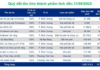

Credit Growth and GDP Expansion

According to the State Bank of Vietnam (SBV), outstanding credit by the end of August 2025 reached over 17 quadrillion VND, marking a nearly 12% increase compared to the end of 2024. The SBV estimates that credit growth in 2025 could hit approximately 20%, surpassing the initial target of 16% set at the beginning of the year.

Meanwhile, the World Bank’s September 2025 Economic Report forecasts Vietnam’s GDP to grow by 6.6%, highlighting the strong correlation between credit expansion and GDP growth. Bank capital continues to play a pivotal role in the economic recovery process. Robust credit growth typically stimulates investment, consumption, and production, thereby supporting GDP expansion. However, it also necessitates careful inflation control and capital quality management in the upcoming period.

Credit Growth and GDP Growth Rates, 2020-2025F

(Unit: %)

Source: State Bank of Vietnam and World Bank

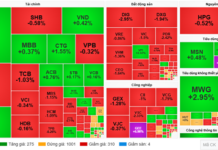

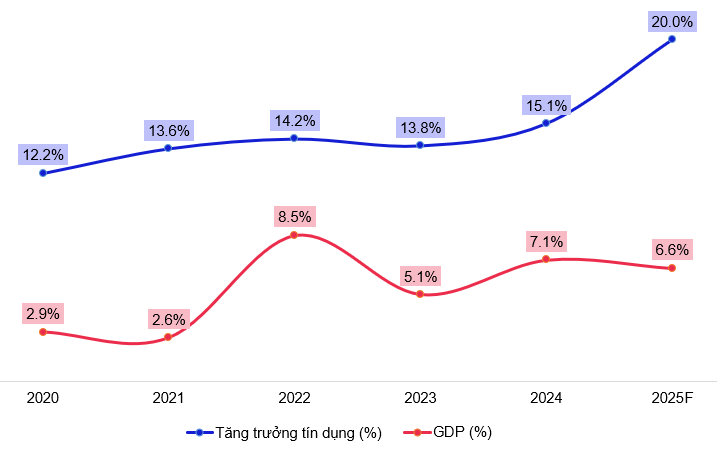

Stable Net Interest Income Growth for MBB

The Compound Annual Growth Rate (CAGR) of net interest income for the period 2020-2024 stands at approximately 19.36%. This reflects a stable and impressive growth rate for a large-scale bank like MBB.

In 2024, post-tax profit reached 22,951 billion VND, and it is projected to exceed 26,000 billion VND this year. Net interest income is also expected to reach 49,118 billion VND in 2025, representing a more than 19% increase compared to the previous year.

MBB’s Business Performance, 2020-2025F

(Unit: Billion VND)

Source: VietstockFinance

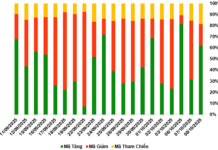

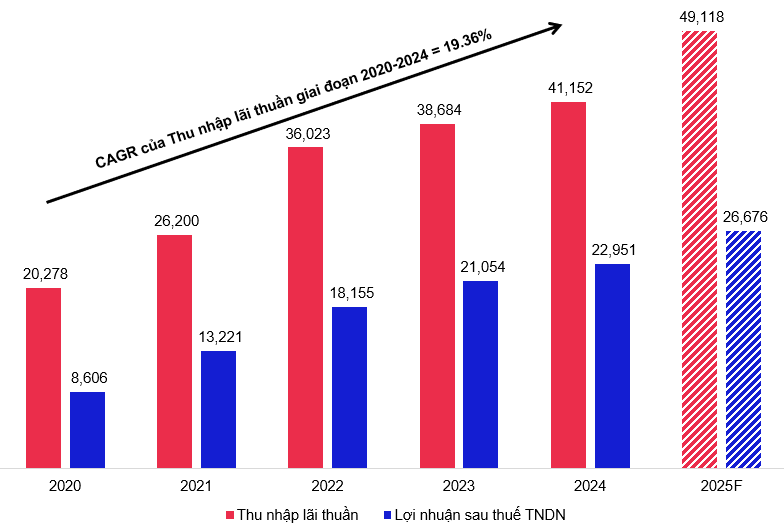

Consistently High NOII/TOI Ratio

During the 2020-2024 period, MBB’s non-interest income to total operating income (NOII/TOI) ratio consistently fluctuated between 18% and 30%, demonstrating a stable and sustainable diversification strategy.

In the first half of 2025, this ratio reached approximately 26%, underscoring the strong contributions from services, bancassurance, and subsidiary financial and insurance companies. With positive growth momentum and ecosystem advantages, it is anticipated that the NOII/TOI ratio will stabilize around 30% by the end of 2025.

Source: VietstockFinance

Corporate Analysis Department, Vietstock Consulting Division

– 09:00 08/10/2025

Skyrocketing Credit Growth Forecast Sparks Inflation Concerns: 15-Year High Predicted

As of the end of September, the economy’s credit growth has reached 13.37% compared to the beginning of the year. It is estimated that credit growth for this year could hit 19-20%, the highest level in 15 years. The State Bank of Vietnam emphasizes ongoing monitoring to ensure both economic growth and inflation control.

Metropolis Rising: A Historic Leap Forward

Ho Chi Minh City is poised to seize a monumental opportunity to expand its market, enhance investment appeal, and integrate infrastructure, thereby elevating its global standing.

Why Is Credit Pouring into Real Estate?

Ms. Ha Thu Giang, Director of the Credit Department for Economic Sectors at the State Bank of Vietnam, revealed that as of the end of August, real estate credit had surpassed 4 million billion VND, marking a significant increase of approximately 19%.