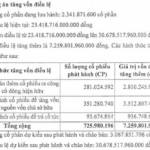

According to the plan, the bank will offer over 270.9 million common shares with a par value of VND 10,000 per share, totaling more than VND 2,709 billion in par value. Following the issuance, Vietbank’s chartered capital is expected to rise from VND 8,210 billion to nearly VND 10,920 billion. The issuance ratio is 100:33, meaning shareholders holding 100 shares can purchase an additional 33 new shares. The distribution period will last 90 days from the date of receiving the registration certificate. This marks a significant milestone, underscoring Vietbank’s commitment to sustainable growth and its determination to enhance its position in the new phase.

Robust Business Growth Lays the Foundation for Capital Increase

As of June 30, 2025, Vietbank’s total assets reached VND 178,671 billion, a nearly 10% increase from the beginning of the year. Customer loan balances grew by 9%, with corporate credit rising 15% year-to-date. Customer deposits also saw positive growth, increasing by nearly 10% to VND 104,208 billion. The bank consistently maintains profit growth by diversifying revenue streams, improving credit quality, and optimizing capital. Additionally, Vietbank focuses on boosting non-interest income, accelerating digital transformation, and effectively controlling costs.

Aiming for Listing on HOSE

Alongside the capital increase plan, Vietbank is actively pursuing the transfer of its VBB shares from UPCoM to HOSE, with completion expected by Q1/2026 at the latest. The bank stated that listing on Vietnam’s largest stock exchange will enhance liquidity, expand access to domestic and international investors, and elevate its brand reputation.

Strengthening Position in the Banking Sector

Amid widespread capital increases by joint-stock commercial banks to meet Basel II standards and prepare for Basel III, Vietbank’s public offering of shares aims to bolster financial capacity and enhance risk management capabilities.

This strengthened financial capacity will enable Vietbank to expand its retail market share, broaden its digital services, and move closer to becoming one of Vietnam’s leading private joint-stock commercial banks.

PV Power to Issue Nearly 726 Million Shares, Boosting Capital Beyond 30 Trillion VND

PV Power is set to simultaneously execute three capital increase strategies by issuing and offering a combined total of nearly 726 million shares, thereby boosting its chartered capital beyond 30,000 billion VND.