Annually unveiled by Investment Bridge Magazine in collaboration with Thien Viet Securities Company (TVS), the TOP50 serves as a benchmark for corporate health, business efficiency, and investor expectations.

The Numbers Speak: When Top 50 Dominates the Market

The TOP50 ranking is a prestigious metric to identify listed companies(*) operating efficiently and sustainably. With clear and transparent criteria, TOP50 serves as a reference to select companies with outstanding performance in their industries and compared to the entire market.

The 2025 TOP50 ranking results reveal many “telling” numbers as this group of companies dominates the market with remarkable achievements, including:

TOP 50 capitalization as of 15/09/2025 is $155 billion, accounting for over 50% of the total market cap of listed companies, equivalent to more than 1/3 of the country’s 2024 GDP. Notably, the number of companies with a market cap over $1 billion in the 2025 TOP50 list increased by 8 compared to the 2024 list, reaching 31 companies.

Accordingly, TOP50’s total revenue in 2024 reached nearly $52 billion, a 12% increase from the previous year, contributing 35% to the total revenue of listed companies. TOP50’s 2024 after-tax profit reached approximately $11 billion, an 18% increase year-on-year, contributing 75% to the market’s total profit. This result was primarily driven by the Banking sector, with a 20% profit growth in 2024, reaffirming its role as a crucial capital provider for the economy.

In 2024, TOP50’s average return on equity (ROE) reached nearly 16%, double the market average (8%). This superiority stems from the large scale, unique competitive advantages, and efficient operations of TOP50 companies within their respective industries.

“These numbers not only honor outstanding companies but also affirm their role in leading the market, raising governance and transparency standards, and providing a reliable basis for domestic and foreign investors,” said Mr. Bui Thanh Trung, Deputy General Director of Thien Viet Securities Company (TVS).

(*) Listed companies on HOSE and HNX, excluding Upcom.

Four Development Cycles: A Reflection of the Economy

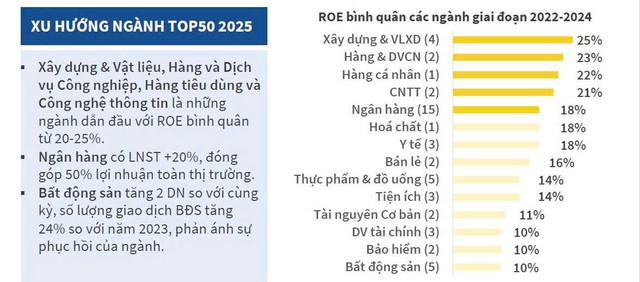

The 2025 TOP50 continues to showcase diverse industries and sectors, reflecting the economy’s shifting trends.

2025 TOP50 Industry Trends, led by the Construction and Building Materials sector in operational efficiency.

The Banking sector remains a pillar, with 3 new banks joining the list this year, bringing the total to 15, a 20% increase, contributing nearly 50% to the market’s 2024 profit.

Meanwhile, another critical sector, Real Estate, made an impressive comeback with 2 new companies entering the ranking. This reflects the real estate market’s recovery, with a 24% increase in transactions in 2024 compared to 2023, raising expectations for a more sustainable growth cycle. CBRE forecasts that the primary housing supply in Hanoi and HCMC will reach 54,200 units in 2025, a 31% increase from 2024.

In terms of profitability, the Construction and Building Materials, Industrial Goods and Services, Consumer Goods, and Information Technology sectors led with an average ROE of 20-25% during 2022-2024. This demonstrates the ability of leading companies in key economic sectors to maintain business efficiency, aligning with future development goals.

Over 14 years since its inception, the TOP50 ranking not only reflects corporate health across sectors but also illustrates the cyclical shifts of industries within the economy, spanning four distinct phases.

During 2012-2015, the Food and Beverage sector “dominated” the ranking, with companies like Vinamilk and Masan consistently in the TOP50. Amid slowing GDP growth, these essential consumer goods companies demonstrated stable operational efficiency with an average ROE of nearly 18%, higher than the overall listed companies during the same period (below 13%).

Mr. Bui Thanh Trung analyzes 2025 TOP50 Trends

The 2015-2018 phase saw the rise of the Construction and Building Materials sector, benefiting from robust public investment in infrastructure. Public investment during this period accounted for 6.5-7.5% of GDP, significantly driving economic growth through direct and spillover effects. This enabled many companies to thrive alongside national key projects and civil construction demands.

From 2017-2021, the real estate sector boomed, led by giants like Vinhomes, Nam Long, and Khang Dien. Their market caps and profits soared as urbanization and housing demands increased. The average ROE of real estate companies in the TOP50 during this period exceeded 20%.

The final phase, from 2019 to present, is marked by the financial sector, particularly Banking. This sector has become a pillar, consistently accounting for 15-30% of TOP50 companies. From 2018-2024, the banking sector’s compound growth rate was nearly 20%, higher than the 12% growth rate of listed companies during the same period. This shift reinforces the financial sector’s growing importance in supporting economic growth, especially amid international integration.

Another notable point, according to Mr. Trung, is the remarkable growth of private enterprises since the first TOP50 announcement. The proportion of private companies in the TOP50 has increased from over 70% in the first year to 90% in the 2025 list. “This clearly demonstrates that the private sector is now a pillar of the economy in this era of global outreach. It’s an excellent springboard for Vietnam to enter the global market,” Mr. Trung assessed.

Overall, over 14 years, the industries and companies in the ranking have evolved significantly, reflecting each company’s role in the economy’s development history. “The TOP50 is not just a ranking but a mirror reflecting the development of the stock market and the Vietnamese economy. It not only honors outstanding companies but also inspires the Vietnamese business community,” Mr. Trung concluded.

SBV Payment Surge: Cashless Transactions Hit 25x GDP in 2024

At the seminar titled “Cashless Payments: Towards Convenience, Safety, and Comprehensive Connectivity” held on the morning of October 7th, Mr. Phạm Anh Tuấn, Director of the Payment Department at the State Bank of Vietnam (SBV), revealed that in just the first 8 months of 2025, key indicators for digital payments and transactions have shown robust growth. Interbank payment transactions surged by 19% in volume and 69.1% in value. Notably, cashless payments have reached a scale 25 times the GDP of 2024.

Bitcoin Hits New Record at the Start of “Uptober,” Becoming the World’s 7th Largest Asset

With a market capitalization of $2.5 trillion, Bitcoin now stands as the second-largest asset class globally, surpassed only by gold, silver, and tech giants like NVIDIA, Microsoft, Apple, and Alphabet (Google’s parent company).

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.