongsan.com.vn

|

The largest supply is concentrated in the Eastern and Northeastern areas of Ho Chi Minh City. Thuận An and Dĩ An lead with over 13,000 new units each. Former Thủ Đức City has approximately 11,800 units, with average prices ranging from 80 to 120 million VND/m².

Notably, Northern investors are increasingly moving into Ho Chi Minh City, with a 28% rise in property searches by Hanoians, reflecting a clear “Southern migration” trend.

The land plot segment in former Ho Chi Minh City and Bình Dương has warmed up after several stagnant quarters. Average land prices in the former Ho Chi Minh City area increased by 6% compared to Q2/2025, reaching 69 million VND/m². Bình Dương saw a 5% rise to 21 million VND/m². In contrast, Bà Rịa – Vũng Tàu remained quiet, with land prices dropping 10% and interest declining by 13%.

Mr. Đinh Minh Tuấn observes that Ho Chi Minh City’s market, after a period of observation, is rebounding strongly, with improved supply and liquidity. Both investment capital and genuine demand are driving this growth. In Hanoi, while prices continue to rise, demand has cooled, and capital remains focused on high-end peri-central properties and condominiums, which continue to lead the market.

– 16:20 07/10/2025

Emerging Real Estate Hotspots: Hai Phong, Hung Yen, Dong Nai, Da Nang, and Khanh Hoa Take Center Stage

The real estate market in 2025 is witnessing a significant shift: capital is moving away from city centers and flowing into suburban areas. From Hai Phong, Hoa Binh, and Bac Giang in the North to Binh Duong, Dong Nai, and Khanh Hoa in the South, satellite localities are emerging as the new hotspots for both investors and homebuyers alike.

82.5% of Manufacturing Businesses Anticipate Improved Business Conditions in Q4 2025

In the fourth quarter of 2025, a survey on business trends within the manufacturing and processing industry reveals optimistic projections. Approximately 40.8% of businesses anticipate an improvement in trends compared to the third quarter of 2025, while 41.7% expect stable production and operations. Conversely, 17.5% of enterprises foresee more challenging conditions ahead.

Revolutionary Projects by Vingroup, Sun Group, Ecopark Shake Up the Market, Redefining the Real Estate Investment Landscape

A wave of mega-projects from real estate giants has been shaking up the market lately. Wherever a blockbuster development emerges, it attracts a flood of investment, drawing in both investors and brokers, transforming the area into a vibrant new hotspot.