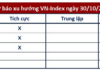

Following a near 50-point surge in the previous session, Vietnam’s stock market cooled off significantly on October 7th. A cautious sentiment prevailed, causing the VN-Index to close in the red, down 10 points at 1,685. Market liquidity dwindled to approximately VND 25.6 trillion, reflecting investor hesitancy ahead of FTSE Russell’s market classification review announcement scheduled for the following day.

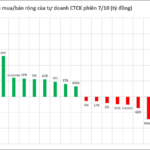

Foreign investors were net sellers, offloading a substantial VND 1,393 billion across the market.

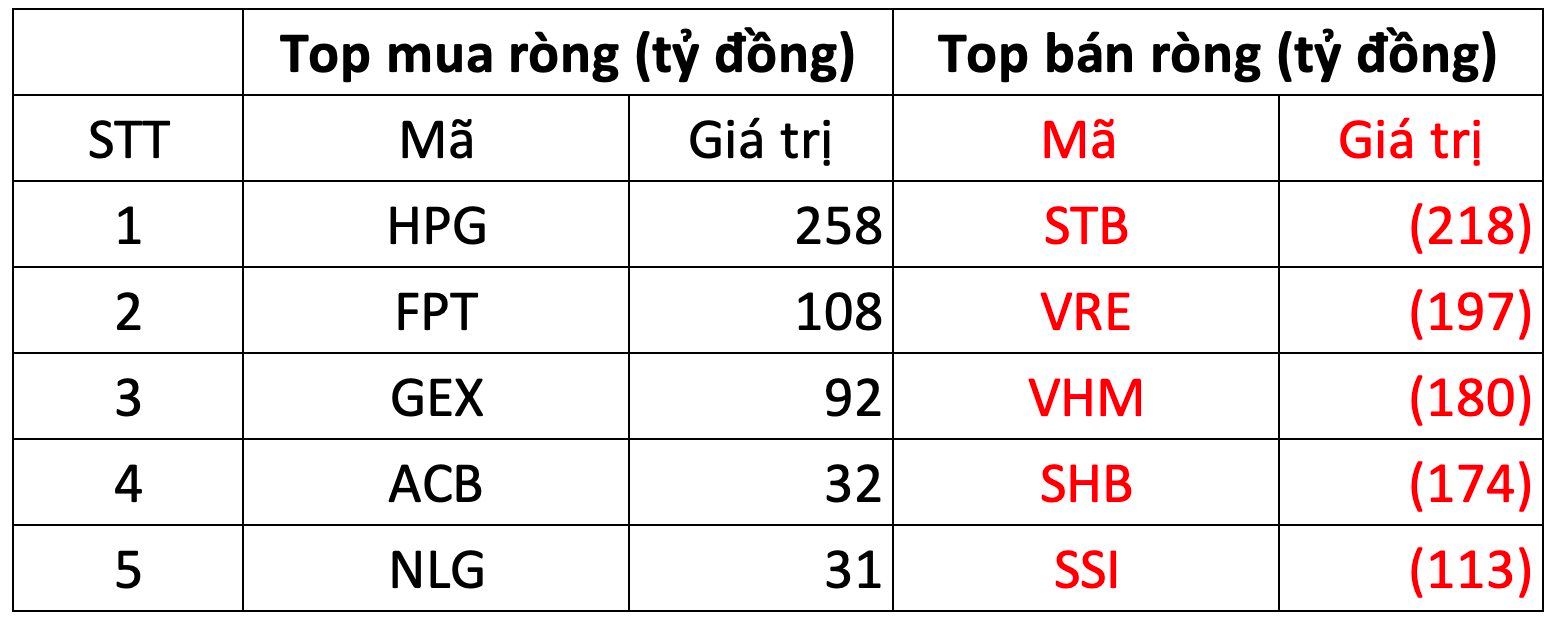

On the Ho Chi Minh Stock Exchange (HOSE), foreign investors net sold VND 1,342 billion.

On the buying side, HPG was the most favored stock by foreign investors on HOSE, attracting over VND 258 billion. FPT followed closely with VND 108 billion in purchases. GEX and ACB also saw significant buying interest, with VND 92 billion and VND 32 billion, respectively.

Conversely, STB led the selling pressure with VND 218 billion in net sales. VRE and VHM were also heavily sold, with VND 197 billion and VND 180 billion, respectively.

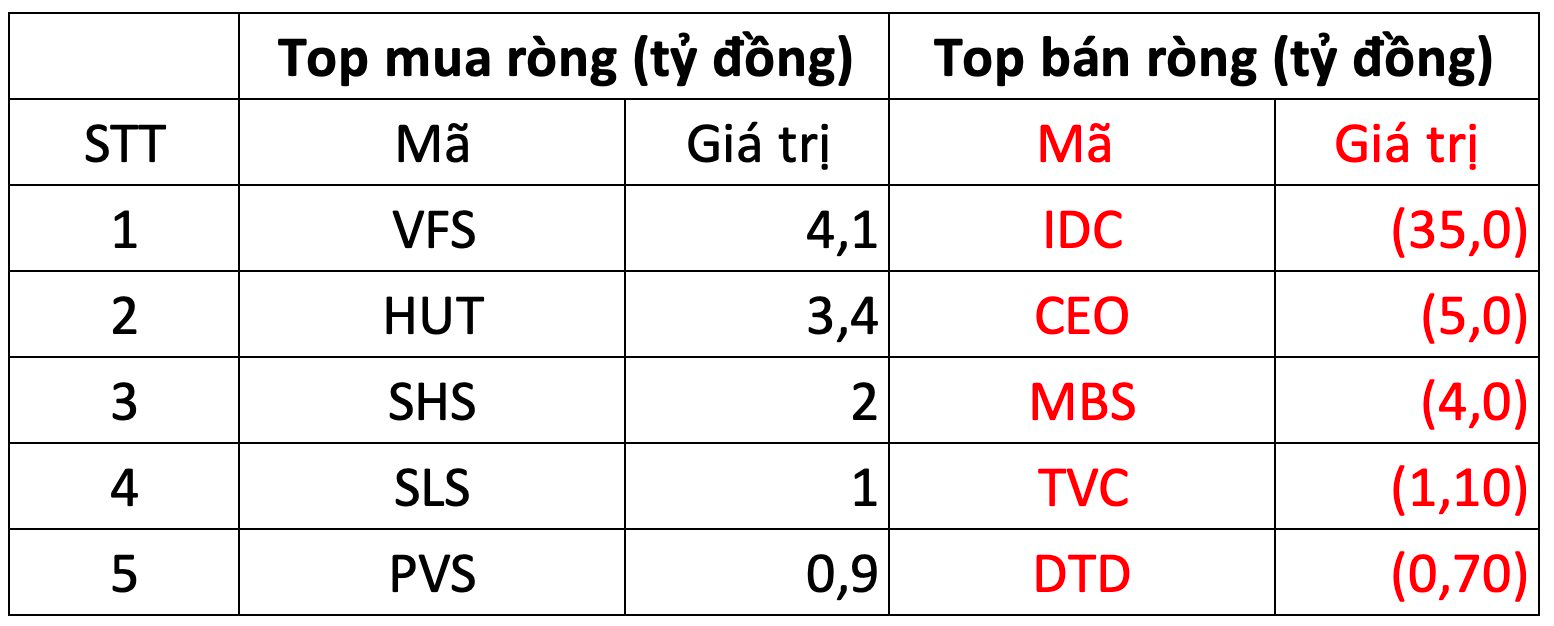

On the Hanoi Stock Exchange (HNX), foreign investors net sold VND 37 billion.

VFS was the top buy on HNX, with VND 4 billion in net purchases. HUT followed with VND 3.4 billion. SHS, SLS, and PVS also saw modest buying interest from foreign investors.

On the selling side, IDC faced the most significant selling pressure, with nearly VND 35 billion in net sales. CEO, MBS, and TVC also saw selling pressure, ranging from VND 1 billion to VND 5 billion.

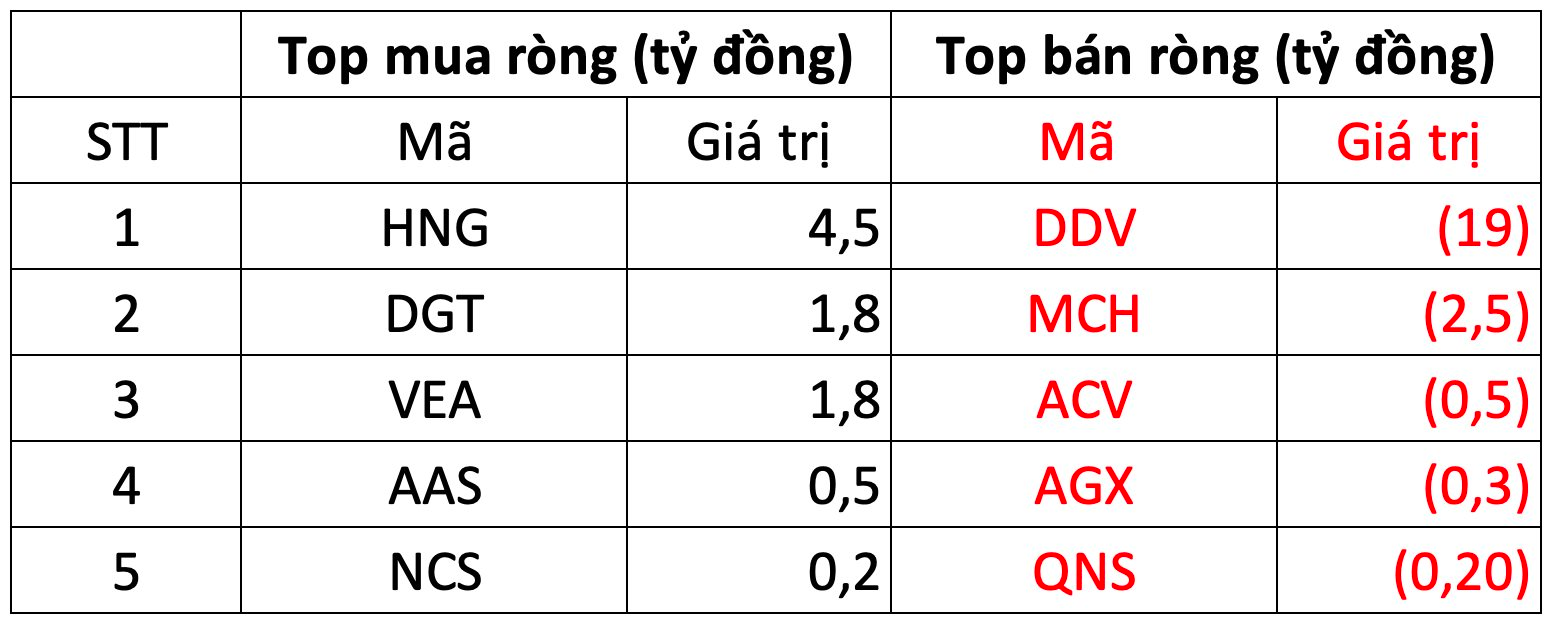

On the UPCOM, foreign investors net sold VND 14 billion.

HNG was the top buy on UPCOM, with VND 4.5 billion in net purchases. DGT and VEA also saw modest buying interest.

Conversely, DDV was the most sold stock, with VND 19 billion in net sales. MCH, ACV, and others also faced selling pressure from foreign investors.

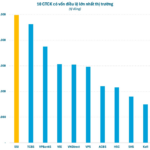

Vietnamese Stock Accounts Surpass 11 Million, Exceeding 2030 Target

As of September 2025, Vietnam’s stock market has surpassed expectations, boasting over 11 million trading accounts—a milestone originally targeted for 2030 under the government-approved Securities Market Development Strategy unveiled in late 2023, according to data from the Vietnam Securities Depository and Clearing Corporation (VSDC).

Is the “King” Stock Still a Magnet in the Final Quarter?

Despite bank stocks no longer being as undervalued as they were earlier this year, securities firms maintain that current price levels remain reasonably attractive.

Market Hits Short-Term Warning Signal

The market is experiencing delicate fluctuations near its peak, making every decision increasingly challenging. “Riding the waves” has never been easy for Vietnamese stock investors, especially as anticipated milestones—such as market upgrades and third-quarter earnings results—begin to reveal their outcomes.