On the morning of October 8th, Vietnam time (following the closure of the US stock market on October 7th), FTSE Russell will release the FTSE Country Classification Report for September 2025. Notably, Vietnam is currently on the Watch List and is highly likely to be reclassified from Frontier Market to Secondary Emerging Market status.

With less than 48 hours remaining, the most anticipated decision by investors is set to be announced.

If officially upgraded, Vietnam’s stock market could attract billions of dollars in foreign capital and, more importantly, elevate the nation’s global standing. This would pave the way for further goals, such as achieving FTSE’s Advanced Emerging Market status and meeting MSCI’s criteria.

In reality, Vietnam has been diligently implementing synchronized measures to enhance its market status. “We have introduced robust reforms and policies, effective immediately, to facilitate foreign investment inflows into Vietnam’s stock market,” stated Minister of Finance Nguyen Van Thang during a meeting with the London Stock Exchange (LSE) in mid-September.

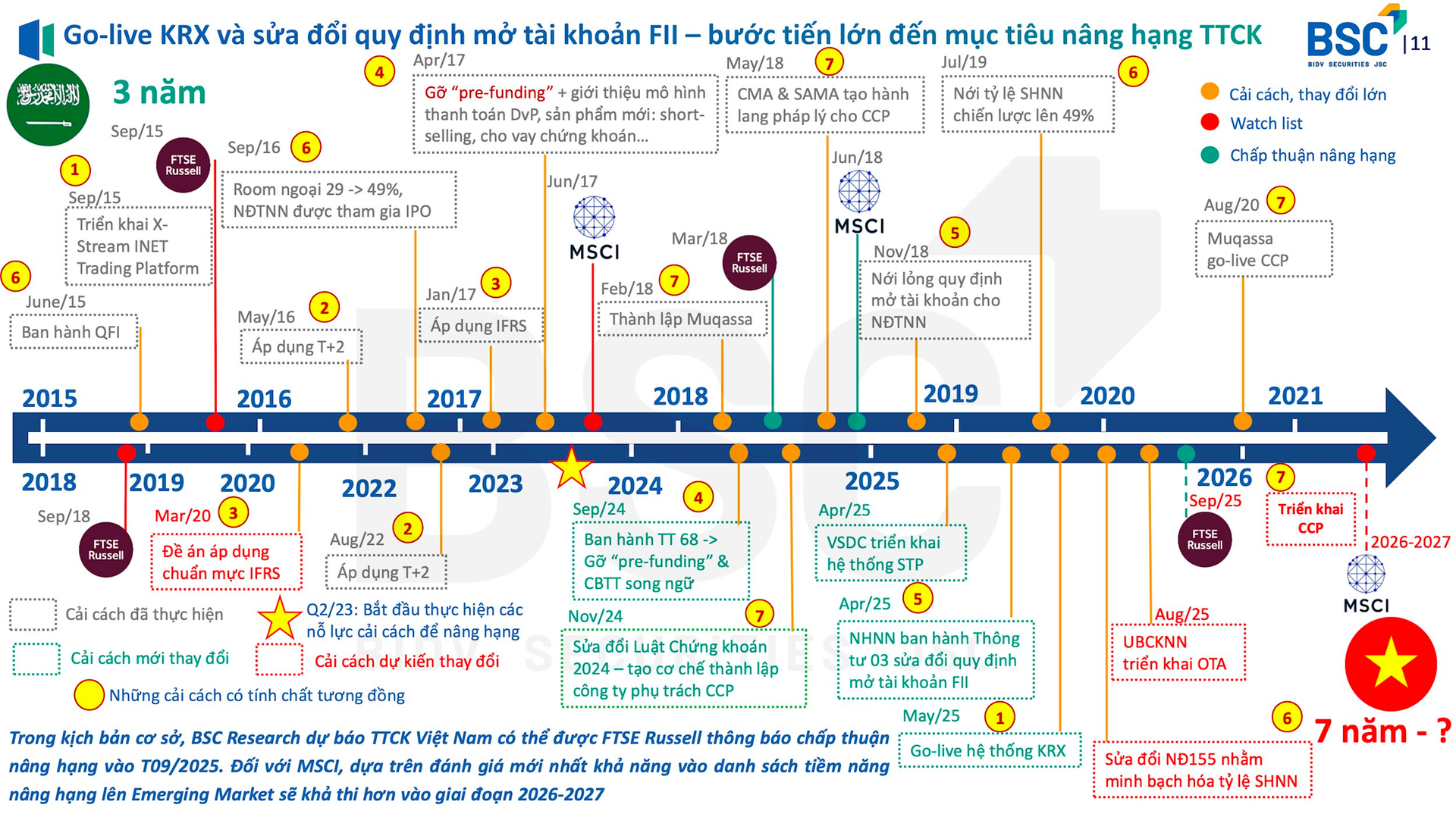

During this visit, FTSE Russell and the Vietnam Stock Exchange (VNX) signed a Memorandum of Understanding (MOU) to develop indices, enhance market infrastructure, and promote international integration. A subsequent update from BIDV Securities (BSC) highlighted that investment promotion activities and the MOU signing with FTSE are crucial steps ahead of FTSE’s assessment announcement on October 7th, 2025.

In its base-case scenario, BSC forecasts that Vietnam’s stock market could be upgraded by FTSE Russell on October 7th, 2025, with a transition process spanning two phases over a minimum of 6–12 months. For MSCI, Vietnam’s potential inclusion in the Emerging Market upgrade watchlist is projected for 2026–2027.

In a related development, during the Ministry of Finance’s Q3 press conference, Deputy Minister Nguyen Duc Chi addressed the market upgrade issue. He emphasized that regulators have implemented all necessary measures to ensure the sustainable development of the stock market, aligning with strategic goals.

Over the past period, authorities have collaborated closely to introduce new policies. The Government has enacted amended laws, decrees, and circulars, while the State Bank of Vietnam has also coordinated efforts. Additionally, regulatory bodies have engaged with international organizations regarding market classification.

“I believe this process is progressing effectively. While the final decision rests with authorized bodies, I affirm that the State Securities Commission will continue working closely with relevant agencies and international organizations to ensure Vietnam’s stock market is evaluated fairly, objectively, and transparently,” stated the Ministry of Finance leader.

Deputy Minister Nguyen Duc Chi added that market upgrading is just the beginning; maintaining this status and striving for higher milestones are essential. “This is a pivotal moment for the stock market’s development, fostering greater transparency to support businesses in capital raising and, in turn, driving the capital market and economy forward,” he remarked.

Earlier, at SSI’s 2025 Extraordinary General Meeting, Chairman Nguyen Duy Hung indicated that the market could receive upgrade results by early October, with a probability exceeding 90%. However, he noted that upgrading is not a panacea, and there are still many goals to pursue, such as meeting MSCI’s criteria.

QR Code Payments: Revolutionizing Every Corner of Life

Payment infrastructure serves as the lifeblood of the economy, ensuring the seamless flow of capital and fostering stability and sustainable growth.

2025 Asset Channel Realignment: Gold, Land, and Condos Take the Lead, Stocks Stabilize, While Savings and USD Yield “Lowlands”

At the “Real Estate Market Overview Q3/2025” event, themed “Leading the Beat,” Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, shared valuable insights into the current state of the real estate market.