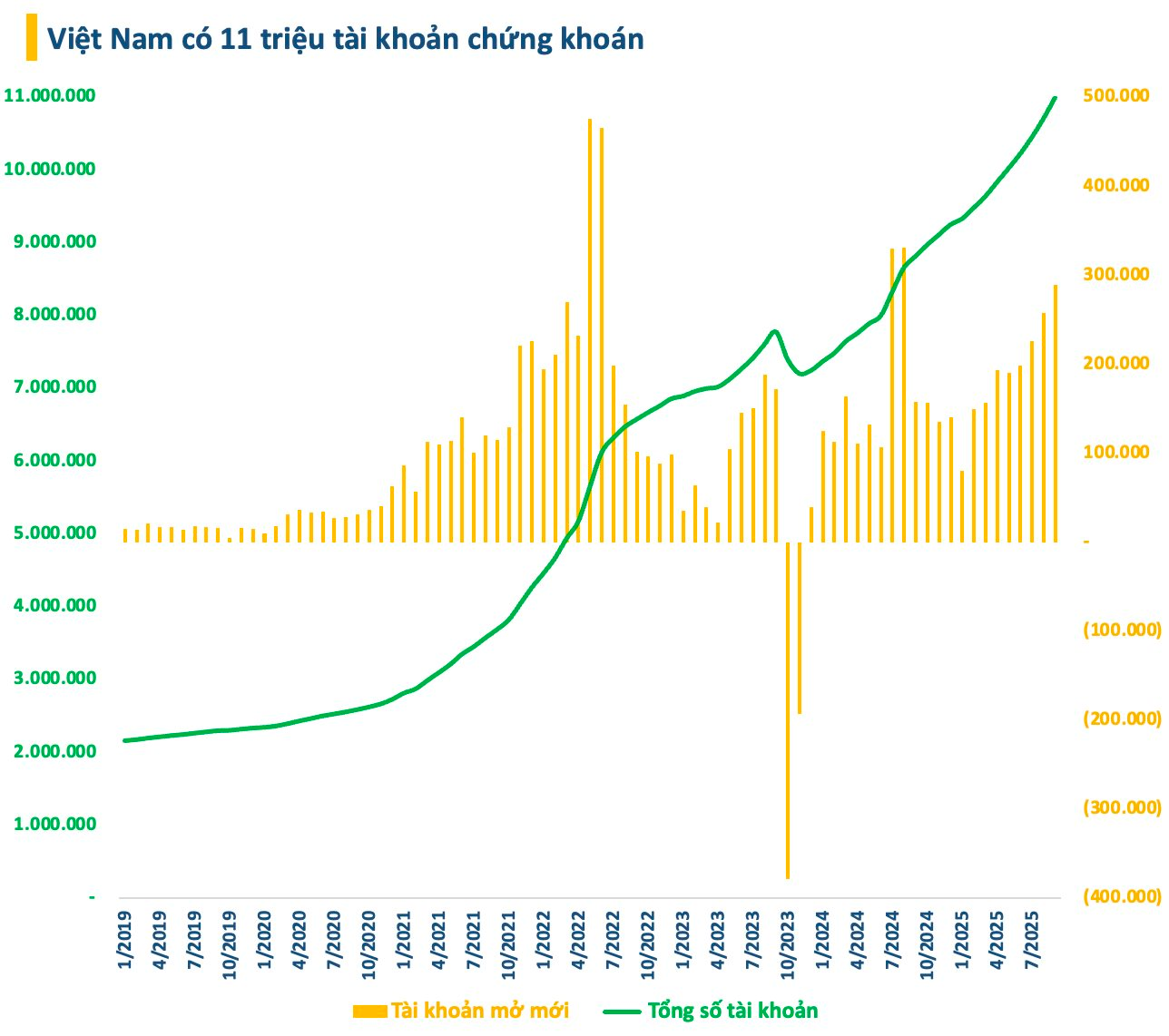

According to data from the Vietnam Securities Depository (VSD), domestic investor accounts surged by nearly 290,000 in September 2025, marking the fourth consecutive month of growth. This represents the most significant increase in the past year. The rise in accounts was predominantly driven by individual investors, while institutional accounts saw a modest addition of 105.

Year-to-date, domestic investor securities accounts have grown by 1.74 million. As of September 2025, individual investors held approximately 11 million accounts, equivalent to about 11% of the population, achieving the 2030 target ahead of schedule. This milestone was reached just before a historic moment for Vietnam’s stock market.

On the morning of October 8th, Vietnam time (following the close of the U.S. stock market on October 7th), FTSE Russell will release its September 2025 Country Classification Report. Notably, Vietnam is currently on the Watch List and is highly likely to be reclassified from Frontier to Secondary Emerging Market status.

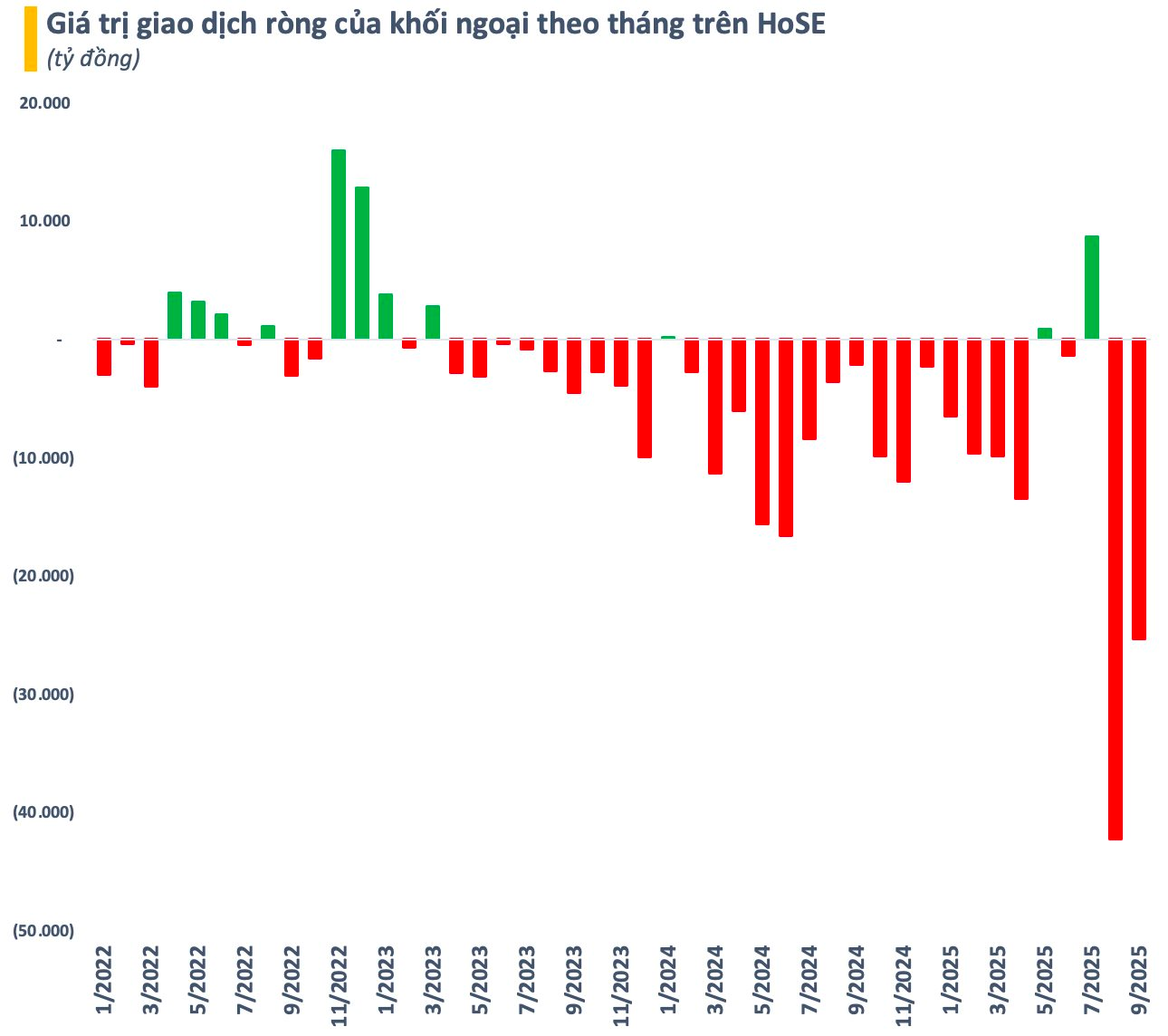

The robust growth in securities accounts comes amid a volatile trading market in September. Strong profit-taking pressure near the 1,700-point peak, particularly from foreign investors, hindered market breakthroughs. Despite foreign investors net-selling over VND 25 trillion on HoSE in September, domestic investor capital remained the primary force stabilizing the market.

Despite consistent net-selling, foreign investor accounts in Vietnam continued to rise monthly. Specifically, foreign accounts increased by 268 in September, slightly lower than the 273 recorded in August. Individual accounts grew by 246, while institutional accounts added 22. Total foreign investor accounts now stand at 49,322.

Market Hits Short-Term Warning Signal

The market is experiencing delicate fluctuations near its peak, making every decision increasingly challenging. “Riding the waves” has never been easy for Vietnamese stock investors, especially as anticipated milestones—such as market upgrades and third-quarter earnings results—begin to reveal their outcomes.

Vietstock Daily 08/10/2025: Caution Prevails Ahead of Potential Upgrade Announcement

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (1,700-1,711 range). Sustaining a position above the Bollinger Bands’ Middle Line remains critical for maintaining the index’s short-term recovery outlook. Currently, the Stochastic Oscillator has generated a fresh buy signal, while the MACD is narrowing its gap with the Signal Line, potentially triggering a similar indication in upcoming sessions.

Portrait of a Thriving Stock Market

What defines a developed market? According to MSCI, there are 23 such markets globally, while FTSE Russell identifies 25. But what criteria determine this classification?