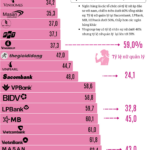

According to the issuance plan, these bonds offer a fixed interest rate of 10% per annum with a 36-month maturity. They are non-convertible, unsecured, and do not include warrants. The transaction is expected to be executed in Q4/2025 or Q1/2026.

BaF Meat branded pork products

|

BAF primarily operates in animal feed production, pig breeding, and commercial pork production. As of June 2023, the company owns 2 animal feed mills, 47 operational and developing pig farms, and 1 food processing plant.

In preparation for this public offering, BAF recently underwent a credit rating assessment by Saigon Ratings (Saigon Prosperous Development Ratings JSC). According to the October 3rd issuance certificate, BAF received a “vnA” credit rating with a “stable” outlook.

Within Saigon Ratings’ scale, an issuer rated “vnA” demonstrates a relatively high capacity to meet financial obligations, though it may still be affected by adverse changes in business conditions and macroeconomic factors.

Regarding capital allocation, 670 billion VND will be used to supplement BAF‘s pig farming operations, while the remaining 330 billion VND will be allocated to partially repay principal on existing loan agreements.

– 5:55 PM, October 8, 2025